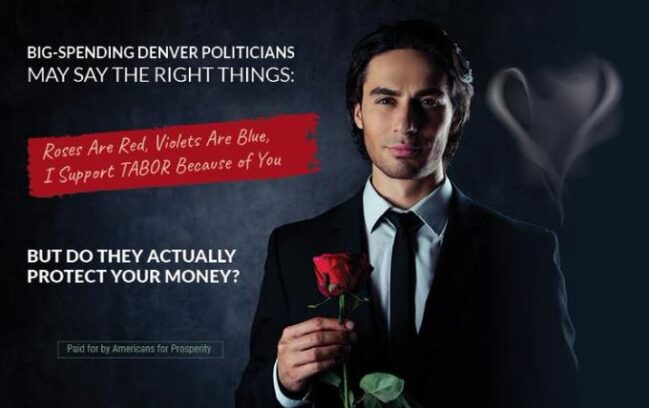

AFP Colorado@AFPColorado

ICYMI: A valentine mailer that hit across Colorado reminding voters to pay attention to an elected official’s actions and not just their words when it comes to the Taxpayer’s Bill of Rights (TABOR)

AFP Colorado@AFPColorado

ICYMI: A valentine mailer that hit across Colorado reminding voters to pay attention to an elected official’s actions and not just their words when it comes to the Taxpayer’s Bill of Rights (TABOR)

The IRS says our TABOR refunds may be subject to income tax. It’s asking Coloradans to hold off on filing their taxes until it makes a determination.

If you received a TABOR refund last year, you might owe federal taxes on that money.

It is the first time the agency has questioned the taxability of TABOR refunds since voters passed the Taxpayer Bill of Rights 30 years ago.

The constitutional amendment caps the amount of revenue the state is allowed to keep and, anything over that cap, needs to be sent back to taxpayers.

Last year, it was nearly $3 billion, which resulted in $750 checks for individuals and $1,500 for joint filers. Continue reading

There are over 4,500 local government agencies in Colorado. Nearly 3,000 of those are special districts. All of these agencies and special districts are included under our Taxpayer’s Bill of Rights (TABOR).

Most voters wouldn’t be able to list off the top of their head all the local governments collecting property taxes from them directly or passed on to them as a percentage of rent by the property owner in the course of business. You might have a couple or several of these governments charging you property taxes — lots of layers.

You can check your special districts using this Colorado Department of Local Affairs (DOLA) GIS map. It’s a great tool offering filters and layers so you get all the information. Click on the district map and you’ll get the annual levy rate and contact information for the district.

Why should we care?

Property Taxes

Special districts, especially metropolitan districts, can amount to a sizable portion of your property tax bill. Just because you don’t directly write the check for the property taxes doesn’t mean you’re not paying part or all of the property tax bill. Tenants and consumers pay a portion of the property taxes in rent or included in the cost of the products they buy. Continue reading

There are over 4,500 local government agencies in Colorado. Nearly 3,000 of those are special districts. All of these agencies and special districts are included under our Taxpayer’s Bill of Rights (TABOR).

Most voters wouldn’t be able to list off the top of their head all the local governments collecting property taxes from them directly or passed on to them as a percentage of rent by the property owner in the course of business. You might have a couple or several of these governments charging you property taxes — lots of layers.

You can check your special districts using this Colorado Department of Local Affairs (DOLA) GIS map. It’s a great tool offering filters and layers so you get all the information. Click on the district map and you’ll get the annual levy rate and contact information for the district.

Why should we care?

Property Taxes

Special districts, especially metropolitan districts, can amount to a sizable portion of your property tax bill. Just because you don’t directly write the check for the property taxes doesn’t mean you’re not paying part or all of the property tax bill. Tenants and consumers pay a portion of the property taxes in rent or included in the cost of the products they buy. Continue reading

Last year, Colorado Democrats championed TABOR refunds as they campaigned for reelection. Yet not a week into the 2023 legislative session, they announced plans to try and halt those refunds indefinitely.

Last year, Colorado Democrats championed TABOR refunds as they campaigned for reelection. Yet not a week into the 2023 legislative session, they announced plans to try and halt those refunds indefinitely.

A forthcoming bill by Rep. Cathy Kipp (D) and Sen. Rachel Zenzinger (D), if passed by the legislature and approved by voters, would allow the state to retain future tax refund dollars mandated under the Taxpayer’s Bill of Rights (TABOR) in Colorado’s Constitution. Kipp says the money would go to fund public schools.

Proponents of this idea have failed in the past to gather the 120,000 signatures required to put the question on the November ballot. The legislature can circumvent this requirement by passing the measure as a bill first.

Every time voters speak on key issues related to TABOR, they send the same unambiguous message: “Leave TABOR alone and let us keep our money!”

Democratic legislators either didn’t get the message, or they just don’t care what voters think.

In 2019 after voters gave Democrats unified control over state government, legislators thanked them by sending Proposition CC–which would have permanently ended TABOR refunds–to the November ballot, where Coloradans soundly rejected it.

Coloradans spoke loud and clear: “Leave TABOR alone and let us keep our money!”

In 2020, voters had the choice between two competing citizen-led ballot initiatives. One would have raised taxes and repealed TABOR’s requirement that Colorado maintains the same income tax rate for all taxpayers. The other, put on the ballot by my organization, Independence Institute, reduced the state’s income tax rate from 4.63 to 4.55 percent. The latter passed with a wide margin. The former failed even to gather enough signatures to appear on the ballot.

Once again, Coloradans spoke loud and clear: “Leave TABOR alone and let us keep our money!”

Fast forward to 2022. If the people of Colorado had not made their will clear enough already, last year left no ambiguity.

To continue reading this story, please click (HERE):