State lawmakers consider reforms in 2020 that would limit the growth of government.

GETTY

Americans are frequently told – by members of the media, candidates, and others – that political division is heightened in this consequential election year. Members of Congress, however, have reached bipartisan agreement that the federal government should spend more money than it brings in, even when the economy is growing and unemployment is low. Fiscal profligacy carries the day in Washington, yet lawmakers in state capitals are taking action to ensure that state spending and the size of government grows at a sustainable clip.

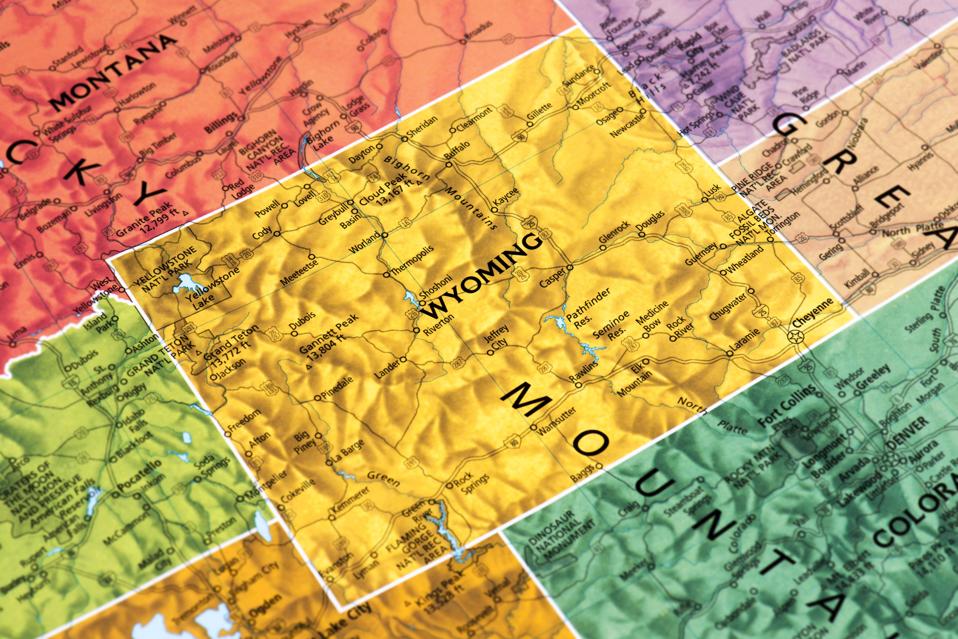

A member of the Wyoming Legislature, Representative Chuck Gray (R), introduced a joint resolution last week that seeks to limit the growth of the state budget and require voter consent for the approval of future tax increases. House Joint Resolution 2, introduced by Representative Gray on February 7, would amend the state constitution to include a “Taxpayer’s Bill of Rights” that would do two things: limit state spending to the rate of population growth plus inflation, and require all state tax hikes receive voter approval.

Representative Gray’s bill is inspired by Colorado’s Taxpayer’s Bill of Rights (TABOR). Like the TABOR measure now pending in the Wyoming statehouse, Colorado’s TABOR, which has been the law since it was approved by Colorado voters in 1992, requires that all state tax hikes receive approval from Colorado voters. Colorado’s TABOR also caps the increase in state spending at the rate of population growth plus inflation.

Colorado’s TABOR is the reason why Democrats who control the Colorado Legislature and would like to impose a host of tax increases are unable to do so. In November of 2019, Colorado voters affirmed their support for TABOR by rejecting Proposition CC, a measure referred to the ballot by legislative Democrats that would’ve gutted TABOR by ending the taxpayer refunds due in accordance with it.

Leave a Reply