- The Gazette editorial board

- Sep 28, 2021Updated 3 hrs ago

Tails should not wag dogs. It defies physics, not to mention the will of the dog. Tails should wag dogs no more than politicians should decide the size and scope of a government established by the governed to serve the governed. A roaring economy should never increase the size and scope of government unless the people demand it.

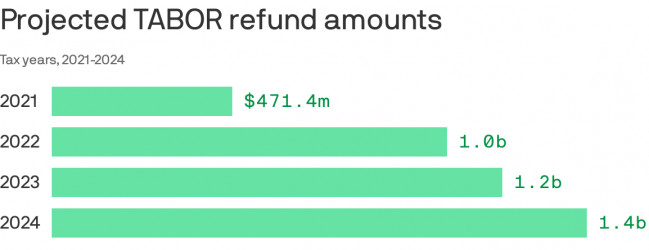

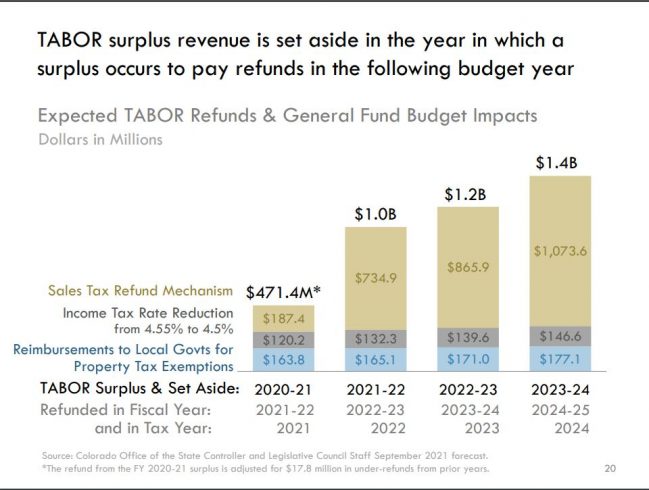

The residents of Colorado have made clear they don’t want more government. They believe the state has all the money it needs. They reiterated this conviction just two years ago when they trounced Proposition CC, a proposal to let the state keep revenues above a floating state spending cap determined by an equation of inflation and population growth.

Just last year, voters went a step further and lowered the Property tax from 4.63% to 4.55%, and probably would have voted for a lower rate had they been given the option.

One reason this center-left blue state wants to throttle back government spending is the general discontent the public has with the way politicians treat their money.

To read the rest of this editorial, please click (HERE):