Category Archives: Taxes

I Want Taxes To Be Less, That The People May Have More

Everyone Desires A Reduction Of Taxes, And There Is A Great Preponderance Of Sentiment In Favor Of Taxation Reform

Collecting More Taxes Than Is Absolutely Necessary Is Legalized Robbery

As I Went About With My Father, When He Collected Taxes, I Knew That When Taxes Were Laid, Someone Had To Work Hard To Earn The Money To Pay Them

Coolidge’s Tax Rates Were Lower & He Cut Budgets

OPINION | Family-leave ‘fee’ (spelled t-a-x) is another end-run on TABOR

It looks like @ColoradoDems in the #coleg are moving “full steam ahead” on state-sponsored #PaidFamilyLeave. But watch how they decide to fund it. They’ll prob create a new tax w/out #TABOR vote – & call it a FEE. My latest for @colo_politics

OPINION | Family-leave ‘fee’ (spelled t-a-x) is another end-run on TABOR

- Jimmy Sengenberger

There are a couple of federal government programs that have been around for decades. You might have heard of them: Social Security and Medicare.

You might also know that these programs are funded by payroll taxes. If you’re an employee working at a company, then the contribution is “split” 50/50 between you and your employer. Your portion is withheld and sent to the government each paycheck. If you’re self-employed, you must pay the full amount yourself. According to the IRS, the tax rates total 12.4% and 2.9% for social security and Medicare, respectively.

You’ll notice that the creators of these programs were clear they’d be funded with a payroll tax on both employees and employers. They didn’t play word games. They were upfront that every working American would be taxed a percentage of their income to support Social Security and Medicare.

Colorado Democrats are moving “full steam ahead” to create a new, statewide paid family leave (PFL) fund. This program would enable employees to receive “12 weeks of paid family leave for pregnancies, infant or sick relative care, or recovery from illness.”

The 2020 bill is still being written following input from a commission tasked with proposing ideas. But if the fund ends up being financed in a way that is similar to the 2019 version’s formula, it would involve a split — perhaps 60/40 — between employees and employers.

To read the rest of this story, please click (HERE):

What’s next after the failure of Proposition CC?

Democrats in the Colorado legislature will sacrifice parts of their agenda or find politically risky ways to pay for it

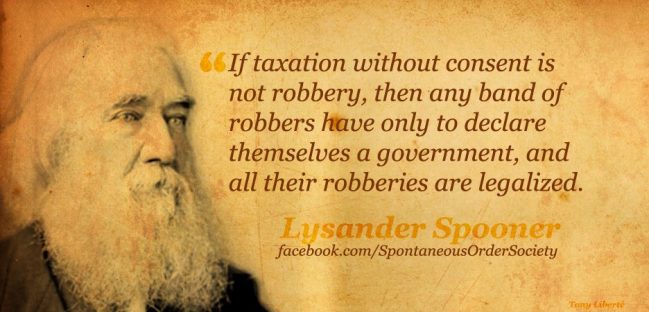

If Taxation Without Consent Is Not Robbery, Then….

Tweet From Michael Fields About TABOR & Prop CC After The November 2019 Election