A lawn sign urges voters to oppose Proposition CC, which would have relaxed a Colorado law that restricts the state’s taxing power. Voters rejected the measure in November. AP PHOTO/DAVID ZALUBOWSKI

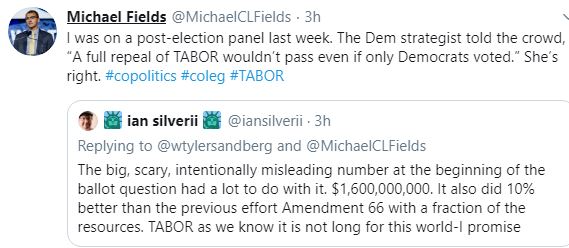

In Colorado and Washington, residents this fall voted to either constrain state tax revenues or cut fees, even as Democratic lawmakers argue the money is needed to support education and transportation programs.

Colorado voters during the past two elections have made clear that while they’re willing to back Democratic candidates, they’re reluctant to give them greater taxing power to help carry out their agendas.

That’s even as progressives argue that funding is falling short in areas like education and transportation. Last month, Coloradans kept up the pattern, rejecting a ballot measure that would have relaxed limits on the amount of tax collections that the state government can keep.

Further west, residents in another left-leaning state, Washington, also voted in November to crimp government revenues. Voters approved a ballot initiative to cap the cost of vehicle registration fees, or “car tabs,” which help pay for transit and other transportation programs.

“I think you could say it’s an anti-tax vote, clearly,” said Rep. Jake Fey, a Tacoma-area Democrat who chairs the Washington state House Transportation Committee.

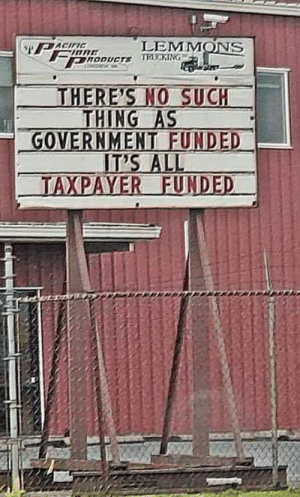

In both places, the election results show how there can be limits to the appetite people have for paying more money for public services and infrastructure—even when a majority of a state’s voters are willing to support Democrats who tend to embrace more progressive platforms, which often involve bigger government.

The measures also highlight the complications and uncertainty that can arise when making tax policy at the ballot box, as well as some unique facets of each state’s tax structure.