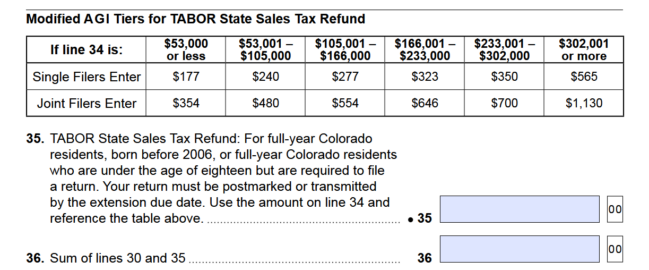

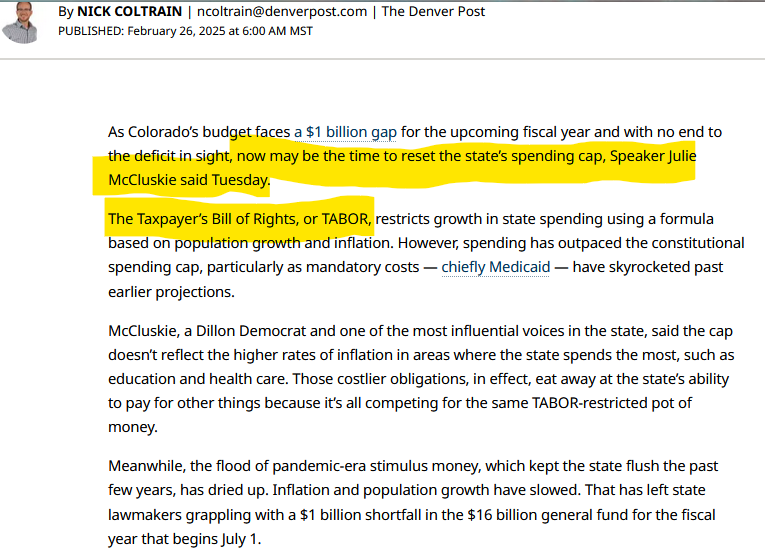

In the November, 2024 general election, Arapahoe County voters approved ballot issue 1A, removing spending limits imposed by the Taxpayer’s Bill of Rights (TABOR). Moving forward, this means county government gets to keep and spend over-collected tax revenue that would have otherwise been refunded to taxpayers.

In other words, voters gave county commissioners what amounts to a tax hike, and now it’s time to keep them accountable for it.

As part of the ballot language, a provision was included that mandates all spending of this tax revenue windfall be transparently reported. Specifically, it requires that the new spending be included in the county’s annual independent audit, published on the county website and that it be monitored and reviewed by a “resident advisory committee.” That’s where you come in.

The county pushed ballot measure 1A as a way to fund existing services that they claimed were potentially going to be cut due to budget shortfalls. And while I understand the need for transparency of how this massive influx of money should be spent, we must also make sure the advisory committee is up to the task and doesn’t just become a rubber stamp for political agendas and new pet projects.

According to the county website, the job of the committee is to ensure that 1A funds “are being used in alignment with their intended purpose, advocating for proper stewardship of these resources.”

If you think you’re up to that task, you should consider applying. It’s a great opportunity to get involved in your community, while also holding your elected officials accountable to the taxpayers.

There are ten committee slots to be filled, with at least one from each county commission district. Members serve three-year terms, with a two-term maximum. And if you’ve ever thought about running for public office, this is a great way to get some local government experience under your belt first.

Arapahoe County voters gave up their TABOR refunds in perpetuity, now it’s time to ensure county commissioner honor that sacrifice and hold up their end of the bargain.

Kathleen Chandler is an Arapahoe County resident and directs the Citizen Involvement Project at the Independence Institute, a free market think tank in Denver. She can be reached by email at Kathleen@i2i.org.

Citizen watchdogs needed for Arapahoe County 1A tax windfall – Complete Colorado