Category Archives: Why TABOR Matters

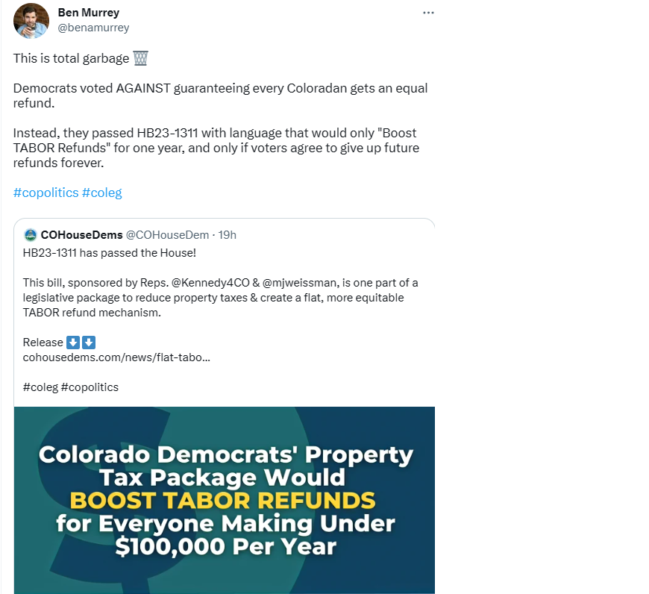

Twitter Post By Roger D. Hudson About TABOR, Gov. Polis, & Colorado’s Property Tax Problem

TABOR Gives Taxpayers a Voice

TABOR Gives Taxpayers a Voice

By Dennis Polhill

By Dennis Polhill

A recent election result showed the great value of the requirement within the Taxpayer’s Bill of Rights for voters to approve new taxes or debt. There was a TABOR election in the Foothills Fire Protection District (FFPS). The outcomes measure how upset voters were with the proposed actions of elected officials.

Ballot issue 6B would have allowed the District to issue new debt. That was soundly defeated 74.11% to 25.89%

Ballot issue 6C would have increased taxes and it too was defeated, by 66.98% to 33.02%

The tactics used to obtain this taxpayer money were very questionable. A former board member who painstakingly reviewed all meeting documentation learned that there had been absolutely zero public discussion of the proposed ballot measures prior to the August meeting when the measure was placed on the ballot. Yet, the proposal passed unanimously – without discussion! Had something been happening behind the scenes, in violation of the Sunshine laws? Note that the August meeting was the last possible moment to meet the County Clerk’s deadline for a November citizen vote to put the referral to the ballot .

Paradise Hills Homeowners Association on Lookout Mountain accounts for close to half of the homes protected by FFPD and owns a vacant lot designated for open space use near an I-70 highway exit. At a Homeowners Association meeting an alert retired firefighter picked up on what was happening when it was mentioned that FFPD would buy the vacant lot for a new station for $400,000, yielding a significant rainy day fund or dues waiver for Homeowners Association owners. Did FFPD intend to buy their votes with their own tax dollars?

Citizens immediately started getting the word out; flyers were printed, yard signs went up, and a couple of large banners created. Comments on Nextdoor were not friendly to FFPD, resulting in the censoring from Nextdoor of some neighbors who posted information.

By this time the community was in angry uproar and five folks who otherwise likely would never have run for any office are now candidates for the five seats on the FFPD board due to be elected on May 2, 2023.

