The good news is that the Colorado state-run hospital provider fee program brought in just less than $700 million last year.

The money, which was matched almost dollar-for-dollar by the federal government, is targeted to increase funding for hospital care for Medicaid and uninsured clients, improve care for clients serviced by public health insurance programs and reduce cost-shifting to private payers.

As a state program, the hospital provider fee (HPF) requires hospitals to pay in an amount that’s based on the number of overnight patient stays and how many outpatient services they were provided.

Since 2009, the program has boosted health coverage for Coloradans and helped more than 300,000 people get insurance.

Even though revenue generated through the HPF program is a welcome addition to the cause of keeping Colorado healthy, it’s creating a controversy in the capital for other impacts it has and could have on the state.

Fee tips TABOR scales

Weighing in as high as it does, revenue from the HPF program adds a generous amount to the state’s revenue. And although that sounds like a good thing, the program is raising issues about how that amount will negatively impact other state spending.

At the base of the controversy is the fact that HPF funds are slated for a particular purpose, and yet they can substantially reduce the amount Colorado will have available for many other projects.

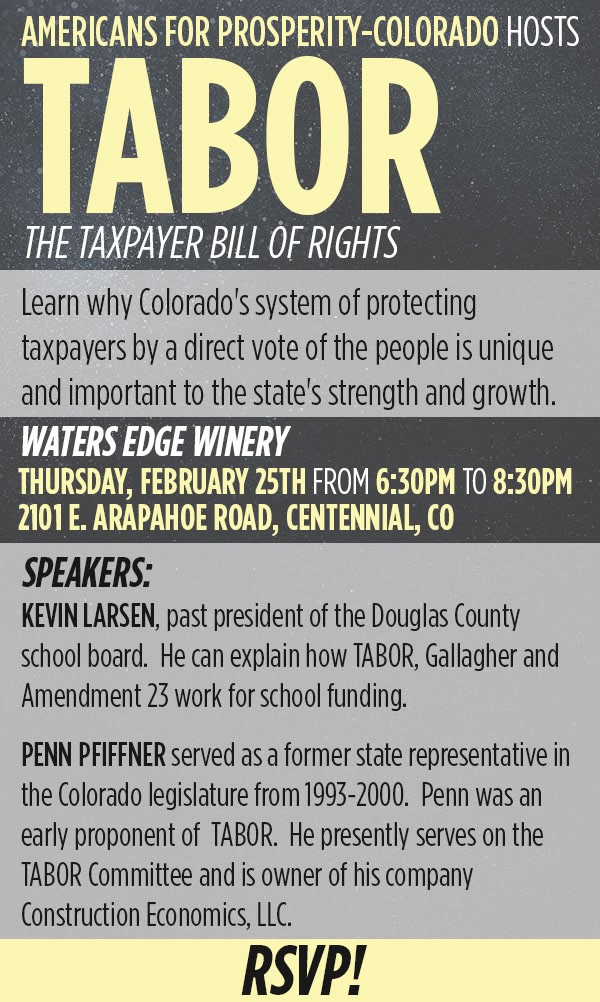

Background to the concern goes back to 1992. At that time, Colorado voters approved the Taxpayer’s Bill of Rights (TABOR), a constitutional amendment designed to keep growth in the hands of the people rather than in the hands of the government.

Hospital Provider Fee

• What is it?

The hospital provider fee (HPF) requires hospitals to pay in an amount that’s based on the number of overnight patient stays and how many outpatient services they were provided. It raised almost $700 million in 2015.

• What is its current status?

Funds from the hospital provider fee currently count against spending limits imposed by the Taxpayer’s Bill of Rights. That status will force tax refunds, thereby mandating cuts in other programs.

• What is the proposal?

Gov. John Hickenlooper proposes reclassifying the hospital provider fee as an “enterprise,” thereby removing it from counting against TABOR spending limits.

• What are the arguments against this proposal?

Opponents argue that the hospital provider fee does not meet the definition of an “enterprise,” that tax refunds should go forward, and that the state pursue budgetary efficiencies and cost-cutting to pay for the refunds.

TABOR prohibits tax increases without a vote of the people and places strict limits on how much revenue the state can keep and how much it can spend. Under TABOR, state spending is only allowed to increase at the rate of population growth plus inflation.

If the state collects revenue that exceeds TABOR’s revenue limits, that amount must be refunded to taxpayers, according to the amendment.

At this point, the HPF is tipping the scales in favor of exceeding those limits.

It’s not that taxpayer refunds — estimated to be in the range of $25 to $125 per individual — would be a bad thing.

Those in favor of the reclassification, however, are looking at rerouting funds as a way of filling in gaps of the 2016 state budget. They see the result of that as being of a greater benefit to all.

The projects that would escape cuts and be allowed to continue moving forward include education, transportation and road maintenance.

Workaround and end-around?

In an attempt to balance the issues — HPF revenue, TABOR limits and the state budget — Democratic Gov. John Hickenlooper has set forth a legislative action that would reclassify how HPF is legally regarded.

