Dems seek TABOR’s demise in court – again | Jimmy Sengenberger | Opinion | gazette.com

We just wanted to remind you that the premise of this case was settled in December, 2021 but the political party on the left doesn’t learn. Here’s the headline and story:

Chief Judge Timothy M. Tymkovich, writing for himself and six of his colleagues, concluded that the Boulder County Board of County Commissioners, a handful of school districts and one special district failed to show that the 1875 Enabling Act that guaranteed to Colorado a “republican” form of government had also given the local government entities the ability to challenge TABOR’s taxing and spending restrictions.

“Looking at the Enabling Act’s language, we conclude the plaintiffs cannot state a claim under the Act’s promise of a republican constitution. Neither the Enabling Act’s text nor structure supports the political subdivisions’ arguments. The clause promising a constitution republican in form has no clear beneficiary,” Tymkovich wrote in the Dec. 13 decision.

A group of Colorado lawmakers has unveiled a plan to fundamentally change state tax policy and attempt to eliminate the Taxpayer’s Bill of Rights, or TABOR.

The plan, announced Monday afternoon by Democratic legislators, includes reclassifying chunks of Colorado highway funding so it doesn’t fall under the TABOR spending cap, which would free up money for other things. They also hope to end Colorado’s flat income tax and replace it with a system in which higher-income taxpayers pay higher rates than low-income filers.

Lawmakers also introduced a resolution Monday that seeks to launch a lawsuit challenging the legality of TABOR, which was passed by Colorado voters in 1992, under the U.S. Constitution.

“The state is coming to a reckoning on whether we can sustain ourselves,” said Sean Camacho, a Denver Democrat. “And all of these measures are critical to figuring that out.”

The lawsuit resolution has attracted a roster of co-sponsors, including some top legislative leaders. The proposals come as Colorado faces a budget hole of more than $1 billion because of the cap set by TABOR.

TABOR limits how much state spending can grow based on inflation and population growth. Certain sectors of government spending, chiefly mandatory Medicaid costs, have far outstripped the pace of consumer inflation, effectively eating into how much the state can spend on nonmandatory programs.

To read the rest of this article, click (HERE) to go to the Denver Post.

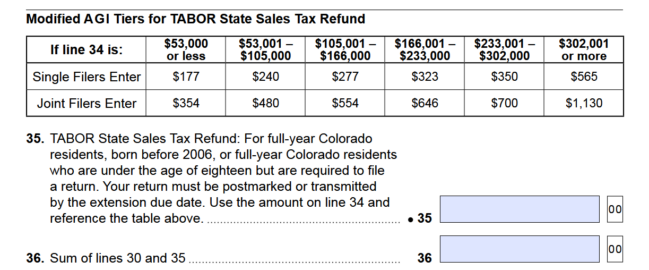

Thanks to Colorado’s Taxpayer’s Bill of Rights (TABOR), residents will receive a refund when filing their 2024 state income taxes in 2025.

? How to Get It:

? How Much Will You Get? Refund amounts are based on your income and filing status. Here’s what to expect:

Single Filers:

Joint Filers:

? Bonus: Lower Income Tax Rate The state income tax rate dropped from 4.40% to 4.25% for 2024 — another TABOR win for taxpayers!

January 7, 2025 By Rep. Ryan Gonzalez

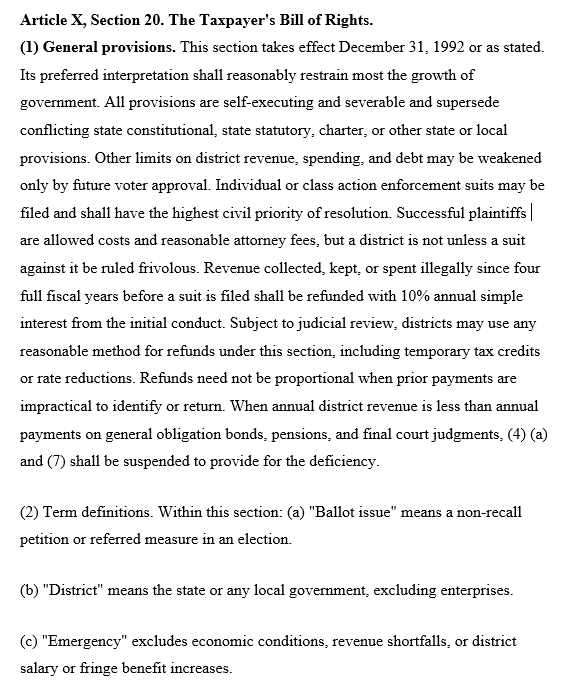

In 1992, Colorado voters passed the Taxpayer’s Bill of Rights, or TABOR, the nation’s strongest tax limitation law to this day. For those who are unfamiliar what TABOR really does, this amendment to the Colorado Constitution allows government spending to reasonably increase using a formula of population growth plus inflation. Excess revenue, known as the “TABOR surplus,” must be refunded to taxpayers. If state government wants to keep the surplus, or raise taxes, voters must approve. That is exactly why progressives abhor TABOR. But the truth is, a little north of 60% of Colorado voters approve of TABOR.

