To read this whole story, please click THIS LINK to go to the Denver Post:

70%+ of Coloradans support TABOR.

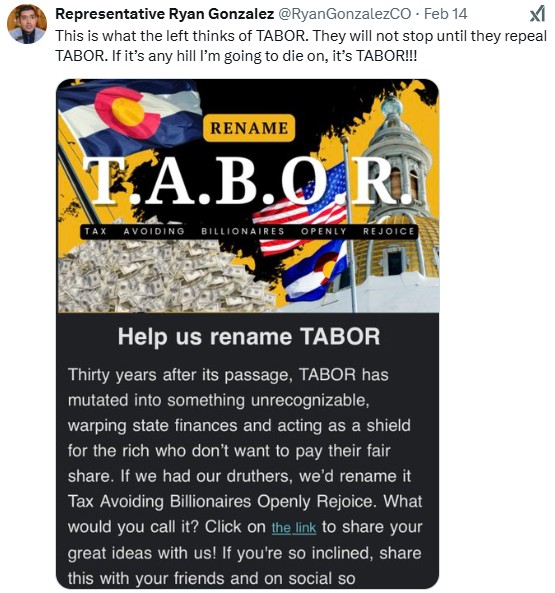

What TABOR stands for:

What one political party in Colorado is trying to wrongfully change it to, according to our TABOR friend, Representative Ryan Gonzalez:

Representative Ryan Gonzalez (@RyanGonzalezCO) / X

February 15, 2025

It has been half a century since Howard Jarvis launched the first property tax revolt with Prop 13 in California. Since then, forty-six states and the District of Columbia have enacted some form of property tax limitation. Some of these measures have proven to be effective, but others are poorly designed and ineffective.

It is not surprising that a new property tax revolt has been launched. Many property owners had sticker shock this year when they got their property tax bills. I am one of the unfortunate sods in Colorado who have seen the property tax on their homes more than double in recent years. Many less fortunate souls on fixed incomes have literally been taxed out of their homes.

The explanation for the discontinuous increase in property taxes today is the same as that during the first property tax revolt in the 1970s. In those years double-digit inflation was accompanied by discontinuous increases in property taxes. Inflation rates recently peaked at 9 percent and have remained well above the target inflation rates set by the Federal Reserve. Increased housing costs are one of the major contributors to this higher rate of inflation. Higher home prices today also reflect the expensive and time-consuming regulations imposed by state and local governments on home construction.

Even in a state such as Colorado, with an effective tax and expenditure limit, homeowners have not been protected from the ravages of inflation. Colorado has experienced one of the highest rates of increase in home prices in the nation. Colorado’s Taxpayer Bill of Rights (TABOR) limits the amount of property tax revenue that local governments can keep and spend. TABOR also requires voter approval for any new tax or increase in tax rates; but it does not cap the amount of property taxes that individual homeowners must pay. TABOR has not shielded homeowners from increased property taxes due to rising property values and other state and local measures designed to increase collections. The Colorado Legislature will hold a special session this year to address the problem of higher property tax burdens.

Click (HERE) to continue reading this story.

#ItsYourMoneyNotTheirs

#DontBeFooled

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

#ThankGodForTABOR

DENVER (KDVR) — Monday marked the first day the IRS could start accepting and processing your tax return.

Colorado filers need to keep an eye out for one key step to make sure they get all the money they are eligible for back in their wallets.

Coloradans are set to get TABOR refunds after they file their taxes this year, but the state is reminding residents that they have to opt in.

“Unfortunately, if you didn’t check that box for your taxes you filed in 2024 for tax year 2023, you did miss out on your tabor refund,” said Elisabeth Kosar, communications director for the Colorado Department of Revenue. “TABOR is something you need to opt into so please, please check that box or again have whoever is preparing your taxes check that box.” Continue reading

January 19, 2025 By Nash Herman

Colorado legislators are discovering first-hand the impossibility of having their cake and eating it too.

