Colorado tax revenues keep rising faster than state economists can predict them, a trend that might seem to be good news for education but which actually could make it harder to trim the $900 million shortfall in K-12 funding.

That’s because projected revenues are rising fast enough that they likely soon will hit a constitutional trigger that requires refunds of surplus revenues to taxpayers. If the trends continue, the 2015 legislature may have to set aside money in the 2015-16 budget to cover refunds in 2016.

The likelihood of reaching what’s called the “TABOR limit” was a key element in quarterly state revenue forecasts presented to the legislative Joint Budget Committee Monday morning by economists from the Legislative Council staff and the executive branch’s Office of State Planning and Budgeting.

“I’ve been thinking this has been coming for years,” said Lisa Weil, policy director for Great Education Colorado, a group that advocates for increased K-12 funding. “It certainly complicates” school finance discussions, she added.

Weil isn’t the only person who’s seen this coming. State economists have referenced the TABOR limit in the last several forecasts. But hitting the trigger always has been far enough in the future that policymakers didn’t think too much about it. Now, it seems, the future is just about here.

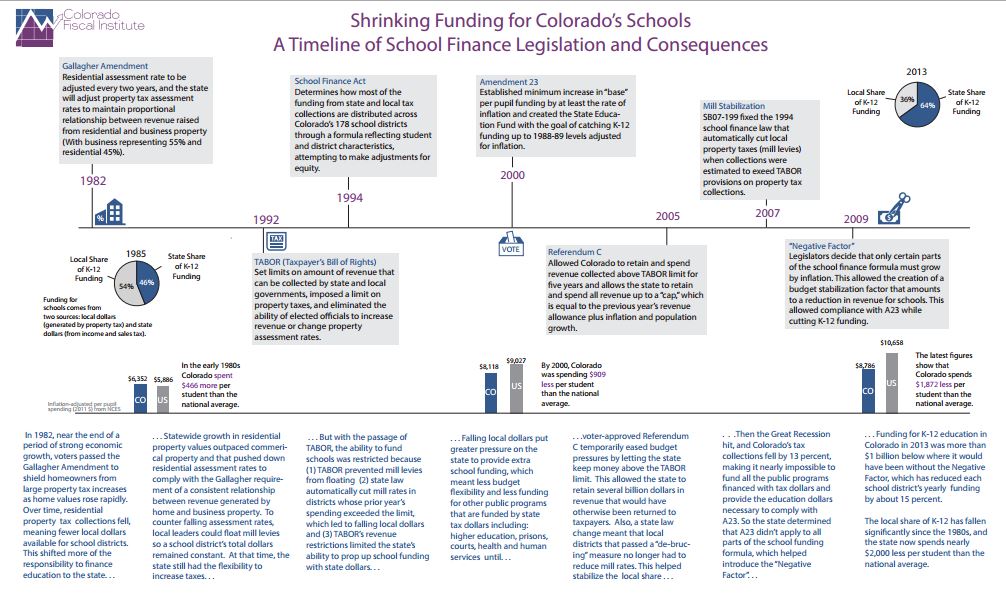

The TABOR limit is part of the 1992 Taxpayer’s Bill of Rights, which required that state revenue growth beyond inflation and population increase in a given year be refunded to taxpayers. That limit was modified by Referendum C, a 2005 voted-approved measure that shelved the limit for five years and eased its restrictions after that.

Legislative economists estimate that Ref C, as it’s called around the Capitol, has enabled the state to retain and spend $9.8 billion that otherwise would have been refunded.

The last TABOR refunds were paid in 2005, triggered by a $41 million surplus in the 2004-05 budget year. The refunds averaged $15 per taxpayer.

Do your homework

Legislative Council forecast (TABOR section starts page 13)

OSPB forecast (TABOR starts on page 48)

Refunds receded into the realm of the theoretical after that as the recession pushed growth in state revenues well below annual TABOR limits. The March 2011 forecasts marked the turnaround for revenues, which have been on the upswing ever since.

Legislative economists estimated Monday that $125.1 million will have to be earmarked in the 2015-16 budget to cover 2016 refunds, and $392.6 million will have to be set aside in 2016-17 to pay for 2017 refunds.

Executive branch forecasters estimate the amounts to be refunded in those two years at $133.1 million and $239.4 million. (The two sets of forecasts offer differ in amounts.)

The legislative staff forecast estimated 2016 refunds at $11 per taxpayer, provided through the earned income tax credit and sales tax refunds. The larger 2017 refund would be provided by a temporary lowering of the income tax rate from 4.63 percent to 4.5 percent, plus more sales tax refunds.

TABOR refunds matter to education spending because they require lawmakers to consider yet another demand as they attempt to juggle competing state spending needs.

The state’s school districts took a $1 billion hit in expected funding after the 2008 recession, a impact known as the “negative factor” after the formula used to reduce K-12 spending in order the balance the overall state budget.

District leaders and lobbyists fought hard during the 2014 session to trim the negative factor, and lawmakers did make a $110 million cut. (Get background in this story.) Education interests have signaled their intent to push for trimming the negative factor further during the 2015 session, an effort likely to be complicated by the need to address the TABOR limit.

“It’s going to take a lot of conversation,” said Jane Urschel, deputy executive director of the Colorado Association of School Boards and the group’s Capitol lobbyist.

The negative factor also is being challenged by a pending lawsuit (see story).

The amount of funding available for education also is a key concern for the state’s colleges and universities. Their state support has recovered modestly in the last two years. But the higher education system also is in the middle of fleshing out a performance funding system mandated by the 2014 legislature. Many in higher ed are worried there isn’t enough funding to allow that new system to operate properly. (Get background here.)

Lawmakers have an alternative to paying refunds – asking voters to let the state keep the money, as Ref C allowed nearly a decade ago.

“It’s time to talk about TABOR’s binding requirements,” Urschel said, adding that it’s “maybe” time to consider a new version of Ref C.

The politics of that are tricky, especially if Republicans take control of the Senate, the House, the governorship or any combination of the three in the Nov. 4 election.

“This is going to a fun session,” Weil said of 2015, with a hint of irony in her voice.

Forecast notes

The forecasts released Monday touched on three other topics of interest for education funding watchers.

State Education Fund: This dedicated account, used to supplement K-12 spending, is projected to have between $561 million and $672 million in it for spending by the 2015 legislature. The fund contained more than $1 billion last spring, prompting a tug of war between lawmakers who wanted to spend more on schools and others who wanted to save for future rainy days. The rainy day crowd mostly prevailed.

Marijuana revenues: Up to $40 million a year in excise (wholesale) taxes on recreational marijuana is earmarked for the Building Excellent Schools Today construction program. Prior marijuana revenue forecasts proved way too optimistic, partly because many users so far have chosen to stick with low-tax medical marijuana. The latest legislative forecast puts excise revenues at under $12 million in each of the next two years and at only $12.3 million in 2016-17. (See this story for more background.)

College construction: The higher education lobby’s big spring 2014 gamble paid off. Scrambling to find campus construction money, higher ed helped push through a bill that earmarked some surplus 2013-14 revenues for buildings – if that surplus materialized. It did, and nine of the 10 projects on the priority list got their money on Sept. 15. The 10th is expected to get its cash near the end of the year after the state’s 2013-14 books are finally closed. The list of 10 includes a few non-campus projects. The higher ed projects are at the Auraria Higher Education Center, CSU-Fort Collins, CU-Boulder, Fort Lewis College and Adams, Colorado Mesa and Western Colorado state universities.

http://co.chalkbeat.org/2014/09/22/revenue-forecasts-bring-good-news-and-a-big-complication/#.VCJDnfJ0xes