Michael Fields and Kristi Burton Brown preview Gov. Polis’ upcoming call for another special session. It’s going to be focused on the budget, but why do liberals want to insist on taxing overtime and tips? What does polling say about this? And, there’s no question that a key public safety issue should be added if the legislature returns to the Capitol in August – it’s one that District Attorneys across the political spectrum agree must be fixed in state law.

Category Archives: TABOR news story

Colorado’s 2025 Special Session: Background and Bills Released So Far – TABOR Refund News

Here we go again! For the third year in a row, Governor Jared Polis has called the Legislature for a Special Session.

This year, they are meeting to address the nearly $1 billion shortfall that the State of Colorado is facing due to the tax cuts in HR 1, otherwise known as the One Big Beautiful Bill Act.

Natalie Menten is a Colorado politics expert and taxpayer advocate. She joined me to provide background on the Special Session, and explain what bills have already been introduced.

If you want to become an expert on the Colorado Legislature, this is a must-watch!

Colorado Democrats have long been critical of TABOR—the Taxpayer’s Bill of Rights.

FYI:

Colorado Democrats have long been critical of TABOR—the Taxpayer’s Bill of Rights.

? What Is TABOR?

TABOR is a constitutional amendment passed in 1992 that:

• Limits how much revenue Colorado can collect and spend.

• Requires voter approval for any tax increases.

• Mandates refunds to taxpayers when revenue exceeds a cap based on inflation and population growth.

It’s popular among many voters for its taxpayer protections.

?? Colorado Democratic Party position on TABOR

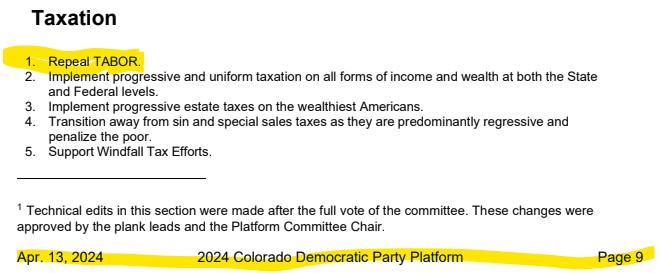

Colorado Democrats have consistently expressed frustration with TABOR’s constraints since it blocks their unlimited spending. Here’s what recent reporting shows:

• Ongoing Efforts: Democrats have tried for decades to dismantle TABOR. Despite controlling the state government for seven years straight, they’ve made little headway due to TABOR’s popularity and constitutional entrenchment.

• Recent Moves: In 2025, some Democratic lawmakers introduced a resolution to direct the legislature’s legal team to file a lawsuit challenging TABOR’s constitutionality. The argument was that TABOR violates the U.S. Constitution’s guarantee of a “republican form of government” by requiring voter approval for tax increases.

• Internal Disagreement: While many Democrats agree TABOR is problematic, they’re divided on how to address it—whether through legal challenges, ballot measures, or incremental reforms.

• Platform Status: There’s clear evidence that “Repeal TABOR” is an official plank in the statewide Democratic platform and is certainly a recurring theme in their legislative agenda and public statements.

?? Political Reality

Despite Democratic control, TABOR remains intact because:

• Voter Resistance: Ballot measures to retain excess revenue (Propositions CC in 2019 and HH in 2023) were rejected by voters.

• Strategic Caution: Democrats are wary of political backlash, especially in swing districts or rural areas where TABOR is popular.

? Summary

So, while many Colorado Democrats strongly oppose TABOR and some have pursued legal and legislative avenues to weaken or eliminate it, it’s accurate to say the party has officially declared war on TABOR in its platform. The issue is deeply divisive, both within the party and among voters.

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

Colorado’s 2025 Special Session: Background and Bills Released So Far – TABOR Refund News

Here we go again!

For the third year in a row, Governor Jared Polis has called the Legislature for a Special Session.

This year, they are meeting to address the nearly $1 billion shortfall that the State of Colorado is facing due to the tax cuts in HR 1, otherwise known as the One Big Beautiful Bill Act.

Natalie Menten is a Colorado politics expert and taxpayer advocate.

She joined me to provide background on the Special Session, and explain what bills have already been introduced.

If you want to become an expert on the Colorado Legislature, this is a must-watch!

???Chainsaw Caucus: Dems’ Tax Trick in CO! ???

