Colorado’s budget gap means more money in taxpayers’ pockets

Have Colorado lawmakers cried wolf about the state’s budget too many times?

The state legislature, after recently reconciling a billion-dollar “budget shortfall” due mostly to a relentless overspending habit, is now back in the barber chair for yet another fiscal haircut.

And while legislators are still overspending and overpromising, state revenue reductions from taxpayer-friendly policy changes in the recently passed One Big Beautiful Bill Act (OBBBA) are now in play as well. This means politicians have less to spend, while Colorado taxpayers keep more money in their own pockets.

Crying wolf

Beginning at the end of 2024, legislators began sounding the alarm over a $1.2 billion budget hole for fiscal year 2025-26.

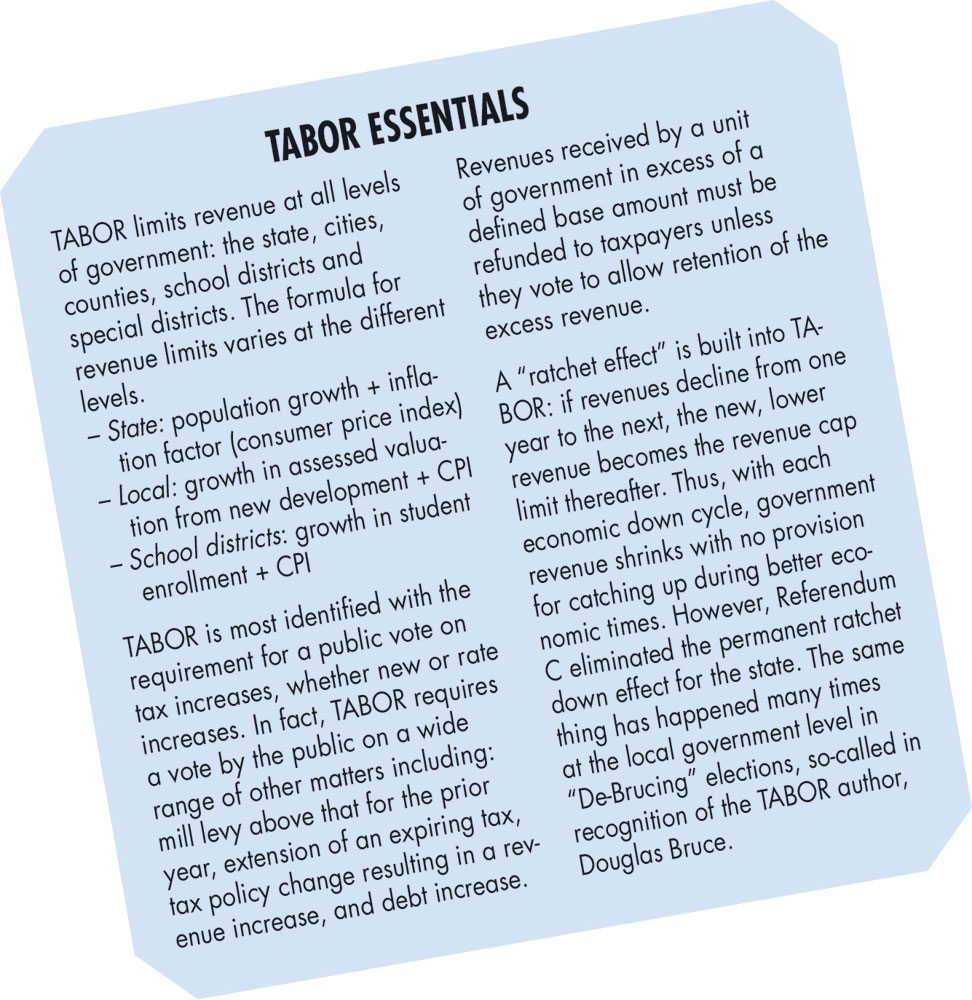

What was termed a “shortfall” was actually a combination of cooling inflation, the depletion of one-time COVID-19 relief funds, a slew of new special interest tax breaks, and ballooning healthcare costs, all running smack into Colorado’s constitutionally guaranteed taxpayer protections.

State government was living beyond its means, but instead of facing reality, majority Democrats instead blamed the Taxpayer’s Bill of Rights (TABOR) and the wealthy not paying their fair share.

Contrary to the doomsaying by legislators, the budget was quietly reconciled, and without any significant cuts to healthcare, K-12 education, and higher education (which alone account for over 70 percent of General Fund appropriations).

Beyond that, the state budget, prior to passage of OBBBA, was actually expected to grow by over 3.5 percent, or nearly $1.5 billion, hardly a crisis by conventional standards.

The One Big Beautiful Bill

On July 30, legislative leadership met with analysts from the governor’s office and Legislative Council Staff to learn more about the impacts of the OBBBA on the state budget.

Despite slightly different estimates, both groups of analysts agreed that a significant budget deficit would emerge this year, due to the immediate impacts of the OBBBA on state tax collection.

Colorado taxpayers and voters are on high alert after the introduction of House Joint Resolution HJR25-1023, sponsored by Democrat Representatives Sean Camacho and Lorena García and Democrat Senators. Lindsey Daugherty and Iman Jodeh. This resolution would initiate a taxpayer-funded lawsuit to challenge the constitutionality of the Taxpayer’s Bill of Rights (TABOR). TABOR was a citizen-initiated, and Colorado voter-approved, constitutional measure in 1992 and has been protecting taxpayers for over thirty years. Republican Representatives and Senators have publicly and vigorously expressed opposition to the resolution.

Colorado taxpayers and voters are on high alert after the introduction of House Joint Resolution HJR25-1023, sponsored by Democrat Representatives Sean Camacho and Lorena García and Democrat Senators. Lindsey Daugherty and Iman Jodeh. This resolution would initiate a taxpayer-funded lawsuit to challenge the constitutionality of the Taxpayer’s Bill of Rights (TABOR). TABOR was a citizen-initiated, and Colorado voter-approved, constitutional measure in 1992 and has been protecting taxpayers for over thirty years. Republican Representatives and Senators have publicly and vigorously expressed opposition to the resolution.