Teach Your Children About Taxes. Eat Half Of Their Halloween Candy

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#TABOR

#FollowTheMoney

#FollowTheLaw

#UnlessLiberalsIgnoreTheLaw

The TABOR Committee 2021 Ballot Recommendations

TABOR Committee position on Proposition 120

The TABOR Committee urges a YES vote on Proposition 120, “Property Tax Assessment Rate Reduction.”

The proposal would put into law the assessed values for residential and commercial property for purposes of calculating annual property taxes. It would lower the calculated tax burden by about $1 Billion.

The repeal of the Gallagher Amendment was argued as a way to simplify the tax system and make it more rational. It also resulted in higher expected property taxes. This proposal reduces the expected property taxes. After the measure qualified for the ballot, the legislature acted to thwart the will of the people by passing a bill which vastly reduced the effect. Voting for the measure will certainly lead to a necessary legal challenge, based on the standing legal theory that the most recent change in statute (the passage of the Proposition) becomes the new controlling law. Not only is this measure’s underlying tax reform a good idea, but the fall-out will be critical in preventing future legislators from denying the people the right of the initiative through dishonest subterfuge.

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#TABOR

#FollowTheMoney

#FollowTheLaw

#UnlessLiberalsIgnoreTheLaw

TABOR Committee position on Proposition 119

The TABOR Committee urges a NO vote on Proposition 119, “Learning Enrichment and Academic Progress Program.”

The initiated measure would change state law to increase taxes by $137.6 Million on marijuana. Proceeds would go to a new program and agency to fund K-12 after-school activities.

That this concept includes voucher-like opportunities is a good, but insufficient reason to support the measure. Yet another new centralized state government program is unlikely to solve the problems, will have a significant administrative burden and necessarily get bogged down in red tape, funding too much bureaucracy and too little programming. Additionally, ever-higher taxes on marijuana will encourage the lower-cost, criminal underground market for pot.

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#TABOR

#FollowTheMoney

#FollowTheLaw

#UnlessLiberalsIgnoreTheLaw

Announcing the TABOR Committee’s position on Amendment 78

The TABOR Committee urges a YES vote on Amendment 78, “Legislative Authority for Spending State Money”

This constitutional amendment respects the separation of powers by putting the General Assembly into the process of appropriating revenues received by the state government. As the system works now, only the Executive branch (Governor and his appointed agencies) determine how federal grants, like COVID relief funds or money from legal settlements, are spent.

The legislative process allows for public comment and input, which is absent under the current system. Passage of this measure would put that process in place, respecting an intent of the Taxpayer’s Bill of Rights. The TABOR Committee is also alarmed that so much power is currently in the hands of one person, which violates one of the founding principles of American governance. Some concern exists that taxes currently counted toward the TABOR annual limitation will be made exempt, but the Committee was unable to identify any. Therefore we endorse the proposed measure for respecting the proper separation of powers.

Voters to decide if El Paso County can keep $15 million in excess revenues

Voters to decide if El Paso County can keep $15 million in excess revenues

From the 2021 Voter Guide: Races and issues in El Paso and Teller counties series

- Breeanna Jent breeanna.jent@gazette.com

- Oct 11, 2021

EL Paso County voters will decide in November 2021 whether to refund $15 million in excess government revenue back to residents or to use the money to address road infrastructure projects and backlogged parks maintenance.

Courtesy of El Paso County Public Works

El Paso County voters will decide whether the county may keep $15 million in excess government revenues to fund road infrastructure and deferred parks maintenance projects when they cast their ballots Nov. 2 — money that would otherwise be refunded to taxpayers under Colorado’s Taxpayer’s Bill of Rights.

If voters approve the question, El Paso County will use $13 million of surplus funds to pay for backlogged roadway improvements, including paving and repairing potholes on roads throughout the county. Another $2 million would fund deferred parks projects such as capital improvements, trail preservation and wildfire mitigation at Bear Creek Park, Paint Mines Interpretive Park, Fountain Creek Regional Trail, Ute Pass Regional Trail, The Pineries Open Space and Fox Run Park, including a northern nature center.

The question also asks voters to decide whether to raise El Paso County’s revenue cap to reflect actual 2021 revenue, increasing the limit from $285 million to about $300 million. The amount of the final revenue cap is unknown until next May, because El Paso County will continue collecting additional state and sales tax revenues through the rest of the year, county spokeswoman Natalie Sosa previously said.