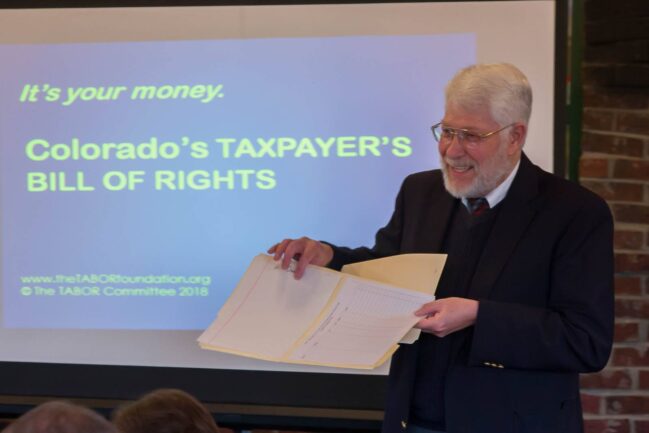

Penn Pfiffner Discussing How TABOR Benefits Colorado

Penn Pfiffner discussing how TABOR benefits Colorado

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

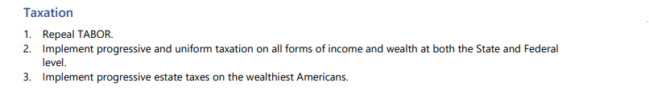

Bullet Point #1 Under Taxation In The Colorado Democrat Party Platform

Did you know?

The Colorado Democrat’s party platform states that they want to eliminate TABOR?

Will The Left Abolish TABOR?

Friday @CompleteCO update:

@JonCaldara, @MichaelCLFields and @benamurrey on defending and strengthening the Taxpayer’s Bill of Rights

#copolitics

http://CompleteColorado.com

https://twitter.com/CompleteCO/status/1636728225970946048?s=20

Click this link, https://www.youtube.com/watch?v=gGkh2Kg-MJU, to watch Jon Caldara, Michael Fields, and Ben Murrey discuss TABOR;

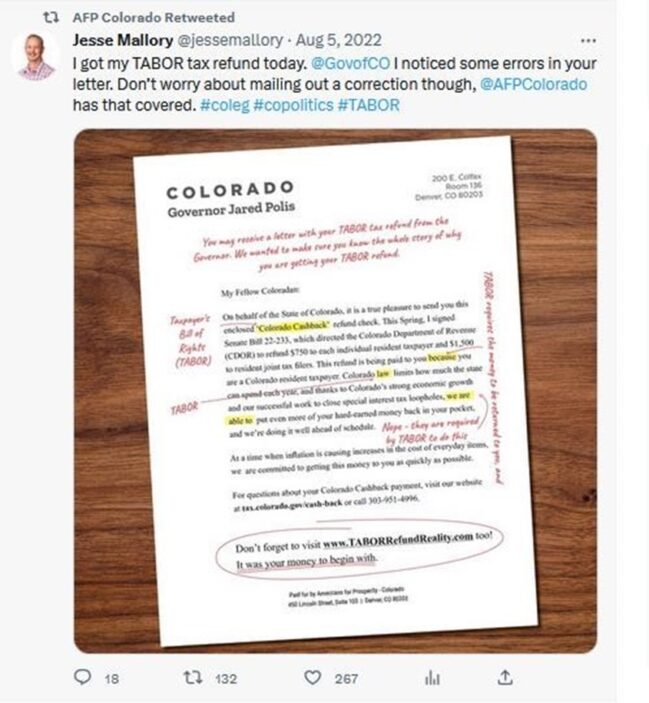

Americans For Prosperity Supports the Taxpayer’s Bill of Rights

TABOR supporter,

Did you know Americans For Prosperity has been promoting and protecting TABOR, the Taxpayer’s Bill of Rights?

Attached is a brochure with their latest activities.

You can learn more by checking their website, https://americansforprosperity.org/state/colorado/