The Joint Budget Committee continues to meet with dozens of departments to reconcile an approximately $750 million budget shortfall in 2025, with some absurdly claiming that deficit is purely a result of the Taxpayer’s Bill of Rights (TABOR) at work.

Granted, it does sounds bizarre that the state must make budget cuts in a year that it is still expected to collect a surplus of revenue beyond what is allowed by TABOR. But by looking at the facts, anyone can come to see how the so-called budget “crisis” is actually a self-inflicted wound from the legislature’s relentless over-spending.

Having their cake

Due to the Covid-19 pandemic, Colorado received a windfall of federal funds to prop up the state economy and boost recovery. To fund that massive stimulus, the federal government printed money, causing an increased supply of dollars chasing the same number of goods. This in turn lead to the dollar being worth less, also known as inflation. Continue reading

January 7, 2025 By Rep. Ryan Gonzalez

In 1992, Colorado voters passed the Taxpayer’s Bill of Rights, or TABOR, the nation’s strongest tax limitation law to this day. For those who are unfamiliar what TABOR really does, this amendment to the Colorado Constitution allows government spending to reasonably increase using a formula of population growth plus inflation. Excess revenue, known as the “TABOR surplus,” must be refunded to taxpayers. If state government wants to keep the surplus, or raise taxes, voters must approve. That is exactly why progressives abhor TABOR. But the truth is, a little north of 60% of Colorado voters approve of TABOR.

In 1992, Colorado voters passed the Taxpayer’s Bill of Rights, or TABOR, the nation’s strongest tax limitation law to this day. For those who are unfamiliar what TABOR really does, this amendment to the Colorado Constitution allows government spending to reasonably increase using a formula of population growth plus inflation. Excess revenue, known as the “TABOR surplus,” must be refunded to taxpayers. If state government wants to keep the surplus, or raise taxes, voters must approve. That is exactly why progressives abhor TABOR. But the truth is, a little north of 60% of Colorado voters approve of TABOR.

Many progressives have made their disdain for TABOR be known, having tried time and time again to chip away at TABOR’s taxpayer protections. And in many ways, they’ve done so; mostly by adding tax credits which pull from the TABOR surplus. They’ve done so by giving everyone equal tax refunds and redistributing wealth; taking from those who paid the most in state taxes and giving more to those who paid little.

In 2022, the Democrat majority, just before a critical midterm election, gave taxpayers what they called the “Colorado cash back” in disguise as a “stimulus” check. What they didn’t tell you is that it was actually your TABOR refund, just early and proportioned against historical distribution. Continue reading

December 20, 2024 By Nash Herman

The University of Colorado’s Leeds School of Business recently released their 60th annual Business Outlook for 2025, and, despite a moderate outlook in 2025, the report includes some disturbing trends in the Colorado economy. Let’s take a look at some of what’s going wrong.

Troubling trends

As pointed out by Denver Post business writer Aldo Svaldi, Colorado was the fifth fastest growing economy in the country in the last 15 years, but was 41st this year.

In terms of personal income growth, Colorado moved from third to 39th.

Although Colorado only moved down from sixth to 15th for employment growth, it comes with the caveat that the job gains this year were skewed toward government, education and healthcare, and leisure and hospitality.

Conversely, the growth of the high-paying professional and business services industry has continued a downward trend since 2022.

Fueled by slowing migration to Colorado and an aging population, Colorado’s labor force growth ranking also moved from sixth to 29th.

Taxes, spending and regulation

Obviously, some of the problems with Colorado’s economy are externally caused, like the lingering effects of the pandemic and subsequent inflation from federal spending.

However, I think there is still more to be said as to why Colorado’s economy seems to be stuttering now.

Colorado’s shift toward bigger government and away from the free market is why these problems are beginning to manifest. Over-regulation, over-spending, and over-taxation are the key culprits. To Coloradans who have witnessed the economy’s decline, the most noticeable difference between today and twenty years ago is that the state now more closely resembles California more than the entrepreneurial Colorado of old. Continue reading