Affordable housing program will cut into your TABOR refunds

By Natalie Menten

Guest Commentary

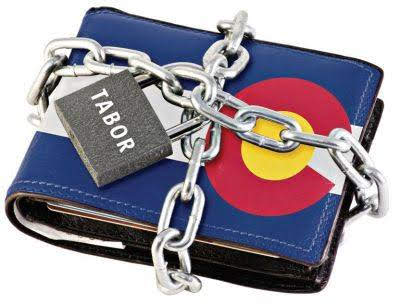

The state government has taken more taxes from you than we allow it to have, and it should rebate that over-collection back to you. That money coming back to all taxpayers is now in jeopardy. We should be alarmed at the potential waste.

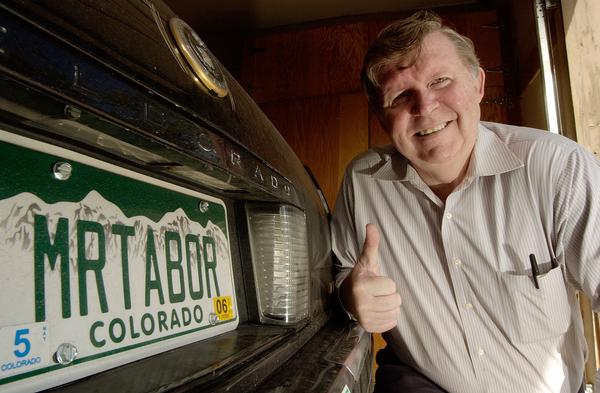

Colorado voters’ dissatisfaction with government growing beyond its means led to the passage of the Taxpayer’s Bill of Rights (TABOR). This constitutional amendment requires voter approval for tax increases and debt. It also limits how fast government can grow. The formula for automatic tax increases is the prior year’s budget plus adjustment for inflation and population growth.

When government collects taxes above the limit, it must refund the surplus. Later this year, each taxpayer will get a $750 TABOR rebate from the state. The economic outlook predicts rebates for the next several years.

Two statewide ballot measures in November claim they don’t raise taxes, but that’s just not true. Funding for new programs comes from our future TABOR rebates. If we don’t get all those rebates back, that’s effectively a higher tax rate and clearly a tax hike.

One measure proposes to divert TABOR rebates to subsidize affordable housing programs. Proponents have spent hefty money on paid signature gathering. They are meeting with local elected officials and lobbying for political buy-in. They gloat that they had raised $5 million by June 1 and that they plan to spend millions more to sway Colorado voters. How much of the campaign donations will come from developers who specialize in subsidized projects?

Our TABOR rebates would be diverted into a new “Affordable Housing Fund,” to be split 60/40 between state and local governments. The requirements to release the funds come with damaging, top-down controls. Local elected officials would have to guarantee increasing affordable housing by 3% each year over a baseline number, as well as implementing a 90-day fast-track permit approval process.

If a local jurisdiction won’t or can’t comply with the measure’s requirements, not only would we taxpayers not receive our TABOR rebates, but the local government would be disqualified from the subsidy.

How would dense metro areas increase subsidized housing units year after year? Would they build out, build up or replace?

At what point might local governments discourage and make it more difficult to build singlefamily homes? Examples abound, including Minneapolis, Oregon and California banning single-family developments. It seems far-fetched that Colorado would enact these restrictive policies, but that’s what we have to anticipate with passage of this ballot measure.

This measure encourages government to compete against Ma and Pa to buy property. Who has deeper pockets?

Seniors whose retirement depends on rental income might well be affected because this proposal creates an eviction defense fund, which would pay attorneys with taxpayer money to prevent landlords from evicting non-paying tenants who are at risk of becoming homeless.

There’s a long list of problems in this extreme initiative (currently No. 108). The paid circulators I’ve encountered know little to nothing about the Taxpayer’s Bill of Rights, so they aren’t informing signers that the money comes from our upcoming TABOR tax rebates.

Since backers are apparently willing to spend many, many millions of dollars to pump out TV ads and fill our mailboxes with slick marketing pieces, I don’t know where our opposition campaign will find similar amounts of money to counter the propaganda.

Citizens who sign the petition likely aren’t aware of the devious, negative results. Hopefully by the time the election rolls around in November, voters will understand this ballot issue’s dangers and vote no.

By Brad Hughes

By Brad Hughes