ChainsawCaucus @ChainsawCaucus posted this today on X (Twitter):

???Chainsaw Caucus: Dems’ Tax Trick in CO! ???

? Democrats are dodging TABOR with a Motte-and-Bailey scam: claiming taxes haven’t risen or the budget is balanced (motte) while piling on fees that act like taxes (bailey). Coloradans are paying the price! ?

How It Works:

? Motte: “No tax hikes! TABOR ties our hands, so we use fees for roads, schools, healthcare.” They lean on the 4.25% income tax rate and small cuts (0.38% since 2018).

? Bailey: Fees exploded to $25.8B in 2024—$4,322 per Coloradan, a 3,369% jump since 1994. That’s a hidden tax hike equal to a 7.68% income tax rate!

Fee Fallout (2019–2024):

– ? College fees up 26.1% (e.g., CU Boulder + 14.28% to $41,943).

– ? DMV fees up $4 (HB25-1189), plus $3 car insurance fees (HB25-1303).

– ?? Restaurant fees + 25% (SB285).

– ?? $5.4B in transport fees (SB21-260).

– ? Non-education fees hit $1,382 per person (2024), up from $97 (2000).

The Trick: Dems use TABOR-exempt enterprises (10 new ones since 2020, $124.3M in FY24) and cite court rulings to avoid voter approval. They even pushed HJR25-1023 to challenge TABOR’s constitutionality! ?

Impact: Fees cost families ~ $4,500/yr (Advance CO). Voters rejected Prop HH (2023) by **18 pts**, showing **70%+** support TABOR on X. Stop the fee frenzy!

?? Fight Back: Initiative 2025-2026 #136 could require voter OK for big fees by 2027. Demand accountability! How are fees hitting you?

https://x.com/ChainsawCaucus/status/1957092257548648955

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

Special Session Study Group: Taxes v. Fees

One of Colorado government’s favorite games is to whine about TABOR, while actively subverting it through “fees.”

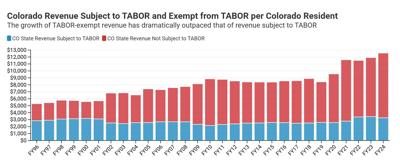

A report from the Common Sense Institute reveals that Colorado’s state spending exempt from the Taxpayer’s Bill of Rights (TABOR) has risen by nearly 30% since 1996.

TABOR limits the amount of revenue the state can retain each year, but exempts certain sources such as voter-approved changes, federal funds, and state enterprises. State enterprises — lottery, health insurance etc. — generate revenue through providing goods or services.

In 1996, 46% of Colorado’s total state spending (about $5,264 per resident) was “exempt from TABOR;” by fiscal year 2024, that share increased to 74%, amounting to just over $9,000 per resident.

Consider that for a moment. “Exempt from the Taxpayer Bill of Rights.”

Something is deeply wrong with that framing.

Colorado Politics broke this story, quoting the study authors Erik Gamm and Judah Weir, “‘The more that fee increases assume the character of tax increases, especially in the aftermath of Proposition 117, the more appropriate it becomes to characterize them as such,’ …adding that fee revenue growth is driving Colorado’s ‘tax burdens’ without giving citizens a say in the process.”

https://coloradofreepress.com/special-session-study-group-taxes-v-fees/

Hands Off Our TABOR Refunds! The 2025 Special Session Better NOT Be A Money Grad

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

Understanding TABOR Refund History: A Comprehensive Guide

Understanding TABOR Refund History: A Comprehensive Guide

The Taxpayer’s Bill of Rights (TABOR) is a cornerstone of Colorado’s fiscal policy, enacted in 1992 to limit state and local government revenue growth and return excess funds to taxpayers. The TABOR refund history reflects decades of surplus distributions, evolving mechanisms, and economic impacts, making it a critical topic for Colorado residents. This guide dives deep into the historical context, refund mechanisms, amounts, eligibility criteria, and key milestones of TABOR refunds, offering a detailed, SEO-optimized resource for understanding this unique program. Whether you’re a long-time Coloradan or new to the state, this article provides clear, actionable insights to help you navigate and claim your refunds.

Since its inception, TABOR has mandated that surplus revenue—beyond inflation and population growth limits—be refunded through methods like sales tax refunds, income tax rate reductions, and direct payments. Over the years, refund amounts have varied based on economic conditions, with notable payouts like the $750 single-filer refund in 2022 and the projected $1,700 in 2025. By exploring the history of TABOR refunds, residents can better understand eligibility, filing deadlines, and how to maximize their financial benefits.

