Nicolais: An attack on TABOR could leave Colorado Democrats feeling the squeeze

A court composed of mostly Hickenlooper appointees turns the governor down cold, setting up a possible legislative showdown

PUBLISHED ONDEC 9, 2018 5:55AM MST

Mario Nicolais@MarioNicolaiEsq

Special to The Colorado Sun

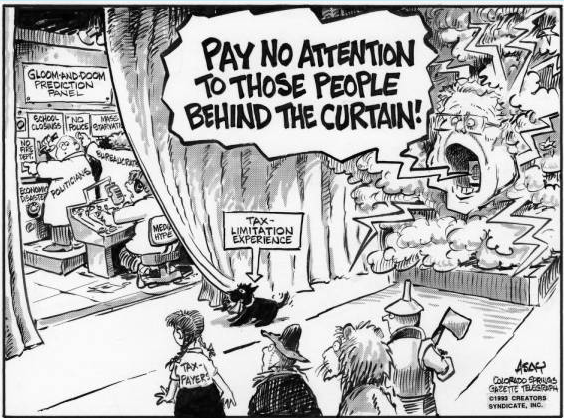

Before walking out the door from the governor’s office, John Hickenlooper took one last shot at a Democratic boogeyman. Last week, the Colorado Supreme Court denied Hickenlooper’s parting attempt to undercut TABOR, the conservative taxpayer’s bill of rights enshrined in the Colorado constitution.

Democrats, have long derided TABOR for the constraints it places on government. Not only does TABOR require a vote of the people to approve tax increases, but several of its provisions work in conjunction with other laws to create a “ratcheting effect” on government spending.

Mario Nicolais

If revenues drop during an economic downturn, they cannot return to prior levels as the economy rebounds. Instead, growth is artificially tied to the down year plus a pittance for inflation.

The ratchet works like boa constrictor wrapped around a person. With every breath out, the snake squeezes a little tighter and the next breathe in is a little shallower.

Eventually, no breath can be drawn, and the person dies. I’m sure it delights TABOR’s progenitor, the eccentric Douglas Bruce, to imagine the government being asphyxiated.

Democrats have a little different view; they see a snake crushing the life from Colorado citizens. Gasping for funds no longer available, state and local services wither and waste away. Continue reading

“‘Take your success elsewhere’ should be the signs erected if Colorado approves Amendment 73,” Penn Pfiffner, former state legislator and chairman of the board of the TABOR Foundation, told Watchdog.org. “The Taxpayer’s Bill of Rights properly treats everyone equally, requiring the same income tax rate be applied to everyone. Currently, if you make more money, you pay more, but only at the rate that everyone else pays. This proposal would change that, bringing an attitude that the upper middle class and wealthy should be attacked and made to pay increasing amounts. It is the worst concept in raising taxes.”

“‘Take your success elsewhere’ should be the signs erected if Colorado approves Amendment 73,” Penn Pfiffner, former state legislator and chairman of the board of the TABOR Foundation, told Watchdog.org. “The Taxpayer’s Bill of Rights properly treats everyone equally, requiring the same income tax rate be applied to everyone. Currently, if you make more money, you pay more, but only at the rate that everyone else pays. This proposal would change that, bringing an attitude that the upper middle class and wealthy should be attacked and made to pay increasing amounts. It is the worst concept in raising taxes.”