FOR IMMEDIATE RELEASE

202-380-7114 – MBLyng@NovitasCommunications.com

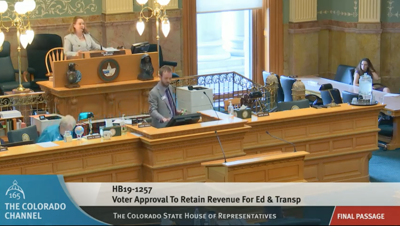

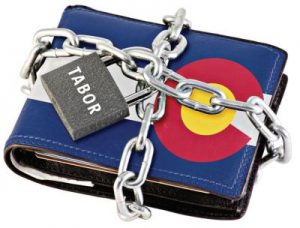

TABOR Repeal Bill Passes Colorado House of Representatives without Single Republican Vote

House Democrats’ attempt to permanently pocket taxpayer refunds advances on party-line vote

DENVER, April 17, 2019 – Yesterday, Democrats in the Colorado House of Representatives voted to pass House Bill 1257, a measure that would require state taxpayers to permanently forego tax refunds in any year in which they overpay the state.

“Colorado Democrats claim that their proposed theft of taxpayers would fund critical services like education and transportation, but Speaker K.C. Becker admitted in a committee hearing that they couldn’t provide any assurances as to how this supposed ‘excess’ revenue would be allocated in the future,” said Amy Oliver Cooke, Independence Institute Executive Vice President and TABORYes coalition member. “This isn’t even the government’s money in the first place. It’s money that hardworking Coloradans overpaid into the system, as codified by our Taxpayer’s Bill of Rights. Continue reading →

Voters would be asked this fall if the state should be able to retain surplus revenue over what the Taxpayer’s Bill of Rights allows under a bill that won final approval in the Colorado House on Tuesday.

Voters would be asked this fall if the state should be able to retain surplus revenue over what the Taxpayer’s Bill of Rights allows under a bill that won final approval in the Colorado House on Tuesday.