Table of Contents

What Is TABOR and Why Does It Matter?

The Taxpayer’s Bill of Rights, approved by Colorado voters in 1992, caps government revenue growth to the rate of inflation plus population growth. When state revenue exceeds this limit, the surplus must be returned to taxpayers unless voters approve retaining it. This mechanism ensures fiscal discipline and directly benefits residents through refunds. Understanding the TABOR refund history is essential for Coloradans to anticipate payments, meet filing requirements, and stay informed about legislative changes that may affect future refunds.

For example, in 2023, eligible taxpayers received $800 (single filers) or $1,600 (joint filers) through sales tax refunds, a shift from earlier years when amounts varied by income. This guide breaks down these changes, offering lists and tables to clarify how refunds have evolved and what to expect in 2025.

Historical Overview of TABOR Refunds

The evolution of TABOR refunds showcases Colorado’s commitment to returning excess revenue to its citizens. Below is a detailed timeline of key milestones in TABOR’s history, highlighting legislative changes, refund mechanisms, and significant payouts.

Timeline of TABOR Refund Milestones

- 1992: Voters approve TABOR, establishing revenue limits and mandating refunds for surplus funds.

- 1997: First TABOR refunds issued, primarily through sales tax refunds, marking the beginning of surplus distributions.

- 2005: Referendum C allows the state to retain some surplus revenue for five years, temporarily reducing refunds.

- 2017: Senate Bill 17-267 prioritizes reimbursements to local governments for property tax exemptions before issuing refunds.

- 2021: Temporary income tax rate reduction from 4.55% to 4.50% for all filers, alongside sales tax refunds.

- 2022: Permanent income tax rate reduction to 4.40% approved by voters, with $750 single-filer and $1,500 joint-filer refunds issued as “Colorado Cash Back” checks.

- 2023: Senate Bill 23B-003 standardizes refunds at $800 (single) and $1,600 (joint), simplifying the process.

- 2024: Income tax rate reduced to 4.25% due to a $1.5 billion surplus threshold, with sales tax refunds projected at $326 (single) and $652 (joint).

- 2025: Forecasted refunds reach up to $1,700 for eligible filers, driven by strong economic growth in technology and tourism sectors.

This timeline illustrates how TABOR refunds have adapted to economic and legislative shifts, ensuring taxpayers benefit from surplus revenue.

TABOR Refund Mechanisms: How They Work

TABOR refunds are distributed through specific mechanisms, which have evolved to balance fiscal responsibility and taxpayer benefits. Below is a comprehensive list of the primary refund methods used historically and their applications.

TABOR Refund for Seniors-What You Should Know

TABOR Refund for Seniors-What You Should Know

The TABOR refund for seniors in Colorado is a vital financial benefit under the Taxpayer’s Bill of Rights (TABOR), ensuring eligible residents, particularly those aged 65 and older, receive a portion of surplus state revenue. For 2023, single filers can claim an $800 refund, while joint filers may receive $1,600, with additional benefits like the Property Tax/Rent/Heat (PTC) Rebate for low-income seniors. This guide provides a detailed, step-by-step roadmap to maximize your refund, including eligibility criteria, filing requirements, and free tax assistance options, optimized for seniors navigating Colorado’s tax system in 2025.

Understanding the TABOR refund process can feel daunting, but it’s a straightforward opportunity to boost your finances. Whether you’re a retiree living on Social Security or a senior with modest income, this article breaks down everything you need to know in clear lists and tables. From filing deadlines to income thresholds, we’ll ensure you’re equipped to claim your refund confidently. Let’s dive into the specifics to help you secure your Colorado TABOR refund without stress.

Table of Contents

What Is the TABOR Refund for Seniors in Colorado?

The Taxpayer’s Bill of Rights, enacted in 1992, mandates that Colorado refunds excess state revenue to taxpayers when collections exceed a constitutional cap. For seniors, this refund is particularly significant, as many rely on fixed incomes. In 2023, the state simplified the process with the DR0104EZ form for those with minimal income, making it easier for older adults to claim their share. Additionally, seniors aged 65 or older with low income may qualify for the PTC Rebate, enhancing their financial relief.