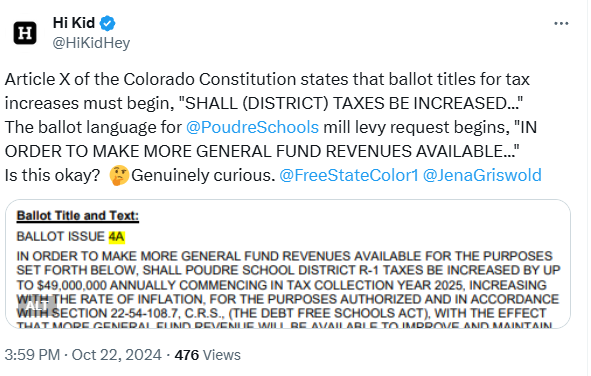

Hi Kid @HiKidHey asked this on X (Twitter): “So what does that mean for voters? Who is ultimately responsible for the TABOR violation? The local county clerk or the district’s designated election official? Genuinely curious.”

Hi Kid @HiKidHey asked this on X (Twitter): “So what does that mean for voters? Who is ultimately responsible for the TABOR violation? The local county clerk or the district’s designated election official? Genuinely curious.”

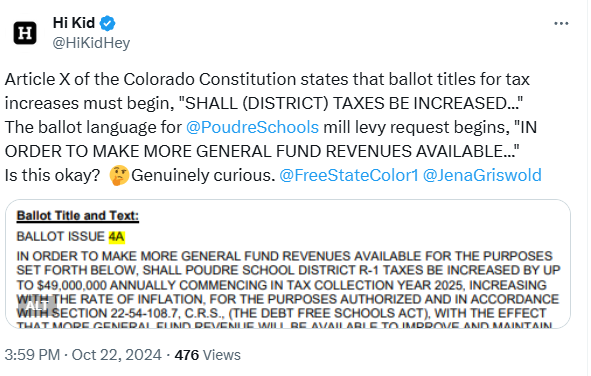

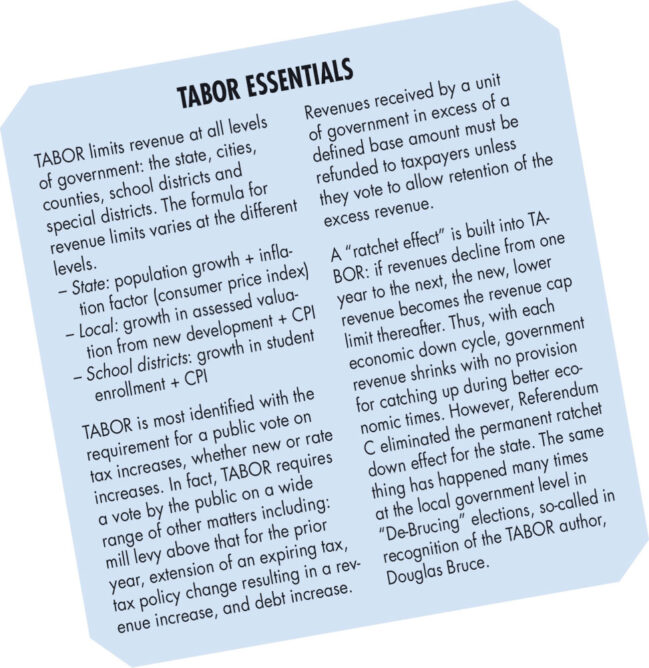

The Taxpayer’s Bill of Rights says taxes can’t be raised without voter approval and the state must refund money that exceeds certain caps.

It’s not easy to find information on the judges appearing on your Colorado ballot. Rebecca Sopkin is a Constitutional Attorney and TABOR Foundation Board Member.

In this video, she is sharing her methodology for determining who to vote for, some resources for voters to use, and her picks for this year’s ballot. Links from the video https://freestatecolorado.com/sopkin/

#ItsYourMoneyNotTheirs

#DontBeFooled

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

#ThankGodForTABOR

Property tax caps have been restored in Colorado. That’s thanks to the pressure from the Citizens’ Tax Cap, compelling state politicians to address the property tax crisis in an August 2024 Legislative Special Session because local governments didn’t lower the property tax mill levies and alleviate the problem.

The property tax crisis was created because voters in local elections in the past has unwittingly voted to forfeit caps in our constitutional Taxpayer’s Bill of Rights (TABOR) and statutory 5.5% Annual Property Tax Cap, recognizing later it was a big mistake. State politicians had mixed feelings about the 2024 Special Session, fiscally conservative legislators thought that HB 24B-1001 didn’t provide enough assurance that residents would not be taxed out of homes. Some “progressive” elected officials thought it was horrible to provide property tax relief in response to a citizen initiative, calling it a “fecal sandwich”.

Jefferson County, like Arapahoe and Weld, has maintained tax caps for over 30 years due to vigilant citizens rejecting misleading ballot issues, such as 1A in 2019 and 2022. However, this is at risk again with a new version of 1A on the 2024 ballot. This version, like before, uses deceptive language and aims to permanently remove these caps.

The key is to share this information quickly and widely. Remind your friends and networks to vote NO on 1A to preserve the caps. Ballots will arrive around October 14-15.

The recent legislative special session caused by the Citizen’s Tax Cap implemented two key changes:

Jefferson County’s 1A, being set before this date, skirts these new transparency rules.