The intent is to reduce the amount of budget woes the state will have to reconcile.

In response to the initiative, Republican Senate president Bill Cadman and other conservatives have taken the stance that the reclassification is unconstitutional and an effort to water down TABOR.

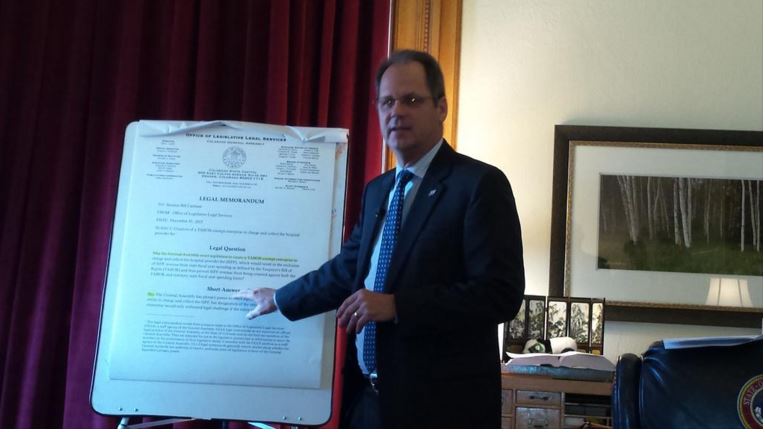

At this point, opposing parties are at a standstill. It’s been more than a month since Hickenlooper requested that Republican attorney general Cynthia Coffman decide about the constitutionality of reclassifying the billion-dollar hospital-fund program.

The current response from Coffman’s office is that the decision still is under review.

While the wait continues, other voices are weighing in on the subject.

On Feb. 11, legal counsels for two former governors released a legal brief that said reclassification of the HPF would be legally sound and fiscally responsible.

Jon Anderson and Trey Rogers, former counsels to Republican Gov. Bill Owens and Democratic Gov. Bill Ritter, completed the legal analysis at the request of a coalition called Fix The Glitch.

The coalition, a group of Colorado business organizations, is requesting that the Colorado General Assembly move forward on the reclassification.

“Regardless of our differing political views on the HPF, we are all strongly supportive of legislation that places HPF funds in an Enterprise Fund. The original law comingles HPF funds with general State revenue, inaccurately impacting revenue growth and creating significant unintended consequences that limit the state’s ability to meet core infrastructure investment priorities,” the group states.

The group’s petition said that HPF funds have begun “to crowd-out road and bridge funding. CDOT right now has more than $3 billion in backlogged road projects.”

Koch-funded opposition

On the other side of the controversy is the conservative political advocacy group initially funded by the Koch brothers — Americans for Prosperity.

Standing in opposition to making the HPF an enterprise, the group’s state director, Michael Fields, responded to Hickenlooper’s challenge for a better solution to close state budget gaps in January.

“With the state budget for next year adding up to an astounding $27 billion, the state should have more than enough money to take care of its core responsibilities.

“By cutting waste, finding efficiencies and re-examining priorities within the budget, we will be able to find more than enough money for important projects like fixing roads, building bridges and adequately funding our schools — without the need for Hickenlooper’s illegal plan to dismantle the Taxpayer’s Bill of Rights.”

The expected revenue from HPF in 2016 is $756 million, according to the economic outlook reported by the Governor’s Office of State Planning and Budgeting.

In contrast, the state fiscal year budget shortfall is $373 million.

In his 2015 State of the State Address, Hickenlooper said that our budget rules aren’t working.

“Coloradans know we’re not fully funding education. They’re fed up with traffic congestion, they’re fed up with potholes and they’re fed up with our inability to expand our highway system,” he said.

“Virtually every chamber of commerce and editorial board across the state … all agree that fixing the Hospital Provider Fee makes sense.”

TABOR practicality challenged

Changing the fee to an enterprise was actually laid out in the TABOR constitutional amendment, according to individuals and groups that see the change as a good one.

The TABOR Amendment defines an enterprise as “a government-owned business authorized to issue its own revenue bonds and receiving under 10 percent of annual revenue in grants from all Colorado state and local governments combined.”

Proponents of the reclassification argue that the action has already been used to the benefit of the state.

Current Colorado enterprises include the state lottery and Colorado Parks and Wildlife.

Keeping the money generated from the HPF out of state revenues would allow it still to be used in the way it was initially intended while keeping TABOR intact and money available to put into other state programs.

If the HPF stays as it is, and TABOR caps are reached, however, the overflow will by law go toward taxpayer refunds, and the budget will demand cuts.

“We have enterprises that run lotteries, and build bridges and manage state parks. The one we propose provides services to our health care system that it can’t provide on its own — and they want to pay us for them,” said Hickenlooper in his state of the state address.

“If we can’t make this very reasonable change — like many already allowed under TABOR — then what choice do we have but to re-examine TABOR?”