Opinion: TABOR has united Coloradans

PUBLISHED ON MAR 10, 2019 5:00AM MDT

Michael Fields@MichaelCLFields

Special to The Colorado Sun

In a growing partisan culture, there’s still something Coloradans ranging the political spectrum can agree on: the Taxpayer’s Bill of Rights (TABOR).

In recent public polling, when given the simple, unbiased definition, 71 percent of registered voters in Colorado support TABOR, while only 28 percent oppose the law.

What’s the secret to this overwhelming popularity? First, Coloradans love being able to vote on tax increases. It’s simple: the government has to make the case to voters in order to get more of their hard-earned money.

Michael Fields

Michael Fields

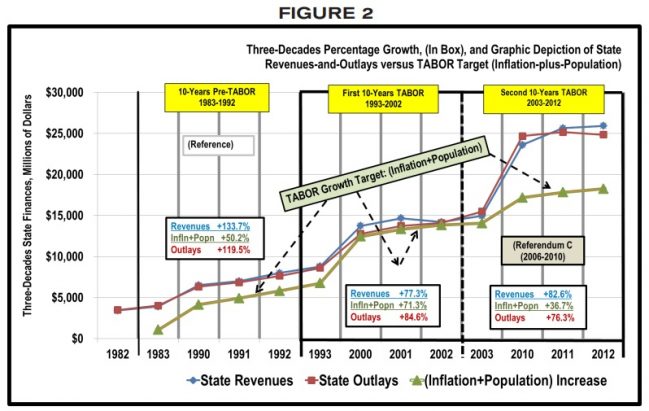

Second, TABOR provides guardrails for the size of government. The state budget still grows every year, but the growth is limited. TABOR keeps the government truly serving the people.

Over the past several years, voters have sent a message to state lawmakers by voting down the last six statewide tax increases on the ballot — most by huge margins.

But this hasn’t stopped lawmakers and progressive special interest groups from developing workarounds in the form of fees, enterprises, and lawsuits to allow the state to spend more taxpayer money. Continue reading →

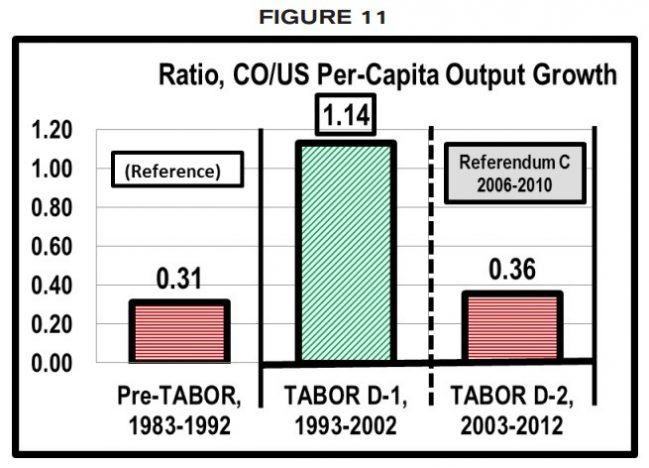

Colorado voters in 1992 authorized TABOR so that citizens would have to say yes or no on tax increases. Over the years voters appreciate this simple and effective check on out-of-control, tax-and-spend politicians. Colorado is one of the best states economically thanks to TABOR.

Colorado voters in 1992 authorized TABOR so that citizens would have to say yes or no on tax increases. Over the years voters appreciate this simple and effective check on out-of-control, tax-and-spend politicians. Colorado is one of the best states economically thanks to TABOR.

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this?

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this?

Michael Fields

Michael Fields

Proponents Carol Hedges and Steve Briggs had

Proponents Carol Hedges and Steve Briggs had