Category Archives: TABOR Refunds

Why #TABOR Matters on May 14th

Because politicians don’t listen….

#TABOR

#ThankGodForTABOR

#TABORYes

#WhyTABORMatters

Colorado legislature moves transportation bond issue to 2020, leaving TABOR refund issue alone on the 2019 ballot

Colorado legislature moves transportation bond issue to 2020, leaving TABOR refund issue alone on the 2019 ballot

State could go off a fiscal cliff

State could go off a fiscal cliff

By: Barry W Poulson

May 5, 2019

Colorado has created a fiscal cliff; the state is woefully unprepared for the revenue shortfall that will accompany the next recession. Citizens might be surprised to learn that the state has been pursuing imprudent policies that will result in a fiscal crisis when the next recession hits. It is important to understand how the fiscal cliff was created and what we can do about it.

Over the past two decades, Colorado has weakened the fiscal constraints imposed by the Colorado Taxpayer Bill of Rights. TABOR limits the rate of growth in state spending to the sum of inflation plus population growth, regardless of the amount of revenue the state takes in.

But most state revenue is exempt from the TABOR limit. The exempt funds include the revenue from enterprises and the fees collected by government agencies, which have grown rapidly over this period. As a result, over the past decade TABOR has not constrained the growth in spending, and this year the state will spend virtually every dollar of revenue it takes in. Continue reading

Sharf: Opponents of the Taxpayer’s Bill of Rights prove why we need it

Sharf: Opponents of the Taxpayer’s Bill of Rights prove why we need it

May 6, 2019 By Joshua Sharf

Look at the list of organizations supporting House Bill 19-1257, the bill to ask Colorado voters to permanently repeal Colorado’s Taxpayer ‘s Bill of Rights (TABOR) spending limits. No fewer than 60 groups hired lobbyists to push for the measure, which will appear on November’s state-wide ballot.

Everyone is represented – governments, non-profits, business groups, unions, school districts, government employees.

Everyone is represented.

Well, everyone except the taxpayer.

Which is why we need a constitutional amendment protecting the taxpayer in the first place.

While TABOR has a number of provisions designed to limit government, there are three main ones. The first requires a citizen vote on all general tax increases – income tax, payroll tax, sales & property tax, etc. Fees directly related to delivering a specific government service are exempt. So-called enterprises, which do not receive general tax revenue, are also allowed to raise their fees and charges without a vote, and what’s more, their revenue doesn’t count towards the overall cap the way than regular fees do. Continue reading

Colorado’s Taxpayer Bill of Rights Should Be a Model for the Nation

Colorado’s Taxpayer Bill of Rights Should Be a Model for the Nation

Monday, June 18, 2018

If you want proof for that assertion, check out states such as Illinois, California, and New Jersey. They all have provisions to limit red ink, yet there is more spending (and more debt) every year. There are also anti-deficit rules in nations such as Greece, France, and Italy, and those countries are not exactly paragons of fiscal discipline.

The real gold standard for good fiscal policy is my Golden Rule. And the best way to make sure government doesn’t grow faster than the private sector is to have a constitutional rule limiting the growth of government.

That’s why I’m a big fan of the “debt brake” in Switzerland’s constitution and Article 107 in Hong Kong’s constitution.

And it’s also why the 49 other states, assuming they want an effective fiscal rule, should look at Colorado’s Taxpayer Bill of Rights (TABOR) as a role model.

Why The Taxpayer’s Bill Of Rights Is Vital For Colorado

Tweet About The Liberals Latest Overreach

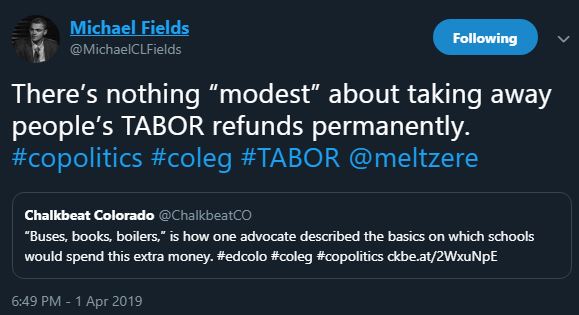

There’s Nothing “Modest” About Taking Away People’s TABOR Refunds PERMANENTLY

I Will Resist You If You….