Gov. John Hickenlooper issued an election-eve budget plan that supported taxpayer refunds next year, but his Democratic colleagues in the legislature are openly considering a move to spend the money.

The talk comes as the Joint Budget Committee continues preliminary meetings to craft the state budget and raises the specter of an intraparty showdown on one of the top legislative issues in the upcoming 2015 session.

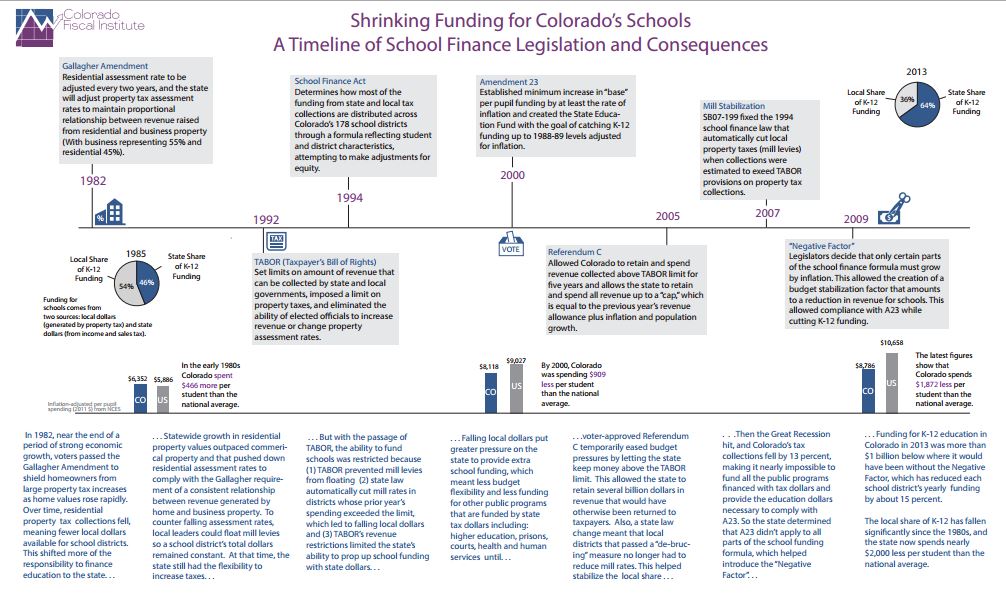

Under the state’s Taxpayer’s Bill of Rights, Colorado must return any tax collections in excess of its constitutional revenue cap, which is set by the rate of inflation plus population growth. Right now, the state forecasts a potential $130 million refund.

In a recent interview, noted in a story looking at Hickenlooper’s second term, incoming House Speaker Dickey Lee Hullinghorst made the most direct suggestion that Democrats may support a ballot measure in 2015 to ask voters to keep the money for state spending instead of issuing a refund

“If we don’t do anything as a state, we are going to be spending almost as much money as we refund, refunding money to people, which doesn’t seem to make a lot of common sense to me,” the Boulder Democrat said. “The people would be far better off if we invested that in infrastructure, education — something that really benefited them rather than (them) getting their 50 bucks to spend on a tank of gas or something.”

“If we don’t do anything as a state, we are going to be spending almost as much money as we refund, refunding money to people, which doesn’t seem to make a lot of common sense to me,” the Boulder Democrat said. “The people would be far better off if we invested that in infrastructure, education — something that really benefited them rather than (them) getting their 50 bucks to spend on a tank of gas or something.”

Hullinghorst didn’t elaborate, but the cost for refunding TABOR is typically negligible because it’s done through tax filings.