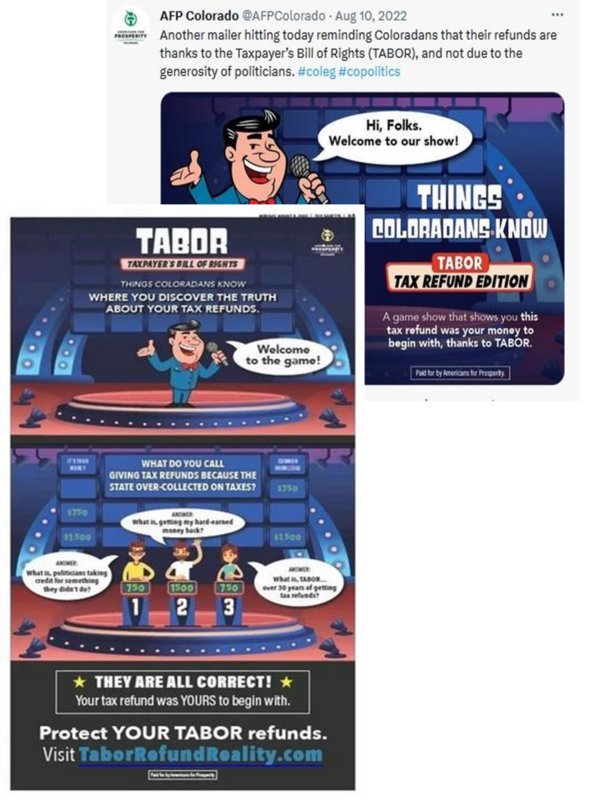

The purpose of this letter is to share a list of Americans for Prosperity’s vigorous activities educating the public about TABOR over the last several months.

Since not everyone may have witnessed those efforts (much is visible on facebook and twitter), I’m including some social blurbs and photos. These blurbs just span back to the July-August 2022 period and I certainly haven’t included all their activities, though there’s more available.

AFP mailers to voters that refunds were thanks to TABOR.

Then, AFP engaged in a gas promotion with unleaded at $2.38 per gallon. AFP covered the difference between the $2.38 and the going rate of $4.45. While drivers waited in line to get the promo gas price, AFP shared information about the Taxpayer’s Bill of Rights, handed out promo materials and water. Continue reading

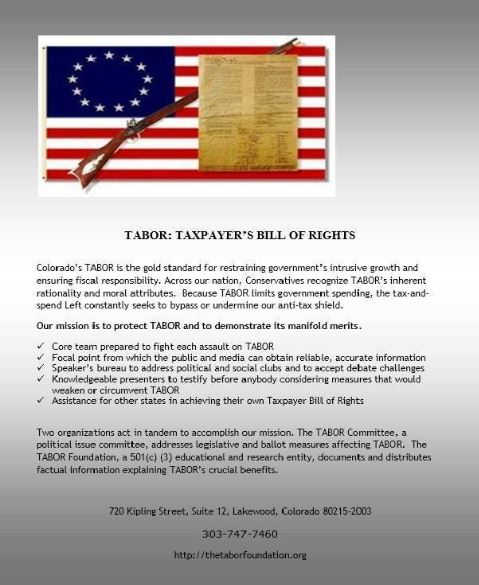

TABOR: Taxpayer’s Bill of Rights

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

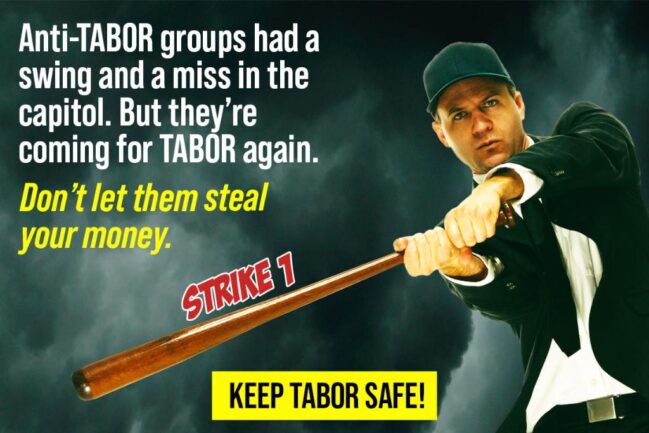

AFP at the state capitol – this Thursday, March 2nd

With looming attacks on our Taxpayer’s Bill of Rights, Americans for Prosperity (AFP) has organized a Lobby Day at the Colorado State Capitol for Thursday, March 2nd from 8:30 am – 3:00 pm. Your participation is welcome, even if you have just a couple hours available.

The focus will be communicating directly with state legislators to:

- Protect TABOR refunds

- Stop the gas tax from going into effect

- Protect Coloradans from soaring energy bills.

The group will be meeting 8:30 am next to the south entry to the capitol at 14th Avenue.

Contact Michael Alarcon with AFP at 303-483-3217 if you have questions or need to meetup with the group through the day.

AFP will provide lunch.

Support The Taxpayer’s Bill of Rights (TABOR).

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw