Dear members of the Commission on Property Tax:

The commission was tasked with providing property tax relief options before the temporary tax adjustments expire at the end of 2024.

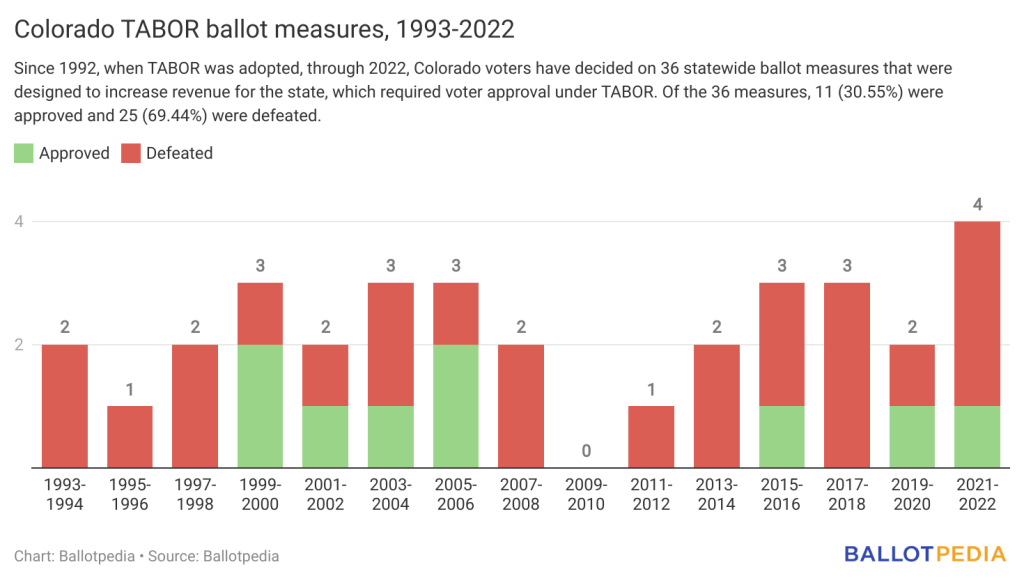

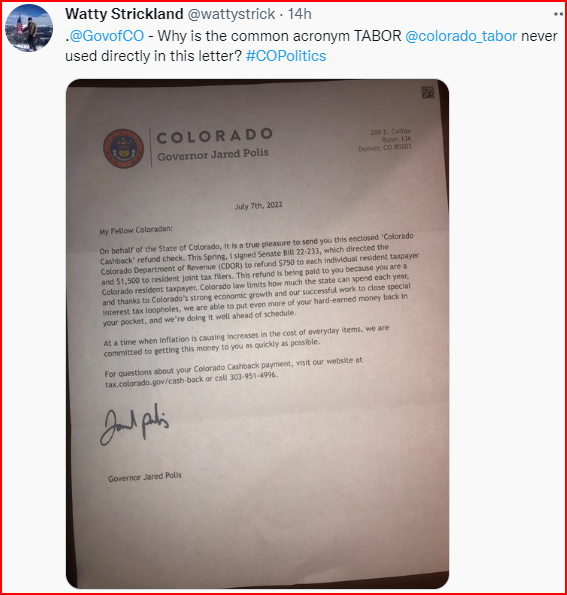

The obvious answer is to restore inflation and growth adjustable property tax revenue caps where they’ve been forfeited in prior elections. Good news – that’s already in the Taxpayer’s Bill of Rights (TABOR) but it needs to be reinforced!

If that doesn’t happen, there will be a hard property tax cap on the 2024 ballot. That’s been clearly stated by two of the proponents of property tax caps if there was insufficient actions from the commission.

Taxpayers want tax caps whether they are hard or inflation adjustable. Taxpayers like me understand that government growth should be relative to the size of the local economy. That is rightly answered in the existing property tax limit contained in TABOR, paragraph 7c, which allows for such growth.

Having sat through all the commission meetings, there’s a few moments I want to highlight.

Bring back the tax caps

In this three minute video, the county assessor from Santa Clara, California described where that state sits now under the Proposition 13 property tax caps. His points illustrate why our Colorado TABOR is ideal. The assessor points out that local California governments didn’t appropriately reduce property taxes in 1978, even referring to property taxes as “money machines.” So, California voters used their right to petition to place a hard tax cap on the ballot, which became Proposition 13. Continue reading