Category Archives: Media

Apr

26

Apr

26

It Is More Important To Kill Bad Bills , Than To Pass Good Ones

Apr

26

Timely Quote From President Calvin Coolidge

Apr

26

There’s Nothing “Modest” About Taking Away People’s TABOR Refunds PERMANENTLY

Apr

26

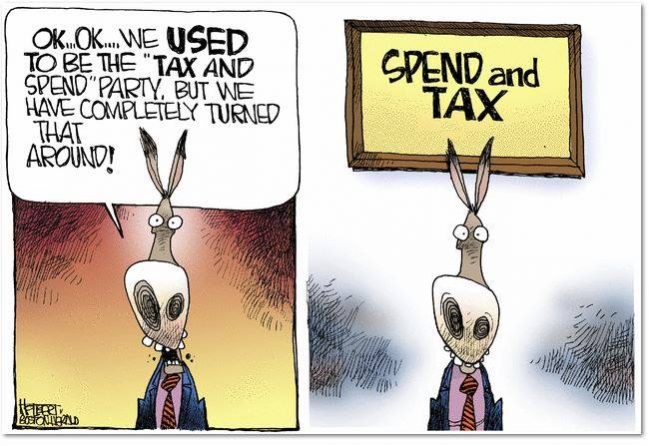

Liberals Used To Be The “Tax & Spend” Party But They Have Completely Turned That Around

Apr

25

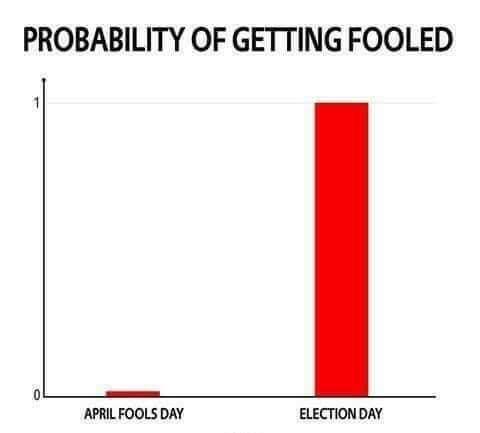

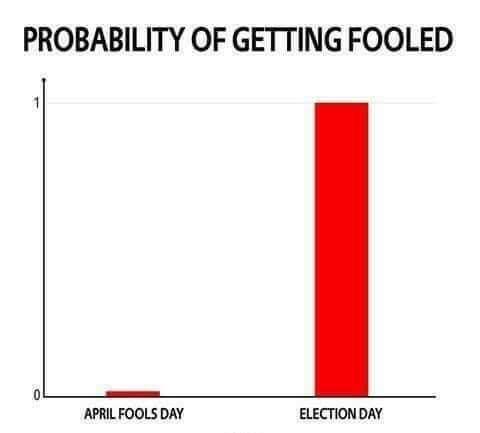

The Probability Of Getting Fooled On April Fools vs Election Day

Apr

25

Do We Need Government To Solve All Of Our Problems?

Apr

25

I Will Resist You If You….

Apr

25

Coloradans may face 4 spending questions this year. Will new nicotine tax measure overload the ballot?

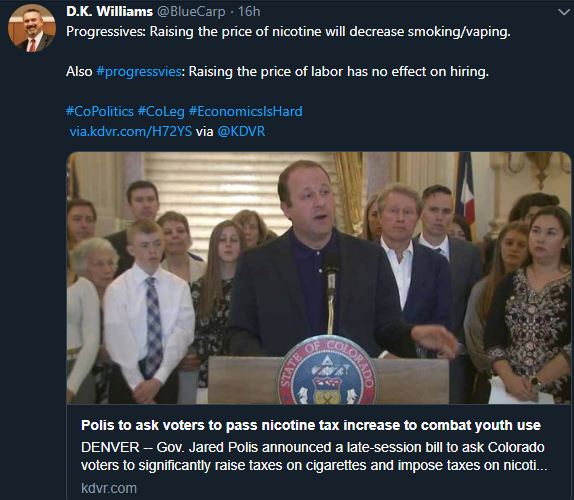

Michael Fields@MichaelCLFields Tweeted:

The state budget went up by $1.6B again this year. Government has enough money already.

Coloradans may face 4 spending questions this year. Will new nicotine tax measure overload the ballot?

The proposal, announced Wednesday by Gov. Jared Polis and Democratic state lawmakers, would set a uniform nicotine tax at 62 percent. That would lift the taxes on a package of cigarettes to $2.49 from 84 cents.

Apr

25

Why #TABOR Matters on April 25

#TheBottomLine

#TABOR

#ThankGodForTABOR