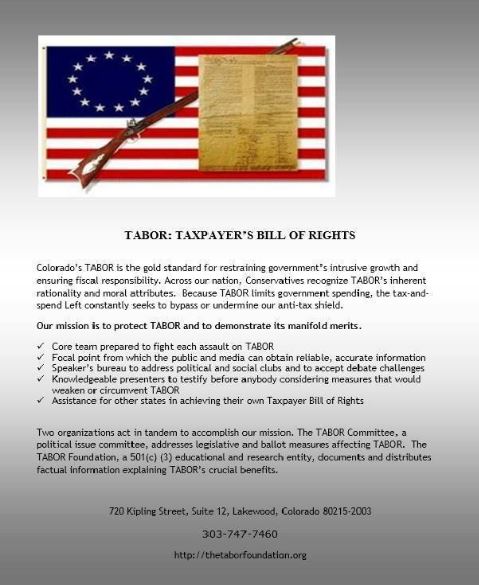

The column above provides how-to and then links to this website which has the local TABOR ballot issue list:

The column above provides how-to and then links to this website which has the local TABOR ballot issue list:

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

Ben Murrey

Thanks to the Taxpayer’s Bill of Rights, commonly known as “TABOR,” Coloradans will receive nearly $4 billion in excess revenue refunded from the state this year. That’s where those $750 checks for individuals and $1,500 for couples came from over the summer. On the ballot this year, Proposition 123 is asking voters to give up their refunds, at least in part.

If adopted by voters, the measure would reduce TABOR refunds by about $86 per person, based on information from the state voter booklet or “Blue Book.”

The measure dedicates up to 0.1% of income tax revenue to affordable housing programs administered by state bureaucracies. For years in which the state has a TABOR surplus, that would reduce TABOR refunds by about $300 million. State economists currently project refunds for at least the next three years.

Even Democrats — who rarely refuse the opportunity to spend more of your money on new government programs — have been skeptical of the measure.

Democratic state Sen. Chris Hansen, of Denver, expressed concern that Proposition 123 could eat directly into the state’s ability to spend on other priorities.

“There’s no free lunch,” Hansen said referencing the measure. “K-12 and higher education (is) where the marginal dollar is in our state budget. So $1 less means $1 less for education.”

The statement proves a bit disingenuous, but the senator is right to say there is no such thing as a free lunch. Continue reading

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

11 News spoke with supporters and opponents of CO Proposition 123 Thursday about their goals and worries.

Published: Oct. 6, 2022 at 8:36 PM EDT

COLORADO SPRINGS, Colo. (KKTV) -Supporters of Colorado Proposition 123 met in Colorado Springs Thursday morning to discuss their hopes and goals for the ballot item, which will appear statewide on Election Day.

If passed, Proposition 123 would dedicate 0.1% of the state budget to help fund affordable housing programs.

That comes out to almost $300 million, and that money would be going to programs designed to create rental units with a cap of 30% of a renter’s income, provide down payment assistance for qualifying individuals, and give grants to local governments for affordable housing development, among other things. Click here to visit Colorado’s “Blue Book” guide with an in-depth look at Proposition 123 on page 30.

Supporters said the proposition will allow people in lower-paying crucial careers, like education and nursing, to be able to afford to live in the communities they work in. Continue reading

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

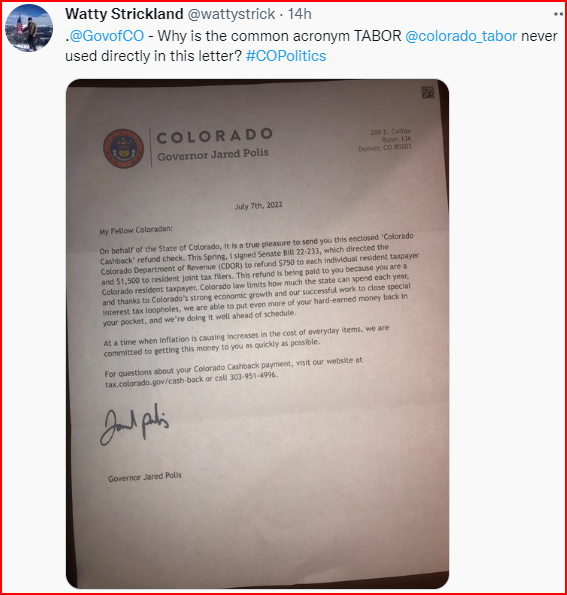

FYI. This was on Twitter yesterday:

BoulderGuyTC@BoulderGuyTC

Replying to @wattystrick @GovofCO and @colorado_tabor