Links from video: https://freestatecolorado.com/herman/ A new proposed tax increase would be disastrous for Colorado. The economy is already struggling and many Coloradans are having trouble making ends meet. And yet, greedy politicians and their authoritarian allies working for non-profits want to take more of our money. Thankfully, we have people like Nash Herman who analyze policy and expose the implications of these schemes. Nash works for the Independence Institute in Denver, a Free-Market think tank. In this video, Nash explains why tax increases are a bad idea and shares insight into the mindset of greedy big government advocates.

Category Archives: TABOR news story

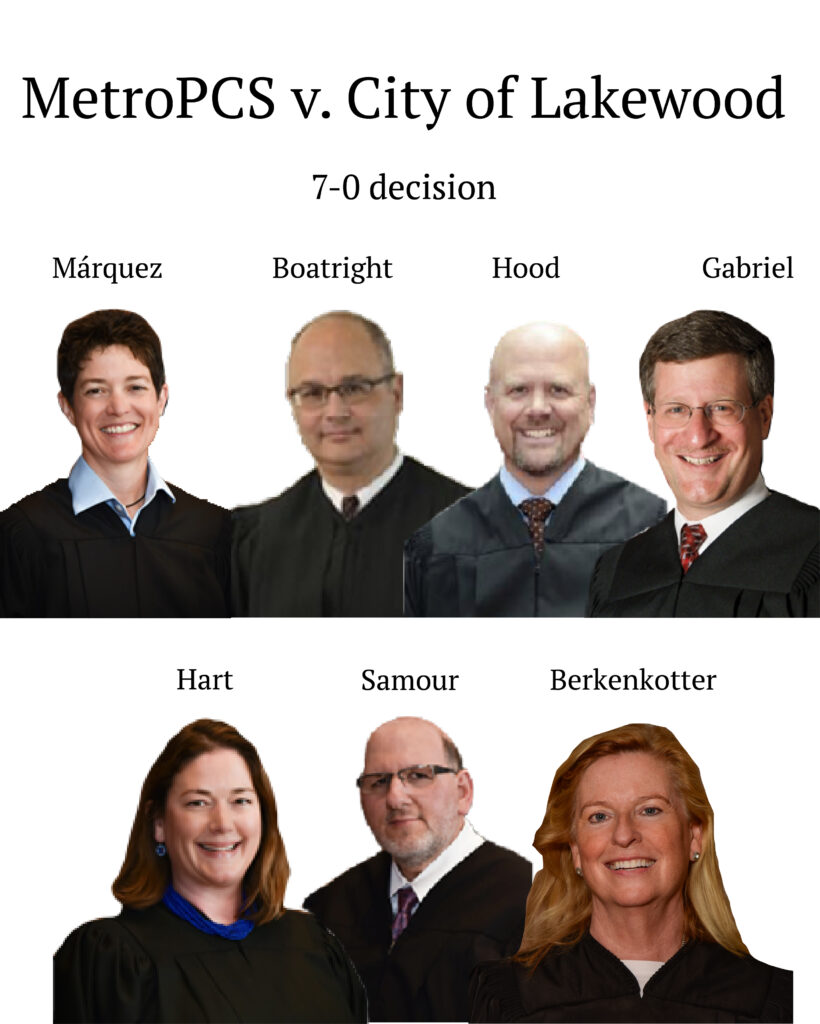

The TABOR Committee’s Response about the T-Mobile/City of Lakewood Tax Case

The members of the TABOR Committee certainly were glad that both the trial court and the Colorado Supreme Court acted to preserve this piece of the Taxpayer’s Bill of Rights : (https://aboutbtax.com/bjrH). We have thought for years that courts have been too lenient in allowing the weakening of TABOR, and so strongly endorse this defense of the constitution.

The City of Lakewood tried to wiggle past this new tax without prior voter approval by expanding the reach of a limited and old telecommunications tax. That the judicial system confirmed that new technologies must be treated as such in order to be taxed and therefore require voter approval, is an excellent protection for the citizens of our state. The application of this understanding, that newly developed inventions cannot have old taxes extended to them, but must first ask the voters, is an important provision going forward that should cover a host of new ideas and innovations. The ruling also somewhat limits the damage done in the rulings for the TABOR Foundation vs. RTD case, in which taxes imposed on items never taxed before without a vote were allowed by the courts.

