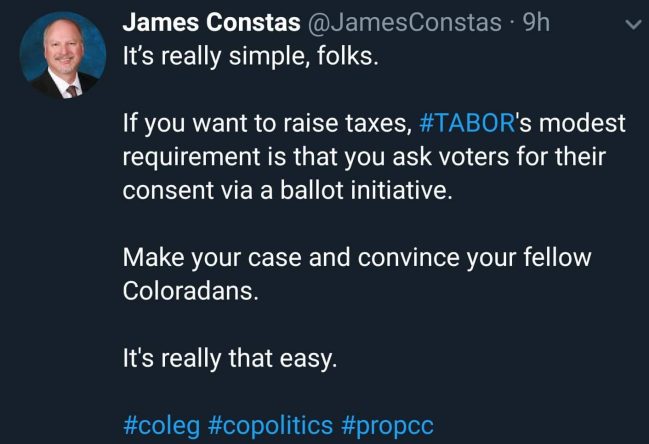

They lied to us in 2005, and they are doubling down on this lie in 2019. Colorado voters were sold a bill of goods with Referendum C in 2005, and it is of the utmost importance that we aren’t fooled again with Proposition CC in 2019.

Proponents of Referendum C originally claimed that their measure was “temporary.” The measure was supposed to offer a five-year reprieve from the constitutional limitations created by the Taxpayer’s Bill of Rights (TABOR), allowing some fiscal flexibility for Colorado lawmakers to invest heavily in education and transportation.

Or so they claimed.