Because politicians don’t listen….

#TABOR

#ThankGodForTABOR

#TABORYes

#WhyTABORMatters

By: Barry W Poulson

May 5, 2019

Colorado has created a fiscal cliff; the state is woefully unprepared for the revenue shortfall that will accompany the next recession. Citizens might be surprised to learn that the state has been pursuing imprudent policies that will result in a fiscal crisis when the next recession hits. It is important to understand how the fiscal cliff was created and what we can do about it.

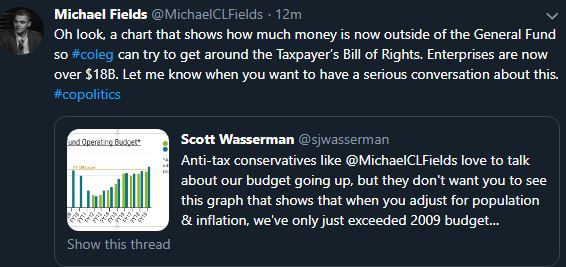

Over the past two decades, Colorado has weakened the fiscal constraints imposed by the Colorado Taxpayer Bill of Rights. TABOR limits the rate of growth in state spending to the sum of inflation plus population growth, regardless of the amount of revenue the state takes in.

But most state revenue is exempt from the TABOR limit. The exempt funds include the revenue from enterprises and the fees collected by government agencies, which have grown rapidly over this period. As a result, over the past decade TABOR has not constrained the growth in spending, and this year the state will spend virtually every dollar of revenue it takes in. Continue reading

May 6, 2019 By Joshua Sharf

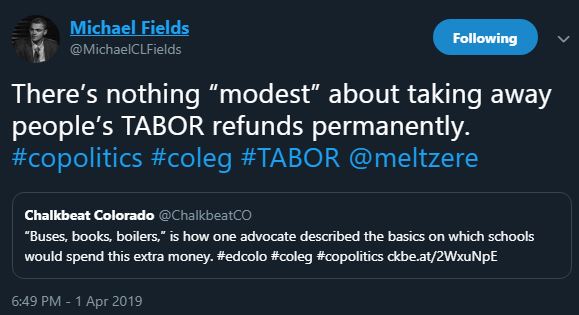

Look at the list of organizations supporting House Bill 19-1257, the bill to ask Colorado voters to permanently repeal Colorado’s Taxpayer ‘s Bill of Rights (TABOR) spending limits. No fewer than 60 groups hired lobbyists to push for the measure, which will appear on November’s state-wide ballot.

Everyone is represented – governments, non-profits, business groups, unions, school districts, government employees.

Everyone is represented.

Well, everyone except the taxpayer.

Which is why we need a constitutional amendment protecting the taxpayer in the first place.

While TABOR has a number of provisions designed to limit government, there are three main ones. The first requires a citizen vote on all general tax increases – income tax, payroll tax, sales & property tax, etc. Fees directly related to delivering a specific government service are exempt. So-called enterprises, which do not receive general tax revenue, are also allowed to raise their fees and charges without a vote, and what’s more, their revenue doesn’t count towards the overall cap the way than regular fees do. Continue reading

If you want proof for that assertion, check out states such as Illinois, California, and New Jersey. They all have provisions to limit red ink, yet there is more spending (and more debt) every year. There are also anti-deficit rules in nations such as Greece, France, and Italy, and those countries are not exactly paragons of fiscal discipline.

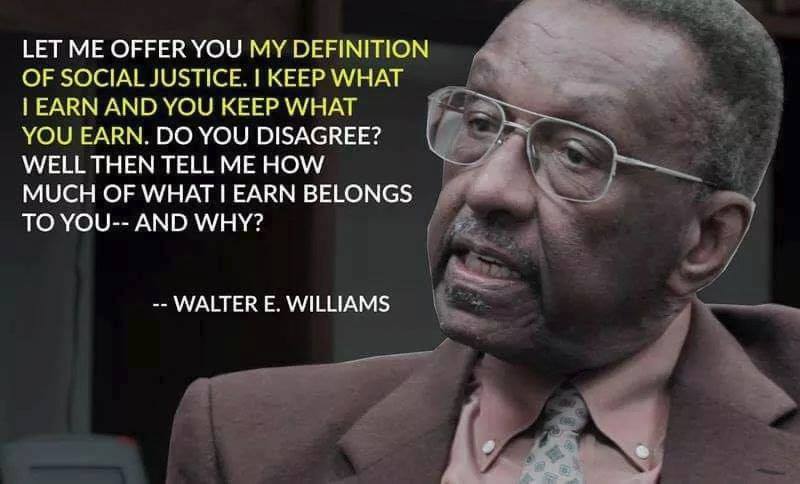

The real gold standard for good fiscal policy is my Golden Rule. And the best way to make sure government doesn’t grow faster than the private sector is to have a constitutional rule limiting the growth of government.

That’s why I’m a big fan of the “debt brake” in Switzerland’s constitution and Article 107 in Hong Kong’s constitution.

And it’s also why the 49 other states, assuming they want an effective fiscal rule, should look at Colorado’s Taxpayer Bill of Rights (TABOR) as a role model.

This filing does not contain the substance of our argument and is administrative in nature.

This filing does not contain the substance of our argument and is administrative in nature.

Don’t be intimidated that the first document is 55 pages long – it contains as an appendix the entire Order issued by the lower court which makes up the overwhelming volume of this Notice.

The Defendants also filed an appeal of Judge Buchanan’s ruling that our team has standing.

Wrong-headed, to be sure, but expected.

That filing is also attached here and also only an administrative step.

There has to be an exchange of documents before the attorneys will be informed of a schedule to submit arguments to the Court of Appeals.

That could take another seven weeks

All of this is public information but we wanted our TABOR supporters to be updated.

Penn

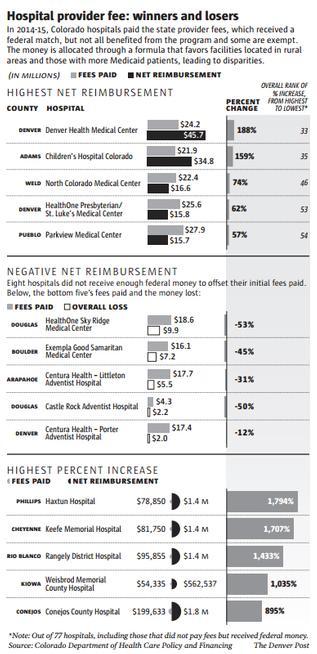

Click here to see the Hospital Provider Fee Notice of Appeal

Click here to see the Hospital Provider Fee Defendants Challenge of Standing by The TABOR Foundation