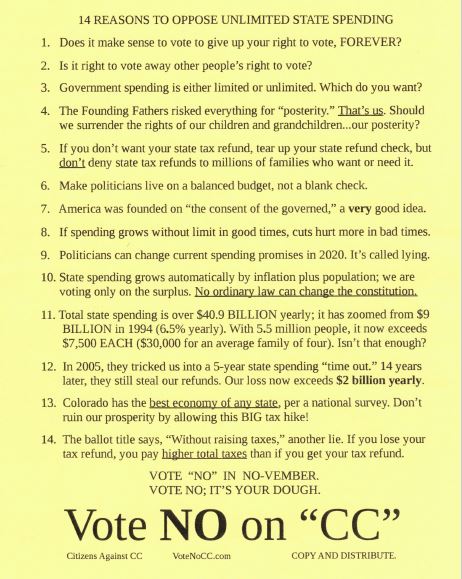

Don’t lose your right to vote on tax increases, your TABOR refund, and no brakes to stop runaway state spending.

If the state keeps it, your taxes have therefore been raised

So they are LYING when they claim “without raising taxes.”

Vote NO on Proposition CC.