DENVER — A New York City-based organization has doubled down on getting involved in Colorado’s election this year.

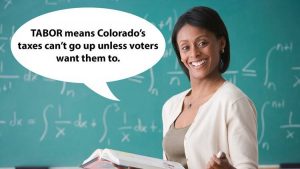

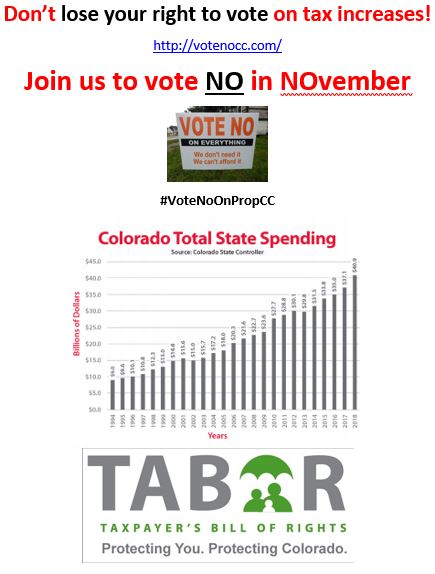

More specifically, Education Reform Now Advocacy (ERNA), which initially sent the “Coloradans for Prosperity aka Yes on Prop CC” campaign committee $100,000 to push a ballot effort to permanently eliminate tax refunds under the Taxpayer’s Bill of Rights (TABOR), sent another $352,000 to the campaign, according to a Major Contributors Report filed by Yes on CC Monday.

According to the ERNA website, it believes that “every child should receive an adequate and equitable allocation of resources no matter their race, socioeconomic status, or zip code nor whether they are enrolled in a traditional district-run public school or public charter school.”

Dan Ritchie, Chancellor Emeritus of the University of Denver told a crowd of mostly Democrat law makers, teachers and students who officially kicked off the campaign last week, that they needed to beware of money from outside of Colorado being spent from the opposition, referring to Americans for Prosperity (AFP), a Washington D.C.-based organization.

According to AFPs website, it advances “policies that will help people improve their lives.” AFP Colorado recently spent nearly $500,000 on a media campaign to oppose Prop CC.

Although both AFP and ERNA have Colorado offices, the difference in the two organizations is their direct ties to the official yes and no on CC groups.

AFP is an independent group making its own decisions on how to target the No on CC message. ERNA is donating directly to the Yes on CC campaign, which will determine how to spend the money.

The additional revenue puts the Yes on CC campaign at slightly more than $2 million in donations, while No on CC has reported only $17,000 in total contributions.