We were also thankful that the justices on the Supreme Court all understood and applied the plain meaning of TABOR and released the Opinion unanimously.

An issue that we wish would have been revisited was argued by the City to allow the new taxes because the taxes raised were too small to be relevant. It should be emphasized that such an argument always should be seen as nugatory, because TABOR has no de minimis language anywhere in its constitutional section. In fact, the opposite applies. Any tax increase ballot must conform to specific language that forecasts the amount to be raised. If the receipts come in higher than the projection, “[T]he excess shall be refunded” and the tax rate adjusted downward to meet the limits (paragraph 7(d)). No exception is mentioned in the provision. In the RTD case mentioned above, the Supreme Court then legislated the de minimis provision into TABOR, creating it out of whole cloth.

Penn Pfiffner

TABOR Committee Chairman

Colorado Chamber Applauds Landmark TABOR Decision from State Supreme Court

For media inquiries, please contact Cynthia Eveleth-Havens at CynthiaE@cochamber.com.

DENVER – The Colorado Chamber of Commerce today applauded the Colorado Supreme Court’s decision in MetroPCS v. City of Lakewood, determining that the City of Lakewood failed to comply with Colorado’s Taxpayer’s Bill of Rights (TABOR). The Colorado Chamber submitted an amicus brief on the case in December 2024.

“This landmark case draws a sharp line in the sand for the state and local jurisdictions trying to tax voters without their approval,” said Colorado Chamber President and CEO Loren Furman. “This is the first time the Colorado Supreme Court has found a violation of TABOR’s voter approval requirements for new taxes, which could set an important precedent moving forward. Businesses depend on the predictability of our laws and tax policies, and we applaud the Court’s decision to prohibit taxing authorities from unilaterally imposing new taxes without the consent of voters.”

The Court ruled that Lakewood violated the state constitution by expanding a 1969 tax ordinance twice in the last three decades when it enacted a business and occupation tax on cell service providers without prior voter approval. The Court declared the ordinances violated TABOR laws making them void and requiring Lakewood to refund the tax it collected unlawfully over the past years.

The Colorado Chamber’s prior amicus brief can be found here: https://cochamber.com/wp-content/uploads/T-Mo-CO-Brief-of-Amicus-Curiae-Colorado-Chamber-of-Commerce.pdf

Colorado Chamber Applauds Landmark TABOR Decision from State Supreme Court

Colorado Supreme Court finds Lakewood unconstitutionally expanded phone provider tax

Colorado Supreme Court finds Lakewood unconstitutionally expanded phone provider tax

The Colorado Supreme Court ruled on Monday that Lakewood improperly expanded the scope of a 1969 tax ordinance twice to encompass cell phone providers without holding the popular vote the state constitution requires.

Click (HERE) to read the whole story

Colorado legislators deny move to delete ‘tax increase’ language in ballot title in statewide publication

Colorado legislators on Thursday rejected an attempt to change the title of a ballot measure in a widely disseminated publication in order to avoid mentioning that it would result in a tax increase for households with incomes above $300,000 a year.

Colorado legislators on Thursday rejected an attempt to change the title of a ballot measure in a widely disseminated publication in order to avoid mentioning that it would result in a tax increase for households with incomes above $300,000 a year.

The proponent of the change argued that keeping “tax increase” in the measure’s title would suggest that everybody’s taxes are going up. Legislators who balked at the move said the proposal, indeed, increases taxes — and policymakers should not hide that fact.

At issue is Proposition MM, which seeks to raise $95 million more for a school lunch program offered free to all K-12 students. Voters had approved the program in 2022, but it has run in the red from the beginning, given that every public school child can now receive a free breakfast and lunch, regardless of income.

Lawmakers had been scrambling to fill that funding gap in the last two years. They have since decided to ask voters to raise the tax liability of residents earning above the $300,000 threshold. That proposal is already slated for this November’s ballot.

Click (HERE) to continue reading this story at Colorado Politics.

The Taxpayer’s Bill of Rights is located in Section 20 of Article X of the Colorado Constitution. The text of the section is as follows:

The Colorado Taxpayer’s Bill of Rights (TABOR) requires voter approval for all new taxes, tax rate increases, extensions of expiring taxes, mill levy increases, valuation for property assessment increases, or tax policy changes resulting in increased tax revenue.

Titles shall have this order of preference: “NOTICE OF ELECTION TO INCREASE TAXES/TO INCREASE DEBT/ON A CITIZEN PETITION/ON A REFERRED MEASURE.”

https://ballotpedia.org/Colorado_Taxpayer%27s_Bill_of_Rights_(TABOR)

Ballot measure seeks tax hike for higher income earners in 2026

A coalition led by a Colorado think tank will file a ballot initiative on Wednesday to raise state income tax rates on annual household incomes and corporations with earnings above $500,000.

The ballot measure, which sets up a “graduated” income tax, would also provide a tax break for households with incomes below the $500,000 threshold.

The ballot measure, which sets up a “graduated” income tax, would also provide a tax break for households with incomes below the $500,000 threshold.

Broadly speaking, under a graduated income tax — which is also known as “progressive” tax — the rates are divided into brackets. The lower brackets pay a smaller rate; the higher levels are taxed a bigger rate. A graduated system would eliminate Colorado’s flat tax rate.

Under the coalition’s proposal, the higher bracket would pay more so that even with the tax break for incomes below $500,000, the graduated system would still pull in a bigger net revenue for the state government.

Click (HERE) to continue reading this TABOR article at Colorado Politics

Don’t buy The Sun’s spin: TABOR isn’t the reason Colorado’s roads are failing, it’s lawmakers’ misplaced priorities

It (The Sun) ignores the fact that TABOR doesn’t direct spending, the politicians running the state do.

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

Don’t buy The Sun’s spin: TABOR isn’t the reason Colorado’s roads are failing, it’s lawmakers’ misplaced priorities

August 29, 2025

By Cory Gaines | Commentary, Colorado Accountability Project

The Sun’s Gigafact check tries, but fails spectacularly.

The Sun has been doing yeoman’s work lately to get the progressive talking points on our state’s budget and TABOR out there. Their Gigafact check linked first below is a great example.

In answer to the question, “Has the condition of Colorado’s roads worsened under TABOR?”, their response is a resounding YES.

Let me pull some non-contiguous quotes. As a quick aside, the amount of text below is about 50% of the entire text in the fact check, a point I will return to shortly.

“The percentage of state roads in Colorado rated “poor” by the Federal Highway Administration has risen from 8% to 24% since the agency began collecting data in 1994, two years after the Taxpayer’s Bill of Rights became law.”

“TABOR is a voter-approved constitutional amendment that limits how much tax revenue Colorado can collect and spend. Colorado’s gas tax, which funds much of the state’s $1.55 billion transportation budget — 48% of which goes to pavement maintenance annually — hasn’t changed since 1991 partly due to TABOR restrictions.”

The problems start with what I wrote right prior to the quotes. Determining the truth of a statement, especially one involving road funding in Colorado, is probably going to need a deeper look than than 150-odd words can provide.

If the Sun limited themselves to a literal interpretation of their title question, have the roads gotten worse under TABOR, then it is possible to determine the truth (or not) of the statement. Yes, the two events have indeed been coincident in time. They happened simultaneously.

But if you read that second quoted passage above again, you’ll see that they do not, in fact, limit themselves to such a question; it becomes pretty clear reading it that what they then do is to turn and try to link the condition of the roads to TABOR–an expansion of the question.

This is the failure.

It ignores the fact that TABOR doesn’t direct spending, the politicians running the state do.

It ignores the MULTIPLE fees that the state charges, some of which is supposed to go to the improvement of our roadways. See, for example, the second link below which is CDOT’s Statewide Bridge and Tunnel Enterprise which takes in fees and is supposed to use them to fund bridge and tunnel improvements, bridges and tunnels which are paved (and some of which are in dire need of repair from the pavement on down to the structure).