In 1992, Colorado voters passed the Taxpayer’s Bill of Rights, or TABOR, the nation’s strongest tax limitation law to this day. For those who are unfamiliar what TABOR really does, this amendment to the Colorado Constitution allows government spending to reasonably increase using a formula of population growth plus inflation. Excess revenue, known as the “TABOR surplus,” must be refunded to taxpayers. If state government wants to keep the surplus, or raise taxes, voters must approve. That is exactly why progressives abhor TABOR. But the truth is, a little north of 60% of Colorado voters approve of TABOR.

Many progressives have made their disdain for TABOR be known, having tried time and time again to chip away at TABOR’s taxpayer protections. And in many ways, they’ve done so; mostly by adding tax credits which pull from the TABOR surplus. They’ve done so by giving everyone equal tax refunds and redistributing wealth; taking from those who paid the most in state taxes and giving more to those who paid little.

In 2022, the Democrat majority, just before a critical midterm election, gave taxpayers what they called the “Colorado cash back” in disguise as a “stimulus” check. What they didn’t tell you is that it was actually your TABOR refund, just early and proportioned against historical distribution. Continue reading

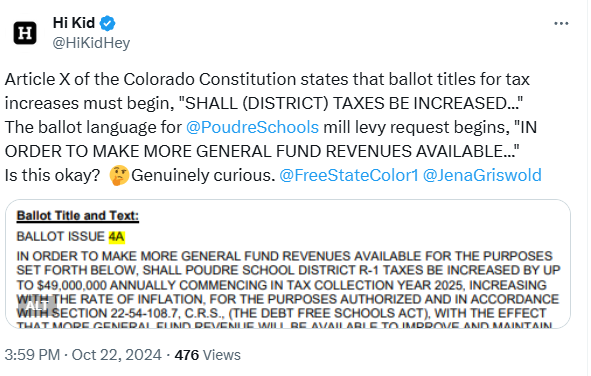

If you see this on your ballot, you are voting for a TAX INCREASE!

“Ballot titles for tax or bonded debt increases shall begin, “SHALL (DISTRICT) TAXES BE INCREASED (first, or if phased in, final, full fiscal year dollar increase) ANNUALLY…?” or “SHALL (DISTRICT) DEBT BE INCREASED (principal amount), WITH A REPAYMENT COST OF (maximum total district cost), …?”

https://www.sos.state.co.us/pubs/info_center/laws/COConstitution/ArticleXSection20.html

Hi Kid @HiKidHey asked this on X (Twitter): “So what does that mean for voters? Who is ultimately responsible for the TABOR violation? The local county clerk or the district’s designated election official? Genuinely curious.”

It’s not easy to find information on the judges appearing on your Colorado ballot. Rebecca Sopkin is a Constitutional Attorney and TABOR Foundation Board Member.

In this video, she is sharing her methodology for determining who to vote for, some resources for voters to use, and her picks for this year’s ballot. Links from the video https://freestatecolorado.com/sopkin/

The District doubled its property tax in 2019 without holding a public approval vote as required by Colorado’s Constitution.

The decision is a win for Colorado taxpayers statewide and will strengthen Colorado’s Taxpayer Bill of Rights (TABOR). The National Taxpayers Union Foundation (NTUF)’s Taxpayer Defense Center, in conjunction with Advance Colorado, represented Aranci and other taxpayers in the case.

“TABOR means what it says, and so a local government cannot double the property tax rate without a vote of the people,” NTUF Senior Attorney Tyler Martinez said. “We’re glad the Colorado Supreme Court declined to review this case further and left in place the unanimous decision by the Court of Appeals.”

NTUF’s Taxpayer Defense Center advocates for taxpayers’ rights across the country. The organization’s in-house team of attorneys challenge overzealous and unfair tax administration. Because of lawsuits brought by the Taxpayer Defense Center, individuals and businesses nationwide have benefitted from fair, equitable policy and victories worth tens of millions of dollars.

“We are grateful for the Taxpayer Defense Center taking up the case,” Chuck Miller, one of the plaintiffs in the case, said. “We wanted to stand up for all taxpayers in the district and protect our TABOR rights.”

For more information on the Taxpayer Defense Center’s victory for taxpayers in Colorado or to discuss the case with NTUF’s legal team, please contact NTUF Marketing Director Courtney Manley at courtney.manley@ntu.org.