The TABOR Committee has taken a position on Proposition LL and Proposition MM. As someone who follows our work, please consider our recommendations.

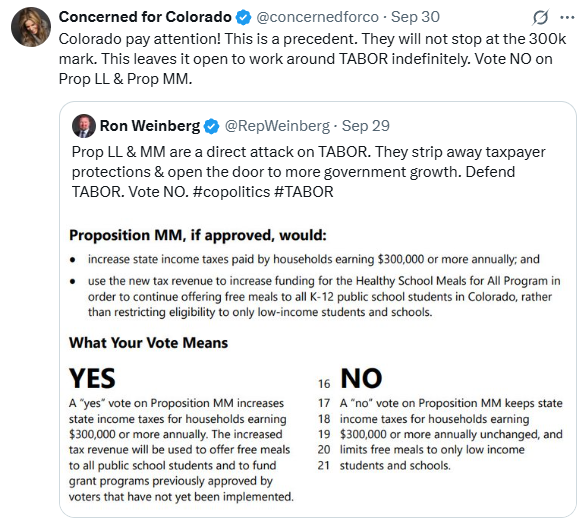

Please vote in this election and vote NO on both propositions.

Reasons for our position are stated below:

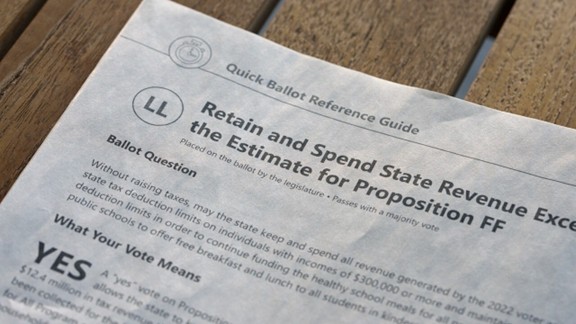

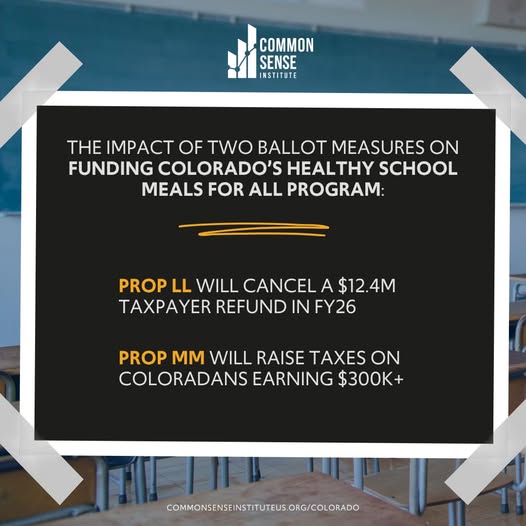

- Both measures deal with raising taxes for school meal programs. The program was passed just a couple years ago, is just now being implemented, and already the government is twisting the taxpayers’ arms for even more funds. LL would cost $67 Million EACH year and MM would collect $103 Million and rising each and every year.

- In a year when the state budget is leading to cuts, these higher taxes would be directed only to this new and untested program.

- Colorado’s income tax report uses the federal tax report (1140) as its basis. These measures enhance the process of creating a different method for calculating State taxes. Our citizens are headed toward having to fill out a second report that uses a different set of rules. That leads to many more hours to file your taxes, using a different basis, and creating real reporting headaches.

Proponents hope that you will support the measures because they “soak the rich.” Think about how all the states that treat wealth as something terrible are seeing people escape those states and move to places where success is not punished.

These measures continue to move the state away from the citizen-approved concept of taxing income at one rate.

Under TABOR, as people earn more income, they pay more taxes, but everybody’s tax rate is the same, so no one is treated differently.

#VoteNoOnPropLL

#VoteNoOnPropMM

#OnlyTaxIncreasesAreOnTheBallot,NotTaxDecreases

#ItsYourMoneyNotTheirs

#DontBeFooled

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

#ThankGodForTABOR

#HandsOffTABOR