Progressives want more from Colorado residential property taxes

By Brad Hughes

By Brad Hughes

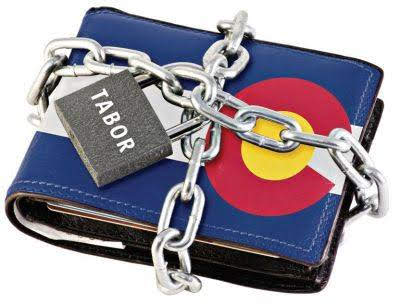

Some Colorado progressives are intrigued by a Bell Policy Center idea to increase property taxes on the wealthy to pay for subsidized housing for the poor. Colorado progressives frustrated that they could not eliminate TABOR, have been targeting property taxes as a source to expand government. The repeal of the Gallagher amendment was a big victory for them in pursuing increased residential property taxation. One of their proposals was to target residential real estate that exceeded $2 million in value. One proposal was to assess an additional 0.57% tax on homes valued at over $2 million. Another proposal was to establish a fee that was 1.1% on houses valued at over $2 million. Fortunately, both initiatives died. This doesn’t mean the idea is dead. It will be back for next year’s session.

Elizabeth Warren (D-MA) was quoted on Twitter as making a comparison between her proposed wealth tax and the traditional property tax. Addressing a crowd, she said: “You’ve been paying a wealth tax for years. They just call it a property tax. I just want their tax to include the diamonds, the yachts, and the Rembrandts.” Under current law, the first $250,000 ($500,000 for married couples) of capital gains on the sale of your primary residence are exempt from tax. Warren wants to create a wealth tax that would fall on the ownership of financial assets such as corporate stock or bonds. Many progressives at the national level like this idea. This will be difficult to accomplish when Americans learn about the magnitude of this taxation. A surtax on residential property in Colorado will be met with resistance if the electorate is informed.

The experiment with the wealth tax in Europe was a failure in many countries. France’s wealth tax contributed to the exodus of an estimated 42,000 millionaires between 2000 and 2012, among other problems. Emmanuel Macron, President of France, ultimately killed it.

In 1990, twelve countries in Europe had a wealth tax. Today, there are only three: Norway, Spain, and Switzerland. According to reports by the OECD and others, there were some clear themes with the policy: it was expensive to administer, it was hard on people with lots of assets but little cash, it distorted saving and investment decisions, it pushed the rich and their money out of the taxing countries—and, perhaps worst of all, it didn’t raise much revenue.1

The wealth tax idea was substantially influenced by the work of discredited French economist Thomas Piketty, whose book “Capital in the Twenty-First Century”, was focused on redistributing wealth in Europe.

Although a wealth tax will be difficult to impose in America, some states, like Colorado, are considering an increased surtax on residential property to accomplish their tax agenda and circumvent taxpayer opposition. It is important for Coloradans to support TABOR, and oppose surtaxes on residential property. Apathy and ignorance encourage the passions of radical progressivism. Stay tuned. The progressives will not give up until they lose elections.

1 https://www.npr.org/sections/money/2019/02/26/698057356/if-a-wealth-tax-is-such-a-good-idea-why-did-europe-kill-theirs#:~:text=The%20experiment%20with%20the%20wealth%20tax%20in%20Europe,twelve%20countries%20in%20Europe%20had%20a%20wealth%20tax.

By Brad Hughes

By Brad Hughes