Good day,

Natalie and I recorded this video last night.

It’s about HB24-1311, Family Affordability Tax Credit. This nefarious bill redistributes our TABOR rebate money into a tax credit.

It’s one of the biggest attempts in years to take away TABOR rebates.

Please watch and share: https://youtu.be/VgneAypMu-8

Thank you,

Brandon Wark

FreeStateColorado.com

Category Archives: Fiscal Policy

Colorado Voter Survey Reveals Major Disapproval to Proposed Alcohol Tax

Colorado Voter Survey Reveals Major Disapproval to Proposed Alcohol Tax

A newly proposed 200 percent hike in alcohol taxes from Sens. Kevin Priola (D-13th District) and Chris Hansen (D-31st District) has been met with strong opposition from Colorado Voters.

In a newly published survey by Nelson Research, the proposal, SB 24-181, “loses support among all major

demographic subgroups as more information is known about the funding mechanism and impacts on

economy, democratic process, small business/consumers, and overall lack of prioritization of current alcohol tax dollars.” Starting with a 2-to-1 general disapproval of alcohol taxes (48.9% opposed vs. 23.3% approve), the measure only fares worse once voters learn how the bill was structured to get around Taxpayer’s Bill of Rights (TABOR) provisions as well as its effect on Colorado’s economy. Its final disapproval rating is 58% with just 26% in favor.

In addition to the provision itself, voters also rejected the plan to label this tax as a “fee” by 61-21 percent.

This poll is clear and overwhelming evidence that Coloradans reject higher alcohol taxes. We hope that the bill sponsors listen to their constituents.

The survey was conducted from March 25 – March 27, 2024. The survey consisted of 538 registered voters in Colorado. The sample size (n=538) is sufficient to assess voter sentiment within a margin-of-error of +/- 4.2% at a 95% confidence level.

Further polling insights include:

? Opposition to a 200% tax increase: Results when told the bill raises the tax on beer, wine and liquor by

200% – or three times the current tax level. 22.1% In Favor & 66.0% Opposed

? Economic impact: Results when told Senate Bill 24-181 would hurt Colorado’s vibrant tourism

economy as it would cost local restaurants, brew pubs and craft breweries over $25 million in lost retail

sales. 16.6% In Favor & 70.4% Opposed

? Current tax allocation: Results when told the state already collects millions of dollars in alcohol tax

payments, but does not prioritize treatment and recovery services. Respondents were asked if legislators

should prioritize the way they currently spend their alcohol tax dollars instead of requiring more taxes.

65.0% Agree or in favor & 40.7% Opposed

Colorado Voter Survey Reveals Major Disapproval to Proposed Alcohol Tax

California Businesses Take On Gavin Newsom Over Tax Hikes

Meanwhile, in the state known for its historic gold rush, a coalition of California businesses gathered enough signatures for a ballot measure that would require two-thirds of voters to approve most local tax increases and roll back some already in place.

California Businesses Take On Gavin Newsom Over Tax Hikes

Governor says ballot measure would decimate funding for basic services; backers say it is needed in the high-cost state

By Christine Mai-Duc

April 4, 2024 9:00 pm ET

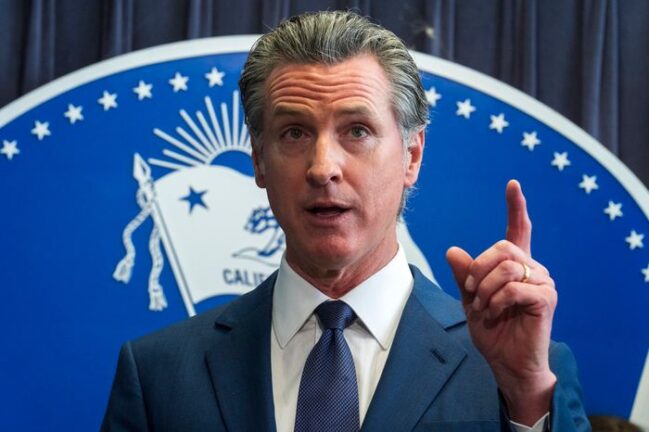

California Gov. Gavin Newsom was featured in an ad calling the tax measure ‘dangerous, an overreach and irresponsible.’ PHOTO: DAMIAN DOVARGANES/ASSOCIATED PRESS

A coalition of California companies is going to war with Gov. Gavin Newsom and his Democratic allies over taxes it says have grown out of control in the Golden State.

