Independence Institute Launches Tax Reduction Ballot Initiative

- May 18, 2020

To “Energize our Economy” Independence Institute Launches Tax Reduction Ballot Initiative

May 18, 2020

Denver – Independence Institute, Colorado’s free-market think tank, announces its petition drive launch today of a ballot initiative that will reduce the flat Colorado state income tax rate from 4.63% to 4.55%.

The signature gathering process for Initiative #306 will begin today.

The initiative, currently known as Initiative# 306, is supported by the issue committee Energize our Economy. The purpose of this ballot initiative is to get Colorado’s economy back to its former strength, by putting money back into the pockets of those who earned it.

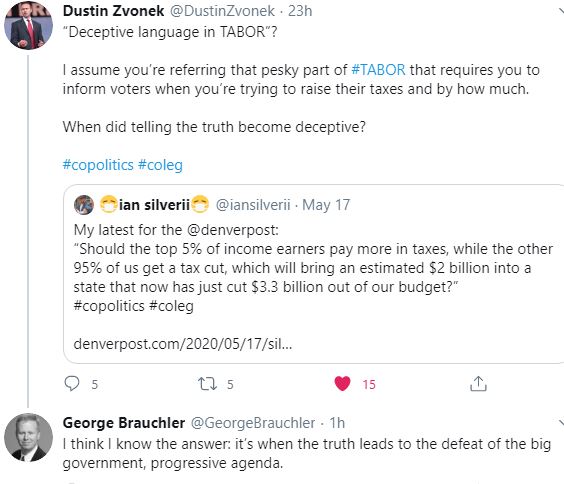

This flat-rate tax cut will also offer voters an alternative to a progressive income tax increase that will also be on the ballot, Initiative #271, that seeks to raise income taxes by $2 billion a year.

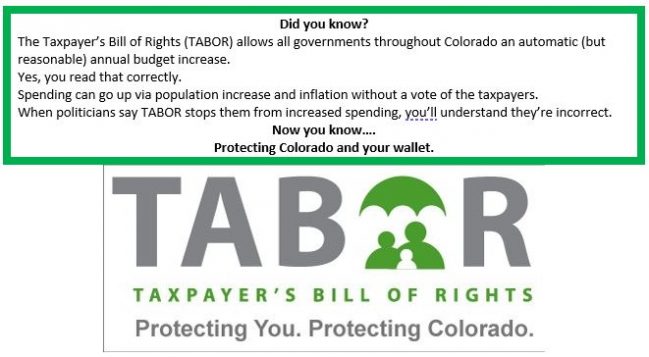

“The Colorado economy —pre-COVID-19— was on fire thanks to our Taxpayer’s Bill of Rights and our flat state income tax,” said Jon Caldara, President of the Independence Institute, and co-ballot proponent of the tax rate reduction. “We look forward to giving the voters a real choice between a progressive tax increase which will be billed as a middle-class tax cut, and a real tax cut for every Coloradan. Question is: which one is actually the tax cut? Hint: Not the ballot question that starts “Shall state taxes be increased $2,000,000,000 annually.”