The last bit of trouble here is the Sun’s use of the recent American Society of Structural Engineer’s (ASCE) report about the condition of Colorado’s infrastructure to help inform their fact check. This ASCE report (see the third link below to an earlier newsletter) was a self-serving effort, also critical of TABOR, and informed by groups that do not like fiscal restraint.

Do not rely entirely on fact checks by any news outlet. There is nothing special about them. There is no heightened sense of fairness or truth involved; they are just as apt to mistakes or bias as any other “news” product.

As you can see above, there is sometimes quite the opposite: there is a redirection of what they originally set out to verify into advocacy.

https://coloradosun.com/2025/08/22/has-the-condition-of-colorados-roads-worsened-under-tabor/

https://www.codot.gov/programs/BridgeEnterprise

Related:

An earlier op ed I wrote about bias in fact checking.

https://completecolorado.com/2024/06/28/gaines-fact-checking-media-check-their-own-biases/

READ THE FULL COMMENTARY AT THE COLORADO ACCOUNTABILITY PROJECT

Editor’s note: Opinions expressed in commentary pieces are those of the author and do not necessarily reflect the opinions of the management of the Rocky Mountain Voice, but even so we support the constitutional right of the author to express those opinions.

https://rockymountainvoice.com/2025/08/29/dont-buy-the-suns-spin-tabor-isnt-the-reason-colorados-roads-are-failing-its-lawmakers-misplaced-priorities/

Posted in Colorado Accountability Project, Approved, Commentary, State

Tagged in Colorado Politics, Colorado Sun, Colorado Supreme Court, Democrat Lawmakers, Fiscal Responsibility, Government spending, Progressive Media, Road Funding, TABOR, Taxpayer Rights

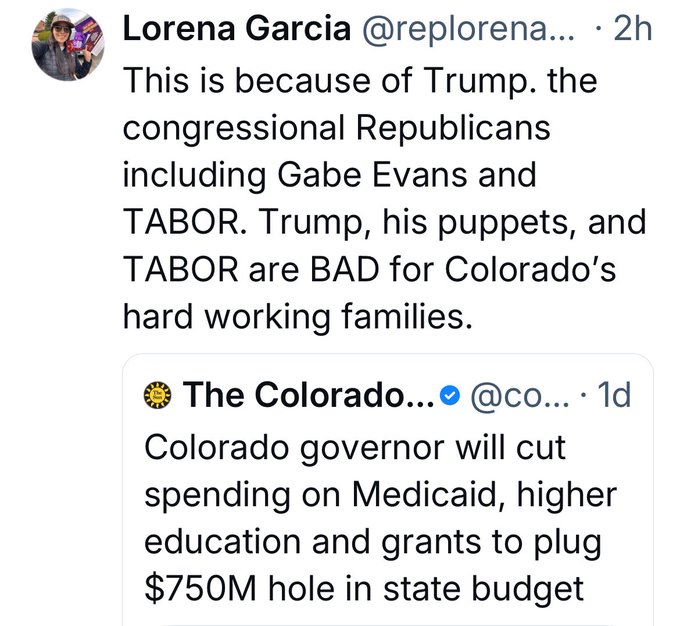

Colorado has some of the worst “Representatives”. Lorena Garcia is at the top of the shit pile.

Colorado has some of the worst “Representatives”. This one is at the top of the shit pile.

https://x.com/Thedukeisking/status/1961551372102369671

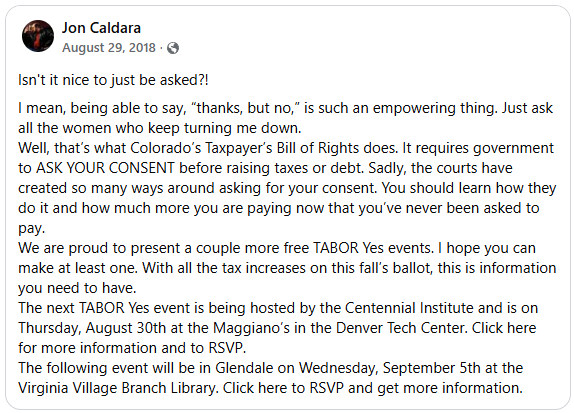

Jon Caldara 7 Years Ago – “Isn’t It Nice To Just Be Asked?”

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes