#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

TABOR – Colorado’s Taxpayer’s Bill of Rights. Protecting You. Protecting Colorado

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

TABOR’s multiple anniversary dates

TABOR’s multiple anniversary dates

November 3, 1992 passed by voters.

November 4, 1992 effective date for section (4) Required Elections

December 31, 1992 effective date for remainder

January 14, 1993 – Gov Roy Romer signed the resolution.

30 Years Later, Colorado’s Taxpayer Bill of Rights Has Been Decimated

TABOR Turns 30: Thirty Years of Colorado’s Taxpayer’s Bill of Rights

This month marks the 30th anniversary of Colorado’s Taxpayer’s Bill of Rights (TABOR), which was approved by voters in November of 1992 as a constitutional tax and expenditure limit (TEL). TABOR is considered the gold standard of state fiscal rules because it limits the growth of most of Colorado’s spending and revenue to inflation plus population. If the state government collects more tax dollars than TABOR allows, the money is returned to taxpayers as a TABOR refund. The receipt of tax rebates, totaling $8.2 billion since TABOR passed in 1992, has strengthened Colorado citizens’ confidence in the TABOR Amendment over the years. To learn more about TABOR and effective TELs, read our latest report and visit FiscalRules.org.

Did You Know This Is In The 2022 Colorado Democrats Platform?

No wonder they have “Tax and Spend,” “Spend and Tax” agenda.

They don’t like being constrained.

No wonder we don’t like their policies.

They try to undermine TABOR at every instance.

They now call them “fees” instead of “taxes,” or categorize them as “enterprises” to skirt TABOR.

They believe that “your” money is “their money.”

If you don’t believe us, here’s a screenshot of page 9 of their 2022 platform:

Pay attention, Colorado, pay attention….

Reining in the Size and Scope of State Government

In celebration of thirty years of the Colorado Taxpayer’s Bill of Rights (TABOR), ALEC today launched its Fiscal Rules campaign, featuring the interactive Fiscal Rules microsite, new Fiscal Rules animated video, and new report, “TABOR Turns 30: Thirty Years of Colorado’s Taxpayer’s Bill of Rights.”

Did You Know This About TABOR?

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

Report touts Colorado’s TABOR as ‘gold standard’ for state tax policy

Report touts Colorado’s TABOR as ‘gold standard’ for state tax policy

- By Derek Draplin | The Center Square

- Nov 4, 2022

Paul Brady Photography | Shutterstock

(The Center Square) – Colorado’s Taxpayer’s Bill of Rights is the “gold standard” for state tax policy, a new report argues.

The report, by the American Legislative Exchange Council, a free-market group that’s known for drafting model legislation adopted in Republican-led states, comes amid the 30th anniversary of TABOR, the constitutional amendment that Colorado voters passed in 1992.

TABOR requires voter approval for tax increases and limits state revenue growth to inflation plus the rate of population growth. It also requires revenue surpluses to be refunded back to taxpayers.

“TABOR is a resounding success for Colorado, despite ongoing attempts to eliminate it,” said Dr. Barry Poulson, author of the report and a professor emeritus at the University of Colorado Boulder. “TABOR uses a straightforward formula for limiting the size and scope of government by capping the rate of growth in state revenue and spending to inflation plus the rate of population growth.”

TABOR contrasts with California’s Gann Amendment, which the report says was “watered down” by special interests. Continue reading

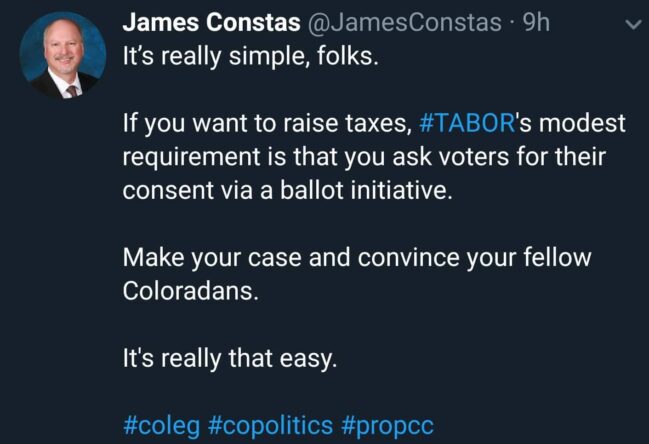

With TABOR, Make Your Case And Convince Your Fellow Coloradans

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw