Guest blog from Dennis Simpson, retired CPA and TABOR activist. Simpson lives in Mesa County.

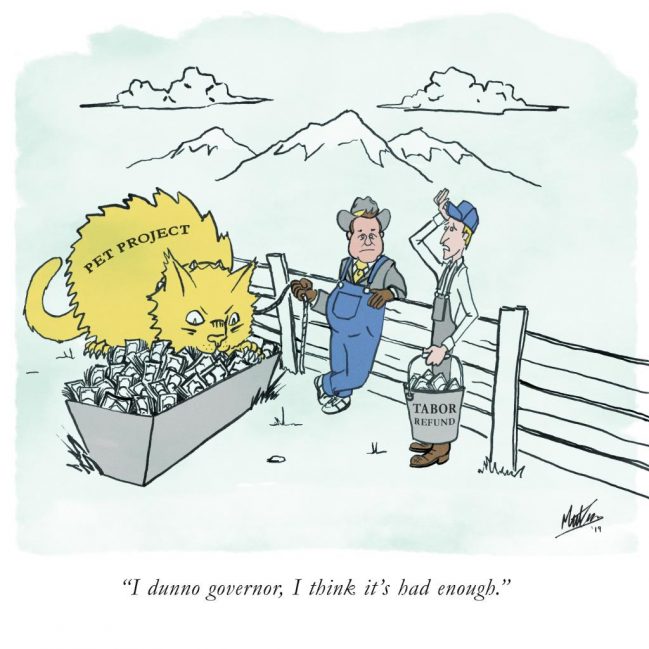

There are not many local Colorado governments left that have not relaxed TABOR restrictions. One of the remaining few is Mesa County. Recent action by County Commissioners increased the possibility that anti-TABOR folks (including our local newspaper) soon will mount an effort to remove protections that TABOR provides you.

In this case, TABOR limits the ability of a government to retain excess revenue in two distinct ways. It limits the amount of property taxes collected and additionally limits the overall revenue collected in any year.

In 2018, Mesa County’s collection of property taxes was not an issue. However, the County had a banner year in the collection of sales taxes which resulted in excess revenue exceeding $5 million.

The concept of refunding anything other than excesses caused by property taxes has not happened for many years, presenting a new challenge to staff and Commissioners. The Commissioners ignored helpful suggestions for alternatives and dismissed the issue too rapidly. They decided to take the option that required the least amount of thought. They are giving the $5 million to property taxpayers proportionate to how much property tax each paid. Our largest property taxpayers are oil companies and box stores with main offices far away. Over $2 million of the sales tax refund will be removed from the local economy. Those who do not own property will get zero and those who own lower value homes will get a pittance.

A guest column on this issue, “Commissioners’ handling of refunds at odds with TABOR’s long-term survival,” provides additional discussion.