Category Archives: X/Twitter

TABOR Turns 30: Thirty Years of Colorado’s Taxpayer’s Bill of Rights

This month marks the 30th anniversary of Colorado’s Taxpayer’s Bill of Rights (TABOR), which was approved by voters in November of 1992 as a constitutional tax and expenditure limit (TEL). TABOR is considered the gold standard of state fiscal rules because it limits the growth of most of Colorado’s spending and revenue to inflation plus population. If the state government collects more tax dollars than TABOR allows, the money is returned to taxpayers as a TABOR refund. The receipt of tax rebates, totaling $8.2 billion since TABOR passed in 1992, has strengthened Colorado citizens’ confidence in the TABOR Amendment over the years. To learn more about TABOR and effective TELs, read our latest report and visit FiscalRules.org.

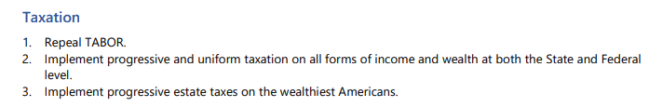

Did You Know This Is In The 2022 Colorado Democrats Platform?

No wonder they have “Tax and Spend,” “Spend and Tax” agenda.

They don’t like being constrained.

No wonder we don’t like their policies.

They try to undermine TABOR at every instance.

They now call them “fees” instead of “taxes,” or categorize them as “enterprises” to skirt TABOR.

They believe that “your” money is “their money.”

If you don’t believe us, here’s a screenshot of page 9 of their 2022 platform:

Pay attention, Colorado, pay attention….

Reining in the Size and Scope of State Government

In celebration of thirty years of the Colorado Taxpayer’s Bill of Rights (TABOR), ALEC today launched its Fiscal Rules campaign, featuring the interactive Fiscal Rules microsite, new Fiscal Rules animated video, and new report, “TABOR Turns 30: Thirty Years of Colorado’s Taxpayer’s Bill of Rights.”

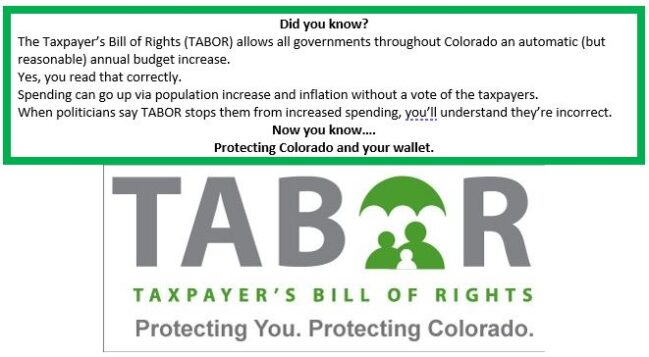

Did You Know This About TABOR?

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

Report touts Colorado’s TABOR as ‘gold standard’ for state tax policy

Report touts Colorado’s TABOR as ‘gold standard’ for state tax policy

- By Derek Draplin | The Center Square

- Nov 4, 2022

Paul Brady Photography | Shutterstock

(The Center Square) – Colorado’s Taxpayer’s Bill of Rights is the “gold standard” for state tax policy, a new report argues.

The report, by the American Legislative Exchange Council, a free-market group that’s known for drafting model legislation adopted in Republican-led states, comes amid the 30th anniversary of TABOR, the constitutional amendment that Colorado voters passed in 1992.

TABOR requires voter approval for tax increases and limits state revenue growth to inflation plus the rate of population growth. It also requires revenue surpluses to be refunded back to taxpayers.

“TABOR is a resounding success for Colorado, despite ongoing attempts to eliminate it,” said Dr. Barry Poulson, author of the report and a professor emeritus at the University of Colorado Boulder. “TABOR uses a straightforward formula for limiting the size and scope of government by capping the rate of growth in state revenue and spending to inflation plus the rate of population growth.”

