Voters to decide if El Paso County can keep $15 million in excess revenues

From the 2021 Voter Guide: Races and issues in El Paso and Teller counties series

- Breeanna Jent breeanna.jent@gazette.com

- Oct 11, 2021

EL Paso County voters will decide in November 2021 whether to refund $15 million in excess government revenue back to residents or to use the money to address road infrastructure projects and backlogged parks maintenance.

Courtesy of El Paso County Public Works

El Paso County voters will decide whether the county may keep $15 million in excess government revenues to fund road infrastructure and deferred parks maintenance projects when they cast their ballots Nov. 2 — money that would otherwise be refunded to taxpayers under Colorado’s Taxpayer’s Bill of Rights.

If voters approve the question, El Paso County will use $13 million of surplus funds to pay for backlogged roadway improvements, including paving and repairing potholes on roads throughout the county. Another $2 million would fund deferred parks projects such as capital improvements, trail preservation and wildfire mitigation at Bear Creek Park, Paint Mines Interpretive Park, Fountain Creek Regional Trail, Ute Pass Regional Trail, The Pineries Open Space and Fox Run Park, including a northern nature center.

The question also asks voters to decide whether to raise El Paso County’s revenue cap to reflect actual 2021 revenue, increasing the limit from $285 million to about $300 million. The amount of the final revenue cap is unknown until next May, because El Paso County will continue collecting additional state and sales tax revenues through the rest of the year, county spokeswoman Natalie Sosa previously said.

2021 Voter Guide: Races and issues in El Paso and Teller counties

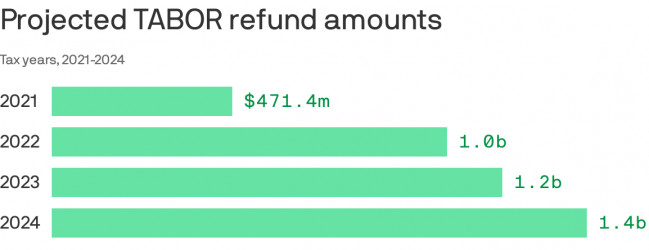

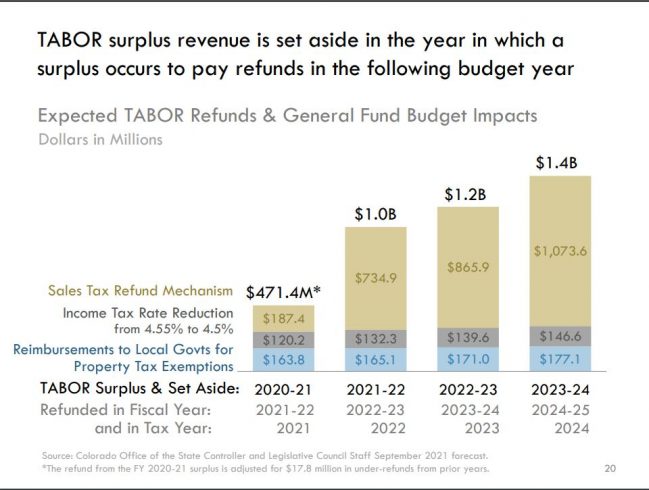

TABOR calculates increases in most local government revenues to a formula based on population growth and inflation. Excess can only be used for voter-approved purposes. Continue reading