KOAA.com | Continuous News | Colorado Springs and Pueblo

Pueblo West will be voting on an initiative that would help fund a new community pool, but it would be using excess money that is supposed to be returned to the taxpayer.

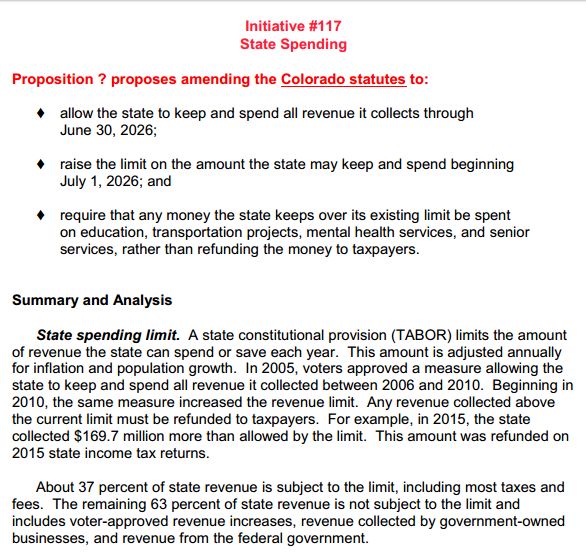

Pueblo West tried voting on de-brucing, but that didn’t work, so the ballot is calling for a TABOR timeout for the next ten years to pay for an aquatic center. Basically that means a ‘yes’ vote allows Pueblo West to obtain all tax revenue, a ‘no’ vote would keep Colorado TABOR laws in place which puts a cap on tax revenue a municipality can obtain, and that municipality has to refund the money to the taxpayers.

Pueblo West’s initiative 5A would bring partial funding for a new pool. Grant Shay says because of the current pool being overcrowded, his kids were turned away. Continue reading