The businesses have gathered enough signatures to put a measure on November’s ballot that would require two-thirds of voters to approve most local tax increases and roll back some recently enacted ones. If passed, it would be one of the most significant changes to the way California funds its government since 1978’s Proposition 13, a voter-approved law that severely limited property tax increases.

Backers say it is necessary to stop continued tax increases that are making it too expensive to operate in California and pushing companies to leave the state. Real estate businesses in Southern California are among the biggest funders, according to state campaign finance records, partly in response to a surcharge on luxury home sales that Los Angeles voters passed in 2022.

Newsom, local officials and labor unions say the proposal would decimate funding for basic services such as trash collection and firefighting and would make budgeting decisions near-impossible.

The companies spent some $16 million to gather signatures to put their proposal before voters and are gearing up for a fight political analysts say could draw tens of millions of dollars in advertising by both sides.

“The business community is fed up, they want to start stepping up to make a positive change. And they recognize that if they don’t do it, nobody will,” said Rob Lapsley, president of the California Business Roundtable, an advocacy group representing some of the state’s biggest businesses and leading the “yes” campaign. Continue reading

Water district subject to TABOR vote requirement

Water district subject to TABOR vote requirement

- By CHARLES ASHBY Charles.Ashby@gjsentinel.com

- Mar 22, 2024

Water districts are like all other government entities that are subject to the Taxpayer’s Bill of Rights when it comes to voters approving tax increases, the Colorado Appeals Court ruled Thursday.

In a precedent-setting case out of Logan County in the northeast corner of the state, a three-judge panel overturned a lower court’s decision that the Lower South Platte Water Conservancy District that serves four Eastern Plains counties violated TABOR by doubling its mill levy starting in 2019 because it did so without voter approval.

The lower court had ruled in favor of the district, saying its raising of the levy from 0.5 mills to 1 mill did not violate that 1992 constitutional amendment because the water district was formed before TABOR was approved, and is required under the state’s Water Conservancy Act to set a mill levy based on a mandatory and non-discretionary formula.

The water district tried to argue that the Colorado Supreme Court, in Huber v. Colorado Mining Association, allows such mill levy increases because of that formula.

But a three-judge panel said that high court ruling applies to entities that aren’t making a legislative or governmental act for a tax-rate increase, but a non-discretionary duty under pre-TABOR taxing statutes, such as the Colorado Department of Revenue making legally required adjustments to severance taxes. Continue reading

TABOR: The enduring success story empowering Colorado taxpayers

TABOR: The enduring success story empowering Colorado taxpayers

BY BARRY W. POULSON, OPINION CONTRIBUTOR – 03/22/24 7:00 AM ET

AP Photo/David Zalubowski

AP Photo/David Zalubowski

The dome of the State Capitol shines in the early morning sun Friday, May 28, 2021, in downtown Denver. (AP Photo/David Zalubowski)

Even as economists tout a soft landing for the U.S. economy, Americans are facing sticker shock at the grocery store, the gas pump, and fast-food restaurants, among other places.

After a long bout of double-digit inflation, not unlike that of the 1970s. We have learned once again that unconstrained growth in federal spending funded by borrowing and accommodative monetary policy eventually triggers high inflation.

In response to stagflation in the 1970s, Congress enacted statutory fiscal rules designed to balance the budget and stabilize debt. The Federal Reserve also pursued tighter monetary polies to stabilize prices. In the 1990s, a period referred to as “The Great Moderation,” the federal government achieved sustainable debt levels and low rates of inflation.

Unfortunately, over the last two decades, the federal government largely abandoned these fiscal and monetary policies. Federal spending has far outpaced the growth in national income, and federal debt has grown at an unsustainable rate. The statutory fiscal rules designed to constrain federal spending are routinely circumvented and suspended.

The Federal Reserve has again used monetary policy to accommodate these fiscal policies, resulting in wide swings in the rate of inflation. It is difficult to argue that we are experiencing a soft landing and that all is well. A more realistic forecast is that over the next decade we will again experience stagflation.

But there is a bright spot in this gloomy outlook.

In response to stagflation in the 1970s, citizens launched state and local tax revolts. Beginning with property tax limitations in California, citizens began to challenge profligate fiscal policies at the state and local level. Using the initiative and referendum, citizens enacted tax and expenditure limits to constrain fiscal policies. Continue reading

A TABOR Lawsuit Victory

Residents in the northeast corner of Colorado contacted the TABOR Committee several years ago about a tax increase imposed without voter approval by their local Water Conservancy District. Our organization kicked off the response with an attorney’s letter warning the District to reverse course. It did not. After other subsequent efforts, a lawsuit was filed by those residents. Two public interest law firms have done the legal work.

Although a lower court allowed the District to increase taxes, the very good news is that the Colorado Court of Appeals recently ruled for the taxpayers! The case still can be appealed to the Colorado Supreme Court, and if not heard there, the trial court must still resolve several questions, so the lawsuit will continue.

The importance here is that the Colorado court system has confirmed the primacy of the Taxpayer’s Bill of Rights and protected the taxpayers in that District.

Penn Pfiffner

Colorado TABOR

Menten: Open letter to the Colorado Commission on Property Tax

Dear members of the Commission on Property Tax:

The commission was tasked with providing property tax relief options before the temporary tax adjustments expire at the end of 2024.

The obvious answer is to restore inflation and growth adjustable property tax revenue caps where they’ve been forfeited in prior elections. Good news – that’s already in the Taxpayer’s Bill of Rights (TABOR) but it needs to be reinforced!

If that doesn’t happen, there will be a hard property tax cap on the 2024 ballot. That’s been clearly stated by two of the proponents of property tax caps if there was insufficient actions from the commission.

Taxpayers want tax caps whether they are hard or inflation adjustable. Taxpayers like me understand that government growth should be relative to the size of the local economy. That is rightly answered in the existing property tax limit contained in TABOR, paragraph 7c, which allows for such growth.

Having sat through all the commission meetings, there’s a few moments I want to highlight.

Bring back the tax caps

In this three minute video, the county assessor from Santa Clara, California described where that state sits now under the Proposition 13 property tax caps. His points illustrate why our Colorado TABOR is ideal. The assessor points out that local California governments didn’t appropriately reduce property taxes in 1978, even referring to property taxes as “money machines.” So, California voters used their right to petition to place a hard tax cap on the ballot, which became Proposition 13. Continue reading

Fiscal Rules and ‘Learning by Doing’

February 28, 2024

Fiscal Rules and ‘Learning by Doing’

An important discovery in understanding productivity change and economic growth is the phenomenon of “learning by doing.” One of the first discoveries of this phenomenon was in the aircraft industry during World War II. Defense contractors discovered that in producing a particular aircraft, the labor force was more efficient with each successive contract. The labor force gained knowledge in producing aircraft in the initial contract that they applied in subsequent contracts.

Learning by doing is found to increase productivity across many industries. It is found in pursuing public policies as well. I gained insight into these learning effects as a member of the Colorado Tax Commission. We held hearings across the state to gain insight into citizen attitudes toward fiscal policy, and in particular to Colorado’s Taxpayer Bill of Rights Amendment (TABOR). If any government in Colorado wants to increase taxes, revenues, or issue public debt, it must have citizen approval. Citizens in Colorado have voted on hundreds of these ballot measures at all levels of government since TABOR was passed through citizen initiative in 1992. Continue reading

Freedom Minute | Colorado’s Taxpayer Bill of Rights (TABOR)

Economist Dr. Paul Prentice explains Colorado’s Taxpayer Bill of Rights (TABOR) amendment. TABOR allows the state budget to grow each year at population plus inflation, while giving taxpayers the ability to vote on all tax and debt increases.

Freedom Minute | Everything You Ever Wanted to Know about TABOR

Rob Natelson wrote THE BOOK on Colorado’s Taxpayer’s Bill of Rights. As he puts it, “It’s everything you could ever want to know about TABOR.” Check it out here: https://www.i2i.org/the-colorado-taxp…