Governments often use tax dollars for public persuasion campaigns and exploit legal loopholes during election seasons to get away with it. I recently discussed this in an interview with Free State Colorado, which you can watch here.

The past proponents of Jeffco 1A tax hikes even resorted to tainting our local TABOR notice booklet in 2019. The shenanigans didn’t stop there.

Our current county commissioners Andy Kerr, Lesley Dahlkemper, and Tracy Kraft-Tharp, have stepped up the attack on taxpayers’ wallets using a $340,000 taxpayer-funded political strategist, and continue to push their intentionally misleading ballot language to eliminate the caps.

Voters must reject this behavior. Vote NO on Jefferson County 1A to keep tax caps in place.

– Property owners: Vote no to avoid excessively higher property taxes year after year.

– Renters: Rising property taxes will be passed on as rent increases, making housing less affordable.

– Consumers: Higher business property taxes will raise prices for goods and services.

Vote NO on 1A to protect yourself from excessively increasing costs. If you can’t afford more at the grocery store, gas pump, insurance bill, or rent – you sure can’t afford removing property tax caps forever. Even if you can afford excessive taxes, can your neighbor on a fixed income handle it or your grandkids?

If you’d like to find out more information, please join these informative meetings hosted by taxpayer advocacy non-profits:

Even the strongest supporter of mass transit must rethink this tax. It’s not a good idea nor is it the right time. Vote NO on the measure.

– Ridership is way down. It dropped to only 65.2 million “boardings” in 2023, when it had been 103.2 million boardings in 2019. That’s a huge drop. RTD wants this for ongoing operations, but that level of spending no longer matches the ridership.

Lifting the TABOR budget limits would be a FOREVER tax. No sunset date. No revisiting it later.

Having no limit on budgets paid off construction debt of $779 million over the past 25 years. The project was built and paid off. The old tax scheme has ended. This extension is a tax increase by keeping what otherwise would be returned to you. If it were not a Taxpayer’s Bill of Rights requirement to vote on renewed taxes, it would not have to go to the ballot. When politicians mislead you to get your vote, it should be a red flag.

There is no plan to use this renewed tax plan for new bonds, and the revenue would just get dumped into the general fund. Vote down this tax extension and give RTD the opportunity to come back with specific ideas and costs, instead of a blank check for who-knows-what.

The state legislature has been seriously considering removal of an elected Board of Directors. We don’t even know who will be controlling the tax increase in a few years!

RTD charges you sales tax on a vast majority of goods, taking money out of your pocket when you buy toilet paper, school supplies, clothing, and groceries. It adds up, the average taxpayer gives up a few hundred dollars to RTD each year in sales tax. Have you gotten your money’s worth?

The system needs to be fixed first. Taxpayers should demand some accountability. RTD must first use current dollars to reverse ridership decline and move to a transit system that is not inefficient, inconvenient and even dangerous. Giving RTD this money does not necessarily mean that light rail will go faster than 10 miles an hour or clean up the stations, buses and trains. Just having a bigger budget does not guarantee reforms. Don’t throw good money after bad.

2024 Election, Elections, Natalie Menten, TABOR, Uncategorized

Menten: Weighing in on local TABOR measures for the 2024 ballot

August 29, 2024 By Natalie Menten

One great, though lesser-known benefit provided in the Colorado Taxpayer’s Bill of Rights (TABOR) is the local ballot issue notice. This guide is sent by mail at least 30-days before the election to all households with one or more registered voters.

The notice includes details about upcoming local ballot measures that increase taxes, add debt, or suspend TABOR revenue limits. It includes a section where registered voters have the opportunity to submit FOR or AGAINST comments, up to 500 words each.

You should know that there are actually two types of TABOR ballot issue notices. One notice is for the statewide measures and commonly referred to as the “Blue Book.” The notice discussed here is for elections held by local governments such as a city, town, school district, or special taxing district. It’s important to know the difference as you could potentially get more than one of these notices in the mail.

Several years back, it was discovered that out that of some 300 local tax issues throughout the state, only 15 had the taxpayer’s voice printed in a ballot issue notice. That’s only 5 percent! You can make a big difference and amplify your voice by being an author of the next ballot issue notice where you live. Considering that you reach thousands of voters, submitting comments in the TABOR notice costs almost nothing and takes relatively little time and energy.

What follows is an explanation of how to participate in the local ballot issue comment process. As in so much of government bureaucracy, instructions must be followed with no room for alteration. The deadline for this year is Friday, September 20 no later than noon to have your comments included in the local TABOR notice. Continue reading

August 9, 2024 By Savana Kascak

DENVER–Governor Jared Polis has consistently said he wants to lower the Colorado income tax, even claiming that legislation passed earlier this year would deliver on that promise. But new research shows that billions of dollars in special interest tax breaks also passed this year in all likelihood means broad-based income tax relief is off the table for the foreseeable future.

Earlier this year, Governor Polis signed Senate Bill 24-228, temporarily lowering the state income tax rate, on a sliding scale, as a refund mechanism when surplus revenue under the Taxpayer’s Bill of Rights (TABOR) is more than $300 million in a given fiscal year, with the maximum rate reduction (from 4.40% to 4.25%) kicking in at a $1.5 billion surplus.

TABOR is a constitutional amendment that requires, among other things, state revenues collected in excess of of a formula of population growth plus inflation be refunded back to taxpayers, unless voters consent to forgo those refunds at the ballot box. An income tax rate reduction is but one potential refund mechanism available to the state. Continue reading