This Monday, April 7th, we need you to speak out in defense of your rights, your paycheck, and your family’s finances.

That’s when HJR25-1023: Require General Assembly TABOR Constitutionality Lawsuit will be heard in Committee.

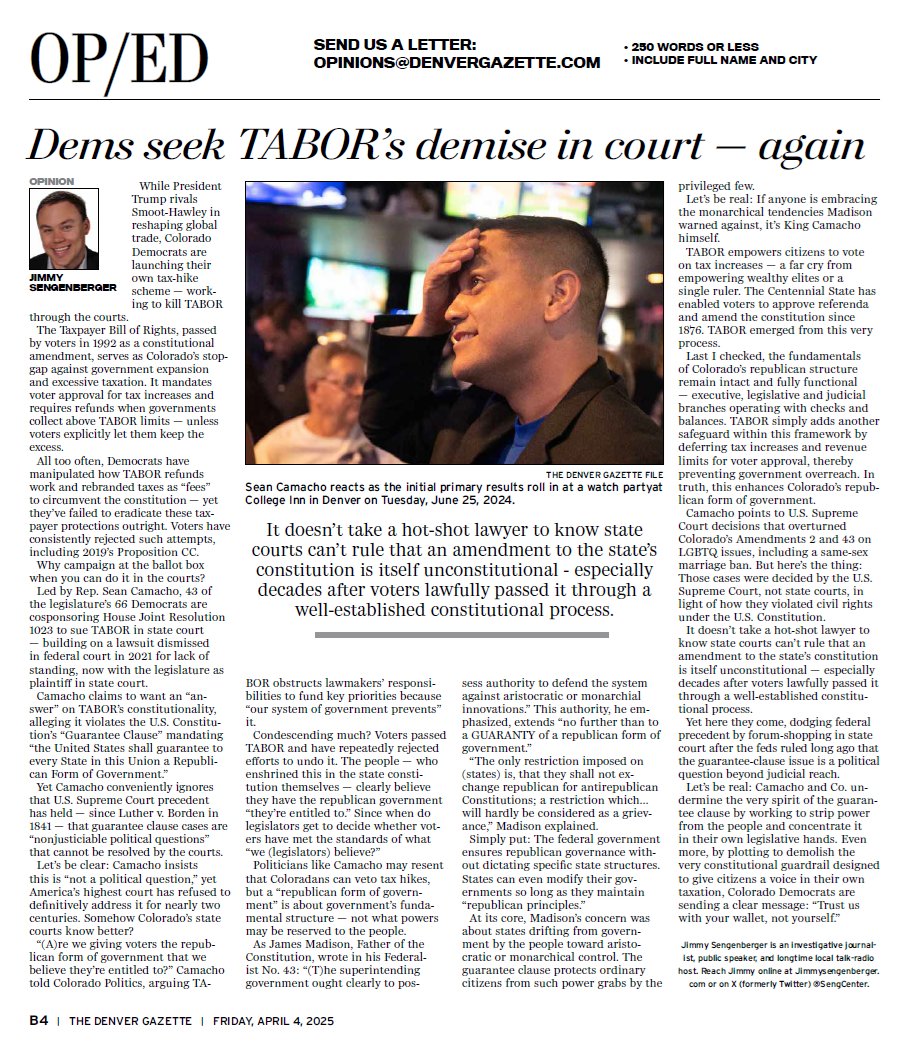

This latest scheme is to sue the people of Colorado with the purpose of repealing the Taxpayer’s Bill of Rights (TABOR).

If successful, this would be the largest tax increase in Colorado history. Your TABOR tax refund would disappear, taxpayers would lose their right to approve tax increases, and governments across Colorado would be able to steal more money from hardworking Colorado families.

In this video, Natalie Menten provides the background on this measure, talking points you can use during testimony, and information on the Taxpayer’s Bill of Rights.

Please speak, in-person or remote in defense of TABOR by opposing HJR25-1023.

Testimony information:

Bill info: https://leg.colorado.gov/bills/hjr25-1023

Hearing time: Monday, April 7th in the House Finance Committee at 1:30 pm in House Committee Room 0112, first floor of the State Capitol.

Sign up here: https://www.leg.state.co.us/clics/clics2025A/commsumm.nsf/NewSignIn.xsp

Easiest to find: “By Committee and Hearing Item”

Committee Name: House Finance

Meeting Date and Time: 04/07/2025 01:30 PM

Hearing Item: House Finance: HJR25-1023 (Require GA TABOR Constitutionality Lawsuit)

Talking Points:

There was excellent news last month. It appears the Plaintiffs have decided not to move forward with the existential threat to TABOR, ending the Kerr vs. Polis lawsuit!

There was excellent news last month. It appears the Plaintiffs have decided not to move forward with the existential threat to TABOR, ending the Kerr vs. Polis lawsuit!