Category Archives: Taxes

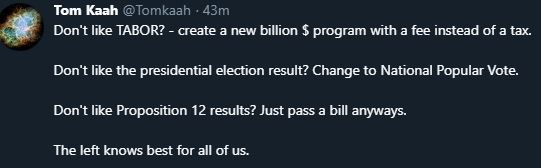

When Liberals Don’t Like Something….

Colorado Democrats look to pass more progressive legislation with four weeks left in session

Colorado Democrats look to pass more progressive legislation with four weeks left in session

The Democratic-controlled legislature has had little trouble passing several controversial bills, leading to Republicans and grassroots groups calling for voters to recall some of the lawmakers behind the pieces of legislation that opponents say don’t represent the views of citizens.

Democrats control both chambers of the General Assembly, and Democratic Gov. Jared Polis supports a vast majority of legislation Democratic lawmakers have passed or plan on passing.

Why TABOR Matters on April 9th

BRITAIN ISN’T THE ONLY PLACE WHERE ELITES TRY TO UNDO BALLOT MEASURES

NATELSON: BRITAIN ISN’T THE ONLY PLACE WHERE ELITES TRY TO UNDO BALLOT MEASURES

When British citizens voted to leave the European Union, I doubted the British political establishment would allow that decision to stand. Today that establishment is doing everything it can to undermine the Brexit referendum.

Such conduct is not limited to Britain. In the United States also, government officials have a long history of sabotaging ballot measures they don’t like.

Similarly, in 2015 SCOTUS reversed 30 statewide votes reaffirming — generally by landslide margins — the traditional definition of marriage.

Join The Reagan Club on April 11th to hear Penn Pfiffner explain the Taxpayer’s Bill of Rights

Colorado voters in 1992 authorized TABOR so that citizens would have to say yes or no on tax increases. Over the years voters appreciate this simple and effective check on out-of-control, tax-and-spend politicians. Colorado is one of the best states economically thanks to TABOR.

Colorado voters in 1992 authorized TABOR so that citizens would have to say yes or no on tax increases. Over the years voters appreciate this simple and effective check on out-of-control, tax-and-spend politicians. Colorado is one of the best states economically thanks to TABOR.

So, what is TABOR and how does it affect you?

Penn Pfiffner, former state legislator and currently the Chairman of TABOR, will provide a TABOR 101 discussion with time for questions.

Admission is $5 for Reagan Club members and $10 for non-members. The doors open at 6:00pm with food and drinks available to order from CB & Potts. The meeting begins at 7:00pm and should be over around 8:30pm. You can order your admission tickets online at the Reagan Club website, www.ReaganClubCo.com/meeting-tickets

| Thursday, April 11, 2019 at 6 PM – 9 PM MDT

|

| C. B. & Potts – Westminster

1257 W 120th Ave, Westminster, Colorado 80234 |

Amid broader budget debate, a modest proposal for more Colorado school funding advances

Amid broader budget debate, a modest proposal for more Colorado school funding advances

A bill that would ask voters to let Colorado keep more tax revenue — with a third of the money going toward schools — moved forward Monday, even as backers stressed that it is not a “cure-all” for the state’s broader fiscal challenges.

That uncertainty has education advocates watching nervously even though the proposed budget includes a major policy win: an $185 million set-aside to fully fund kindergarten starting this fall. If lawmakers and Gov. Jared Polis do put a lot more money into transportation, other K-12 programs could feel a pinch.

TABOR defense starts with you!

TABOR defense starts with you!

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this? Continue reading

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this? Continue reading

Fields: Taxpayer’s Bill of Rights deserves credit for Colorado’s economy, not John Hickenlooper

Under the scrutiny of the national media, John Hickenlooper’s official campaign for President has gotten off to a rocky start. Most of the national media coverage following his announcement has focused on his refusal to be labeled a capitalist during an interview on MSNBC. In a characteristic Colorado style, local TV anchor Kyle Clark tweeted, “’I may be a capitalist,’ @Hickenlooper writes. His 180 turned into a 360 now a 540. That’s @SeanWhite-level rotation.”

In his prepared launch video, and in media appearances since then, Colorado’s former governor has been regularly touting his role in Colorado’s booming economy. It’s true that Colorado has been ranked as the nation’s #1 economy. We’re consistently on lists of the best places to live and work in the U.S., and we attract hundreds of thousands of new residents every year.

Still, the fact is that our economy isn’t thriving because of John Hickenlooper. In actuality, a majority of the credit goes to the Taxpayer’s Bill of Rights (TABOR) – a unique law that allows Coloradans to vote on any and all tax increase.

It’s a simple concept – lawmakers have to make the case to voters in order to get more of their hard-earned money. TABOR also provides guardrails for the size of government. State spending still grows every year, but it’s limited to inflation plus population growth. The end result of TABOR is to keep the government truly serving the people. Continue reading

Amy Oliver Cooke: Colorado Democrats plan to trick voters into killing TABOR

Amy Oliver Cooke: Colorado Democrats plan to trick voters into killing TABOR

Colorado Democrats plan to trick voters into killing TABOR

As expected, Democratic lawmakers announced their intent to keep all taxpayer money and permanently set aside the spending cap that is key to the effectiveness of the Colorado’s Taxpayers Bill of Rights (TABOR), an amendment to the state constitution passed in 1992 that requires state and local government to seek voter approval before raising taxes. The measure also limits growth in state spending to population growth, plus inflation, and if the state takes in more than it is allowed to spend, the state must return the surplus to taxpayers.

TABOR is simple it’s about consent. Our government can raise taxes, but it has to ask first. Democrats in the State House and Senate don’t think they should have to ask first. In addition to seeking voter approval for additional taxes, TABOR fosters good, fair, and consensual government.