The Taxpayer’s Bill of Rights is universally despised, neigh, deplored by every tax-happy progressive around the country. Ever wonder why it’s like sunlight to a vampire to them, and why they’ve weakened it in court-ruling after court-ruling for 25 years? Then please join us on Monday, April 23, in Colorado Springs for our first stop on the TABOR Road Show 2018.

The Taxpayer’s Bill of Rights is universally despised, neigh, deplored by every tax-happy progressive around the country. Ever wonder why it’s like sunlight to a vampire to them, and why they’ve weakened it in court-ruling after court-ruling for 25 years? Then please join us on Monday, April 23, in Colorado Springs for our first stop on the TABOR Road Show 2018.

There’s a growing coalition of national, state, and local TABOR supporters that won’t tolerate any more attacks on or weakening of the greatest gift Colorado voters ever gave themselves or future generations – the Taxpayer’s Bill of Rights and the right to vote on increases in taxes and debt. We are crisscrossing the state to let people know about the TABOR Yes coalition, some two dozen strong and growing, and why Coloradans should fall in love with TABOR again.

For additional information on TABOR and our coalition, visit our Web site TABORYes.com.

Please RSVP here!

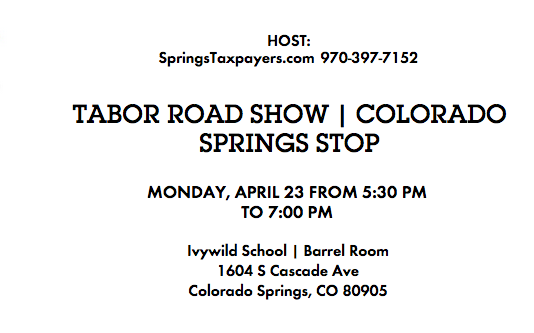

Monday, April 23rd

5:30-7 PM

Barrel Room at

IvyWild School

1604 S. Cascade Ave.

Colorado Springs, CO 80905

Local Host: SpringsTaxpayers.com

Emcee: Jeff Crank, The Jeff Crank Show

Moderator: Amy Oliver Cooke, Independence Institute

Panelists:

Michael Fields, Americans for Prosperity Foundation

Jon Caldara, Independence Institute

Hadley Heath Manning, Independent Women’s Forum (invited)

Supported by the

TABOR YES COALITION

Americans for Prosperity- Colorado

Americans for Tax Reform

America’s House of Commons

Americhicks

Approval Voting

Arapahoe Tea Party

CATO Institute

Centennial Institute

Center for Freedom Prosperity

Coalition to Reduce Spending

Colorado Issues Coalition

Colorado Log Cabin Republicans

Colorado Union of Taxpayers

Independence Institute

Independent Women’s Forum

Mountain States Legal Foundation

National Asian Indian Republican Association

Reagan Republicans

Republican Liberty Caucus Colorado

SpringsTaxpayers.com

Taxpayers Chamber of Commerce

Taxpayers Protection Alliance

The Hudson Firm

The Steamboat Institute

Wake Up with Randy Corporon (710 KNUS)

Kelsey M. Alexander

Barbara Piper

Dennis Polhill

Geri Zahner

The anti-TABOR, consent-hating, government-expanding, nannyist bureaucrat will interview and probably lecture our esteemed panelists of limited government, free market activists. What could go wrong?! It’s bound to be entertaining and educational!

The anti-TABOR, consent-hating, government-expanding, nannyist bureaucrat will interview and probably lecture our esteemed panelists of limited government, free market activists. What could go wrong?! It’s bound to be entertaining and educational!