2021 Voter Guide: Races and issues in El Paso and Teller counties

TABOR calculates increases in most local government revenues to a formula based on population growth and inflation. Excess can only be used for voter-approved purposes. Continue reading

Lawsuit filed seeking to remove Amendment 78 from Colorado’s November ballot

Amendment 78 would transfer the power to appropriate custodial funds (state revenue not generated through taxes) from the state treasurer to the state legislature.

Plaintiffs alleged that the amendment is not substantially related to Colorado’s Taxpayer’s Bill of Rights (TABOR) and therefore should not appear on the 2021 ballot. Measures that can go on the ballot during odd years in Colorado are limited to topics that concern taxes or state fiscal matters arising under TABOR. This requirement was added to state law in 1994. The Colorado Taxpayer’s Bill of Rights (TABOR) requires voter approval for all new taxes, tax rate increases, extensions of expiring taxes, mill levy increases, valuation for property assessment increases, or tax policy changes resulting in increased tax revenue. TABOR limits the amount of money the state of Colorado can take in and spend. It ties the annual increase for some state revenue to inflation plus the percentage change in state population. Any money collected above this limit is refunded to taxpayers unless the voters allow the state to spend it

To continue reading this story, please click (HERE):

EDITORIAL: $4 billion in returns will fuel the economy

- The Gazette editorial board

- Sep 28, 2021Updated 3 hrs ago

Tails should not wag dogs. It defies physics, not to mention the will of the dog. Tails should wag dogs no more than politicians should decide the size and scope of a government established by the governed to serve the governed. A roaring economy should never increase the size and scope of government unless the people demand it.

The residents of Colorado have made clear they don’t want more government. They believe the state has all the money it needs. They reiterated this conviction just two years ago when they trounced Proposition CC, a proposal to let the state keep revenues above a floating state spending cap determined by an equation of inflation and population growth.

Just last year, voters went a step further and lowered the Property tax from 4.63% to 4.55%, and probably would have voted for a lower rate had they been given the option.

One reason this center-left blue state wants to throttle back government spending is the general discontent the public has with the way politicians treat their money.

To read the rest of this editorial, please click (HERE):

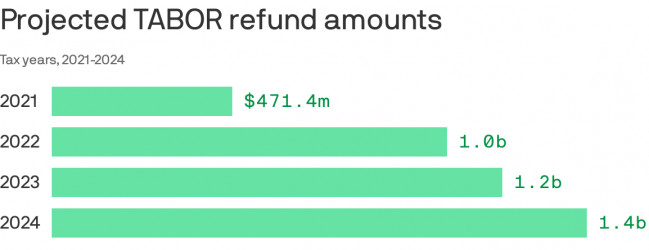

Colorado to issue $4.1 billion in taxpayer refunds in next four years

Source: Colorado Legislative Council; Chart: John Frank/Axios

Colorado is preparing to issue $4.1 billion in refunds to taxpayers over the next four years, new projections show.

State of play: Whether that’s a good thing remains up for debate among state lawmakers.

What’s happening: Democratic lawmakers and liberal advocates are renewing a push to bypass the Taxpayer’s Bill of Rights and keep the surplus tax revenue, saying the money is needed to help the state build back from the pandemic and improve education.

- Early discussions involve moving certain revenue off the books.

- Another possibility is asking voters to keep the money through a ballot measure.

What they’re saying: “This coming year, taxpayers will see rebate checks, but those will come at the expense of better funding for public services that reduce costs for all of us,” state Sens. Chris Hansen and Dominick Moreno, both Democratic budget writers, wrote in a recent opinion piece.

The other side: Gov. Jared Polis, a Democrat, is cheering the refunds, saying they’re a sign of a good economy.

Conservative supporters of TABOR are blasting Democrats for wanting to keep the cash.

- “Colorado voters have said time and time again they want their TABOR refunds,” said Jesse Mallory, the Colorado director of Americans for Prosperity, a limited-government group. “The legislature should not ignore the will of the voters and look for loopholes to keep them.”

How it works: Under TABOR, the voter-approved constitutional amendment, Colorado’s tax revenues cannot exceed the rate of inflation plus population growth. When they do, the surplus must go back to taxpayers unless voters allow the government to spend the money.

The size of the surplus determines how it is refunded.

- For the current year through 2024, the surplus is so large it will result in a temporary reduction of the state’s income tax rate from 4.55% to 4.5% and a sales tax refund.

To read the rest of this story, please click (HERE):