TABOR contrasts with California’s Gann Amendment, which the report says was “watered down” by special interests. Continue reading

With TABOR, Make Your Case And Convince Your Fellow Coloradans

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

Maybe it’s time to call off one-party rule in Colorado

October 28, 2022

Maybe it’s time to call off one-party rule in Colorado

By C.S. Boddie

Colorado has been under one-party rule by the Democrats for two or three elections now. It’s a mess. One of the people who helped create the mess, state senator Brittany Pettersen, is now running for Congress against Republican Erik Aadland in Colorado’s redrawn CD7. Voters are making their choice right now.

Will Coloradoans elect Pettersen to a higher office? Seems as though it would be failing her upward as Democrats did with Biden, and we see how that turned out.

During the recent 9News Debate, where journalists tossed softballs at Pettersen, the Democrat was first described in a voiceover as a Democratic state senator Brittany Pettersen who has focused on support for working families, mental health care and substance abuse issues.

Let’s focus on the phrase “working families” here. Has Pettersen really supported them? We can check her words for clues.

Pettersen’s website reads, “As a Colorado legislator, I passed the nation’s strongest Equal Pay for Equal Work Act, Colorado’s Red Flag law, and the Secure Savings Act.” The first one seems supportive of working people, but it’s also a liberal darling. The other two do not seem to relate; whether or not those accomplishments benefited working families is questionable.

Inflation is the top concern of working families; they are being harmed by record inflation in Colorado every day. What has Pettersen said about inflation? The word “inflation” does not appear anywhere on the candidate’s website. However, the website is chock-full of Democrat canned phrases and talking points, which echo Governor Polis and President Biden.

Pettersen claims that as a state senator, she ensured that every Colorado taxpayer received a $750 check in July to provide relief in this difficult time (still referring to the pandemic). The truth is that citizens received a refund because of the Taxpayer Bill of Rights (TABOR), not because of Pettersen. Democrats just made the payment happen earlier so that it could be used as a talking point for the election.

The website does include another bit about rising prices without mentioning the word “inflation”: “Prices for everything are going up because big corporations are increasing costs in a time of crisis while they are making record profits, and politicians in Washington aren’t putting our families first. In the Colorado Senate, Brittany sponsored legislation to hold companies accountable for price gouging and will do the same in Congress.”

Nothing about how Democrats spending like drunken sailors has caused record inflation. Nothing about how the Democrats’ war on oil and gas has raised prices on everything. Oh, but she cut the gas tax in Colorado.

Pettersen’s website says, “In Congress, Brittany will fight to help address critical workforce needs by passing loan forgiveness programs in areas like education and health care.” How does that address inflation?

How can a candidate help working families in Congress if she does not even recognize what a problem inflation is for them or admit that the source of inflation is government spending?

On taxes, Pettersen’s website repeats another old, false Democrat chestnut: “She will fight to repeal the 2017 Trump tax cuts that only benefited the wealthy and largest corporations, and will work to help give breaks to the middle class who have been left holding the bag for far too long.” Seems like every candidate needs to get Trump’s name out there somehow.

What about crime? Crime is another great concern of working families in Colorado. How can they get to work on time if their car is stolen? Car thefts have greatly increased while Pettersen has been in the state Senate. Any ideas?

Nope. No mention of crime and what she will do to reduce crime. But she does mention protecting democracy.

How can Pettersen bring answers to one of the biggest concerns of our state’s working families when she doesn’t even mention crime as she is running to be their next representative in Congress? And, by the way, the USA is representative democracy or a constitutional republic, not a direct democracy; shouldn’t a candidate who wants to represent people in Congress know that and not just parrot the talking points of her party’s elite?

By focusing only on the phrase “working families,” one can see a picture emerging of who Brittany Pettersen will be in Congress, and the picture is not a good one. She may be another Squad member. She will likely be only a rubber stamp for Democrats’ harmful policies that do not help, that do harm, working families all across the USA.

As for mental health and substance abuse issues, well, Pettersen cosponsored a bill to create heroin safe injection sites, but it did not go to a vote. She sponsored a useless bill to fix flawed fentanyl law. Enough said.

Let’s not fail Brittany Pettersen up into a seat in Congress.

C.S. Boddie writes for Meadowlark Press.

TABOR Foundation board member Natalie Menten on her opposition to Prop 123

Colorado’s Taxpayer’s Bill of Rights. Protecting Colorado Families For 30 Years!