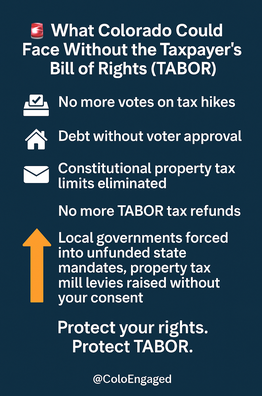

TABOR simply means voter consent.

TABOR simply means voter consent.

TABOR is democracy.

Weakening TABOR is weakening democracy.

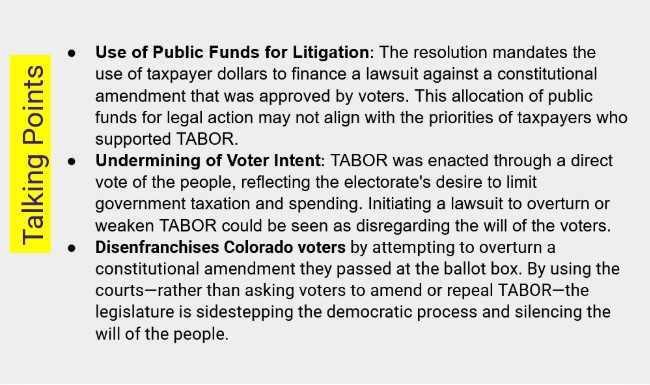

Every couple of years the spending lobby orchestrates an assault on our Taxpayer’s Bill of Rights. They are testing another onslaught likely for next year.

I was around for the fights to pass TABOR in the early 1990s. Then-Gov.Roy Romer famously declared if it passed, it will put a “going out of business” sign on the entrance to Colorado.

Oddly, our population has nearly doubled since then, and state spending has ballooned from just more than $6 billion to roughly $44 billion.

Read that headline again. Since TABOR, our population grew one-fold, state spending grew 7-fold. Predictable tax and spending policy helped create a boom.

The opposite of Romer’s scare is true. If we mess with our Taxpayer’s Bill of Rights, then we might as well put a “going out of business” sign on the entrance to Colorado.

Like telling tales of the boogeyman around the campfire to frighten children, those who feed on unconstrained spending want to scare the kids too. The young in this case are those who weren’t in Colorado before we demanded simple voter consent over our own money.

Get ready for a new batch of stories on how this Chupacabra of fiscal restraint is somehow making our lives worse, and the only way to slay the monster is to attack democracy and take away our right of consent. Continue reading