Category Archives: Fiscal Policy

Apr

26

Apr

26

A Tweet About TABOR And The Liberals Distort The Facts

Apr

26

The Liberals Modus Operandi

Apr

26

Collecting More Taxes Than Is Absolutely Necessary Is Legalized Robbery

Apr

26

President Calvin Coolidge And Taxes

Apr

26

Timely Quote From President Calvin Coolidge

Apr

25

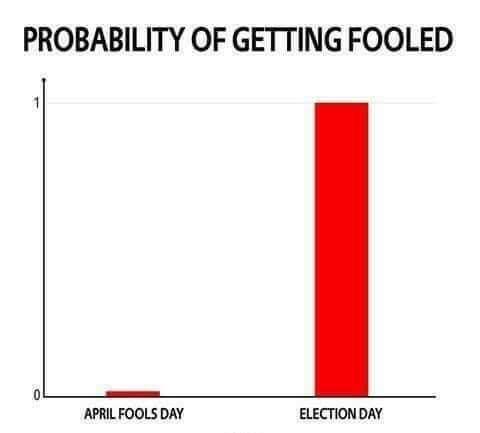

The Probability Of Getting Fooled On April Fools vs Election Day

Apr

25

Do We Need Government To Solve All Of Our Problems?

Apr

25

Coloradans may face 4 spending questions this year. Will new nicotine tax measure overload the ballot?

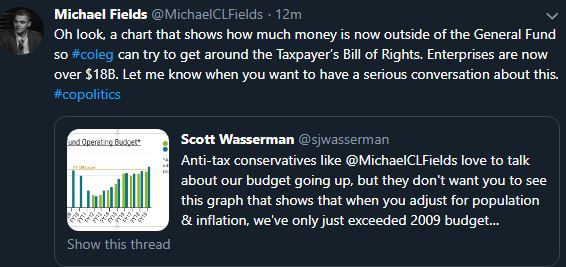

Michael Fields@MichaelCLFields Tweeted:

The state budget went up by $1.6B again this year. Government has enough money already.

Coloradans may face 4 spending questions this year. Will new nicotine tax measure overload the ballot?

The proposal, announced Wednesday by Gov. Jared Polis and Democratic state lawmakers, would set a uniform nicotine tax at 62 percent. That would lift the taxes on a package of cigarettes to $2.49 from 84 cents.

Apr

25

Why #TABOR Matters on April 25

#TheBottomLine

#TABOR

#ThankGodForTABOR