Mark Hillman: State Democrats ignore voters’ voices

By MARK HILLMAN |

August 11, 2021 at 7:30 a.m.

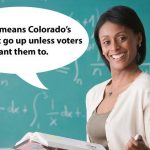

Gov. Jared Polis and Progressive Democrat majorities at the Ssate Capitol have spent the past three years ignoring clearly-expressed voices of Colorado voters on tax and economic issues. In fact, Progressive Democrats’ disregard for many of the same voters who elected them has become so brazen that they seem to be daring voters to hold them accountable.

With commanding majorities of 41-24 in the House of Representatives and 20-15 in the state Senate, it’s understandable that Democrats are developing a sense of invincibility.

However, it remains to be seen if the Democrats’ recent surge — in 2017, they held a 34-31 margin in the House, while Republicans had an 18-17 majority in the Senate — is due to their own popularity or because Donald Trump irritated many Colorado voters.

In 2018, Colorado voters rejected (59%-40%) a tax increase to raise $700 million a year for highways and transportation. In that same election, voters said “no” (55%-45%) to draconian restrictions on oil and gas development across the state. Polis, campaigning for governor, claimed to oppose those severe oil-and-gas restrictions.

To continue reading this story, please click (HERE):