FYI. Posted as it mentions TABOR and you can see what the other side is saying….

EAGLE COUNTY — Call it the Colorado Conundrum.

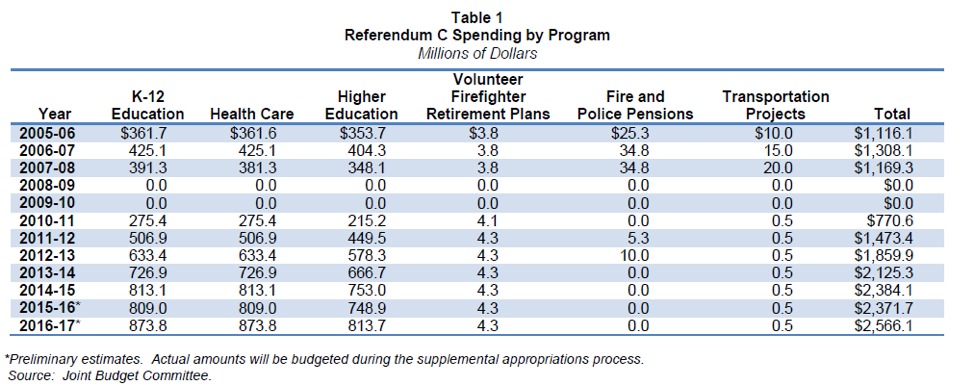

Colorado homeowners in the next couple of years will see a property tax break, while our state government is forced to make budget cuts. That’s because we stand at the crossroads of a couple of constitutional amendments — Gallagher and the Taxpayers Bill of Rights, or TABOR.

Tim Hoover is the communications director for the Colorado Fiscal Institute, a nonprofit and nonpartisan fiscal policy and analysis organization. They don’t have a dog in this fight, but if they did they’d root against TABOR.

“This is a profoundly serious problem. TABOR is not a watchdog. It’s a rabid dog,” Hoover said. “TABOR is literally threatening public safety.”

When the Gallagher Amendment intersects with TABOR, that causes problems, Hoover explained.

IT’S NOT COMPLICATED

That conflict is not as complicated as you might think, and it goes like this: Continue reading

An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support. File photo.An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support, though the legislation faces an uphill battle.

An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support. File photo.An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support, though the legislation faces an uphill battle.