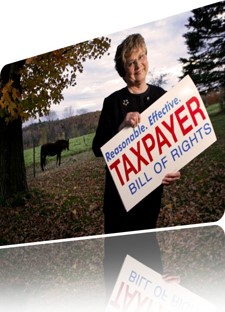

TABOR Refund for Seniors-What You Should Know

The TABOR refund for seniors in Colorado is a vital financial benefit under the Taxpayer’s Bill of Rights (TABOR), ensuring eligible residents, particularly those aged 65 and older, receive a portion of surplus state revenue. For 2023, single filers can claim an $800 refund, while joint filers may receive $1,600, with additional benefits like the Property Tax/Rent/Heat (PTC) Rebate for low-income seniors. This guide provides a detailed, step-by-step roadmap to maximize your refund, including eligibility criteria, filing requirements, and free tax assistance options, optimized for seniors navigating Colorado’s tax system in 2025.

Understanding the TABOR refund process can feel daunting, but it’s a straightforward opportunity to boost your finances. Whether you’re a retiree living on Social Security or a senior with modest income, this article breaks down everything you need to know in clear lists and tables. From filing deadlines to income thresholds, we’ll ensure you’re equipped to claim your refund confidently. Let’s dive into the specifics to help you secure your Colorado TABOR refund without stress.

Table of Contents

What Is the TABOR Refund for Seniors in Colorado?

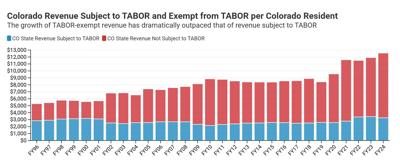

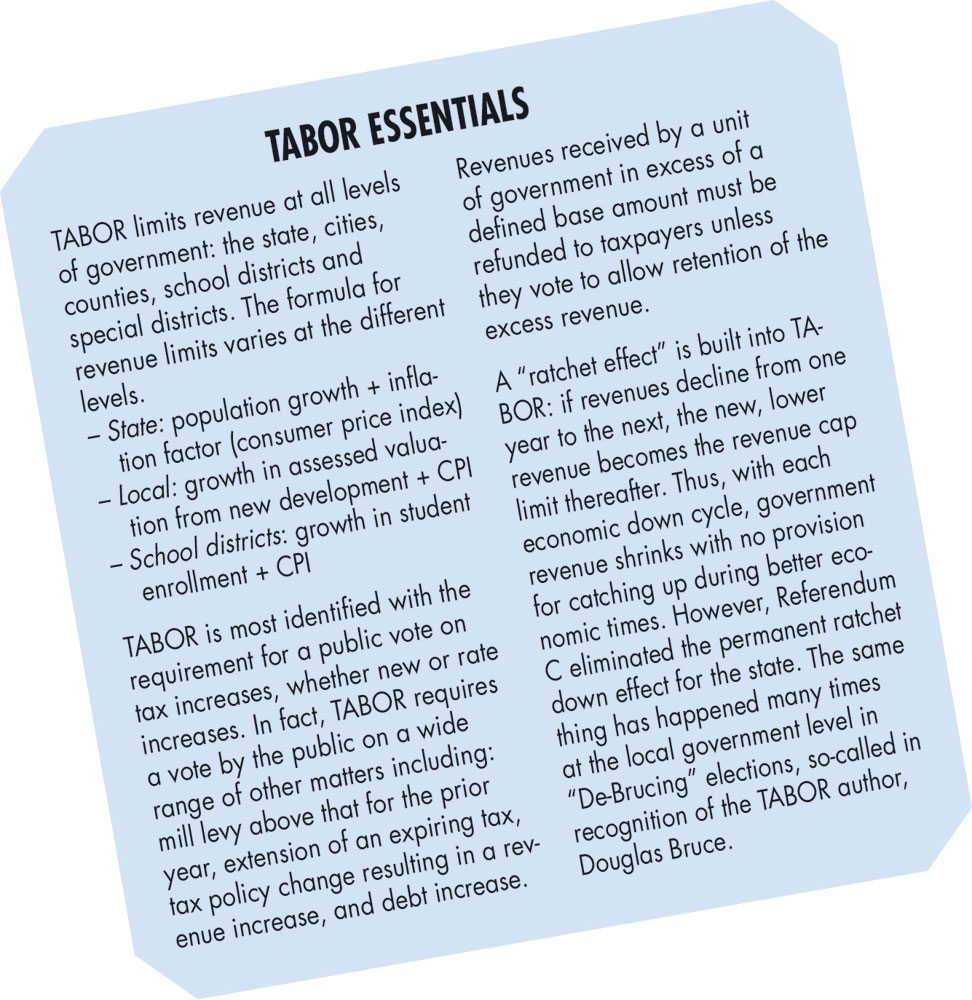

The Taxpayer’s Bill of Rights, enacted in 1992, mandates that Colorado refunds excess state revenue to taxpayers when collections exceed a constitutional cap. For seniors, this refund is particularly significant, as many rely on fixed incomes. In 2023, the state simplified the process with the DR0104EZ form for those with minimal income, making it easier for older adults to claim their share. Additionally, seniors aged 65 or older with low income may qualify for the PTC Rebate, enhancing their financial relief.