#TABOR #VoteNoOnPropCC #ItsYourMoney #VoteNoOnPropositionCC #DontLoseYourRights #NoOnCC #DontGetFooledAgain #TABORMatters

Even though I don’t write a column anymore, some issues demand attention. Today, it’s Proposition CC. The question is, where to start.

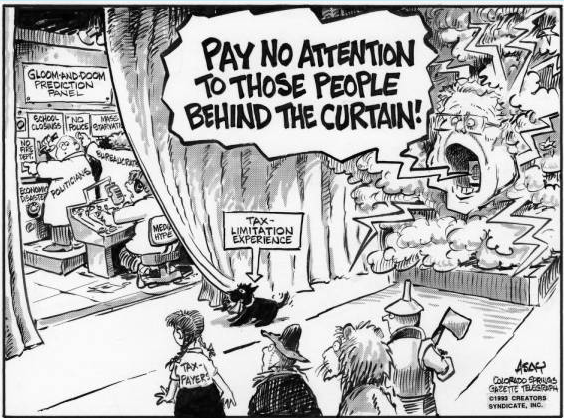

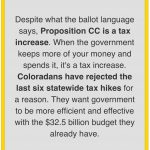

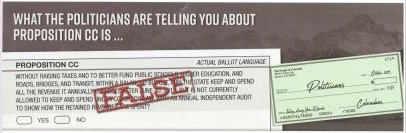

The deceptive wording is as good a place as any.

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?”

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?”

It seems to me if the legislature wants to strip one of the fundamentals of the Taxpayer’s Bill of Rights, our lawmakers should have the nerve to say so.

For those of you who don’t know, in 1992 voters amended the Colorado Constitution to limit the growth of government by limiting spending — a bill affectionately known as TABOR.

To read the rest of this TABOR editorial, please click (HERE):

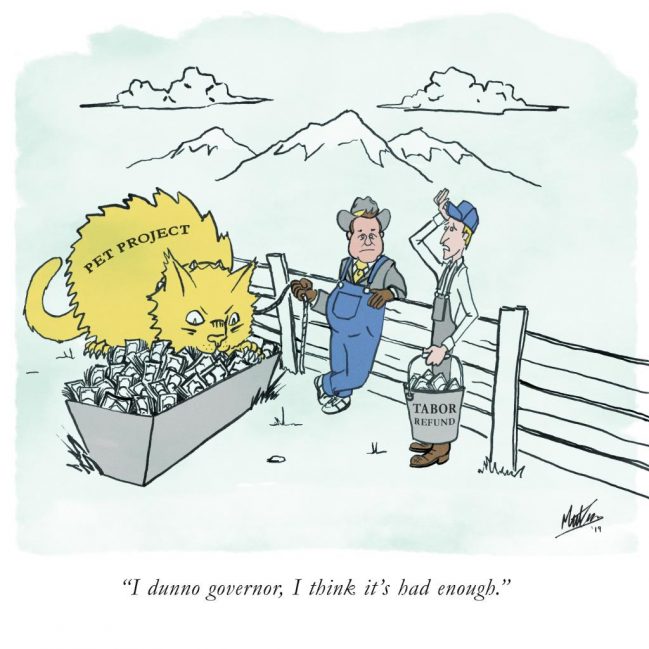

Kevin McCarney of Mesa County reminds voters “All tax revenue goes to the general fund” with #PropositionCC.

Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.

Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.

No other state in the union has one.

It is a most simple law. If the politicians want to raise our taxes, they have to put to a vote of the citizens. If they want raise our debt, they have to put it to a vote of the citizens. If the tgovernment collects more tax revenue than permitted they have to return the money to us. Simple as that.

Bureaucrats hate this law. So do most lawmakers. You see, they think they know how to spend our money better than we do and want the right to spend without limits.

Our Taxpayer’s Bill of Rights has led to a backlash at every level of government, and it stretches across party lines. Our people who represent us in government have one thing in common: They can never get their hands on enough of our money to spend.

DENVER — Democrats who control Colorado’s Statehouse are asking voters in November to dismantle part of a state tax regime that for decades has served as a model for fiscal conservatives nationwide.

Coloradans will decide if the state can permanently keep tax revenue that otherwise would be refunded under limits set by a 1992 constitutional amendment called the Taxpayer’s Bill of Rights, or TABOR.

Democratic lawmakers who won a substantial legislative majority in 2018 elections that pushed this onetime swing state to the left placed Proposition CC on the ballot. They say it’s time to chip away at a formula has led to a multi-billion dollar under-investment in fast-growing Colorado’s schools and roads.

TABOR requires that proponents go to the ballot to let voters decide.

DENVER (AP) – Democrats who control Colorado’s statehouse are asking voters to dismantle part of a state tax regime which for decades has served as a model for fiscal conservatives nationwide.

Coloradans will decide Nov. 5 if the state can permanently keep tax revenue that otherwise would be refunded under limits set by a 1992 constitutional amendment called the Taxpayer’s Bill of Rights.