Colorado taxpayers should expect to see Taxpayer’s Bill of Rights refunds for the next several years, provided state revenues continue to do well over that time, state economists told lawmakers Tuesday.

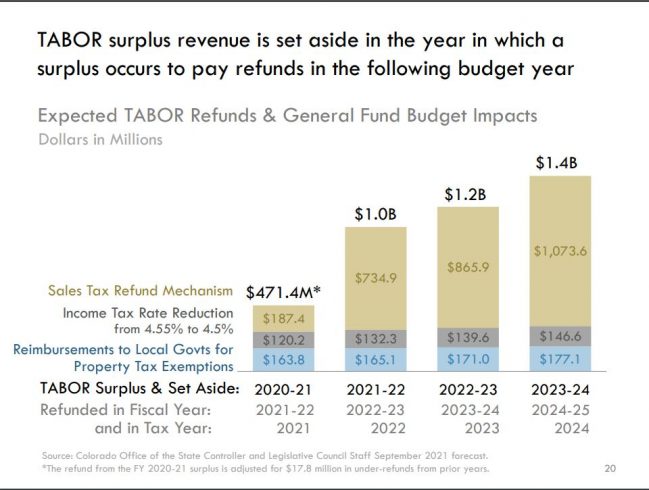

Those economists told the Colorado Legislature’s Joint Budget Committee that their third-quarter revenue forecasts are showing that if the economy continues to bounce back from last year’s pandemic downturn the way it is right now, the state could see more than $4 billion in surplus revenue over the next four years.

That’s money over and above what the 1992 TABOR and 2005 Referendum C voter-approved amendments allows the state to retain, meaning it all is to be refunded to taxpayers when they file their income tax forms starting next year.

That’s all possible because the state’s economy overall is at or near at pre-pandemic levels.

To continue reading this story, please click (HERE):