FYI:

Colorado Democrats have long been critical of TABOR—the Taxpayer’s Bill of Rights.

? What Is TABOR?

TABOR is a constitutional amendment passed in 1992 that:

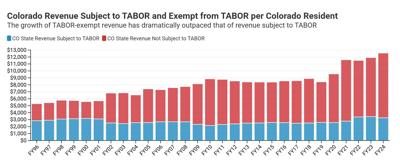

• Limits how much revenue Colorado can collect and spend.

• Requires voter approval for any tax increases.

• Mandates refunds to taxpayers when revenue exceeds a cap based on inflation and population growth.

It’s popular among many voters for its taxpayer protections.

?? Colorado Democratic Party position on TABOR

Colorado Democrats have consistently expressed frustration with TABOR’s constraints since it blocks their unlimited spending. Here’s what recent reporting shows:

• Ongoing Efforts: Democrats have tried for decades to dismantle TABOR. Despite controlling the state government for seven years straight, they’ve made little headway due to TABOR’s popularity and constitutional entrenchment.

• Recent Moves: In 2025, some Democratic lawmakers introduced a resolution to direct the legislature’s legal team to file a lawsuit challenging TABOR’s constitutionality. The argument was that TABOR violates the U.S. Constitution’s guarantee of a “republican form of government” by requiring voter approval for tax increases.

• Internal Disagreement: While many Democrats agree TABOR is problematic, they’re divided on how to address it—whether through legal challenges, ballot measures, or incremental reforms.

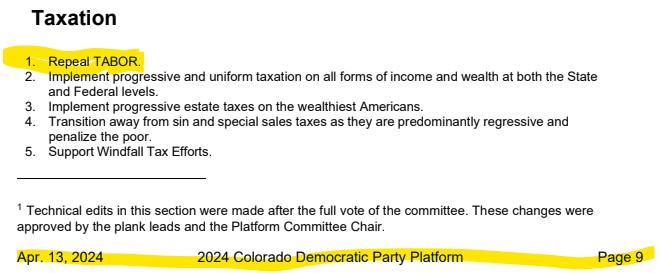

• Platform Status: There’s clear evidence that “Repeal TABOR” is an official plank in the statewide Democratic platform and is certainly a recurring theme in their legislative agenda and public statements.

?? Political Reality

Despite Democratic control, TABOR remains intact because:

• Voter Resistance: Ballot measures to retain excess revenue (Propositions CC in 2019 and HH in 2023) were rejected by voters.

• Strategic Caution: Democrats are wary of political backlash, especially in swing districts or rural areas where TABOR is popular.

? Summary

So, while many Colorado Democrats strongly oppose TABOR and some have pursued legal and legislative avenues to weaken or eliminate it, it’s accurate to say the party has officially declared war on TABOR in its platform. The issue is deeply divisive, both within the party and among voters.

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes