Category Archives: Fees

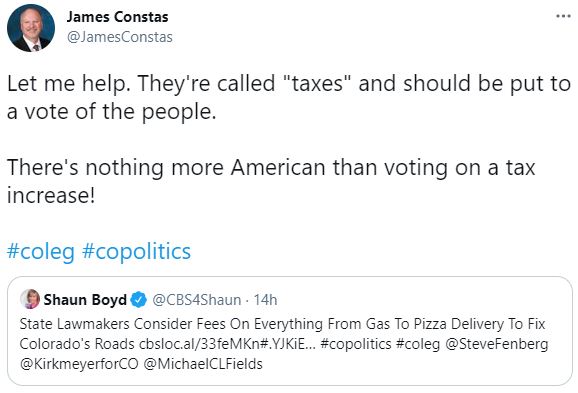

Tweet By James Constas About The Transportation Bill Should Go To The Voters

Protect Colorado Taxpayers – Vote NO on the Gas Tax

You’ve likely heard about the legislature’s new gas tax proposal, which seeks to raise over $4 billion to “solve” our infrastructure needs. This massive proposal includes new charges at the gas pump, on delivery services like Amazon, ride-sharing services like Uber and Lyft, and more. No matter who you are, they have a new charge for you.

We all agree that our roads and bridges need repair, but Coloradans already pay 22 cents per gallon in State taxes, on top of the 18.4 cents we pay in federal taxes. For certain politicians that’s just not enough.

Much of the debate has focused on the questionable legality of the proposal, due to the passage of Proposition 117 just this past November. That requires governments to receive voter approval before enacting these types of new, large “fees.” The unique protections of our Taxpayer’s Bill of Rights, require the legislature to obtain voter approval before raising taxes. But sponsors won’t let that stop them. Instead, they’re calling these new taxes, “fees,”’ so that Colorado voters won’t have a voice in the process. Continue reading

Conservative advocacy groups look to cut Colorado’s gas tax rate

(The Center Square) – Two of Colorado’s most influential conservative advocacy groups say they will join forces on ballot measure language to reduce the state’s gas tax in 2022.

Americans for Prosperity-Colorado (AFP-CO) and Colorado Rising State Action announced the plan in a statement on Monday in response to a Democratic-backed proposal to hike fees on gasoline to fund the state’s transportation system.

The $3.9 billion fee proposal, which hasn’t been formally introduced in the General Assembly yet, would include fee increases on regular gas, diesel gas, electric vehicle registrations, ride-shares, and online retail deliveries.

To read the rest of this story, please click (HERE):

2021 Colorado Legislature: Bigger Government, Smaller Us

By Christine Burtt, TABOR Foundation Board Member

By Christine Burtt, TABOR Foundation Board Member

4/13/2021

There are several onerous pieces of legislation in Colorado this year that will negatively impact your standard of living, if not your way of life.

Here are three notable examples.

- HB21-1083, the so-called “Don’t dare to challenge the government’s valuation on your home” bill, was designed to create a chilling effect on homeowners questioning the assessment that calculates their property tax.

The bill, which has been signed into law by Governor Polis, was initiated by the Colorado Assessors. It changes existing law that prevented a county assessor from raising taxes on a property if the homeowner challenged an assessment. The previous law gave homeowners an appeals process if they believed their property had been assessed at a value higher than was warranted.

, with the new law, if you challenge the valuation set by the county assessor, the assessor may keep the valuation as stated, or may even increase your property tax. It won’t go down. Continue reading

State-Based Policy Groups Launch New Coalition to Oppose Gas Tax Proposal

State-Based Policy Groups Launch New Coalition to Oppose Gas Tax Proposal

APR 6, 2021 BY AFP

Battle Intensifies After Introduction of Framework, Initial Coalition Expands

DENVER – Americans for Prosperity-Colorado (AFP-CO) and partners formally launch the Colorado Taxpayers Coalition, a group of local advocacy partners set out to protect Colorado taxpayers by defeating the legislature’s current gas tax proposal and protecting the Taxpayer’s Bill of Rights (TABOR).

AFP-CO is also running a statewide campaign that urges Coloradans to contact their elected official to advise against the bill. These efforts included a poll that revealed constituents in several state senate districts strongly oppose the proposal.

AFP-CO State Director Jesse Mallory issued the following statement: Continue reading

Several key principles the majority of Coloradans support

Dear Friend,

Even though times may seem more polarizing now than ever, one thing most Coloradans can agree on is that they want every citizen of our state to be allowed to flourish. They may have strong opinions on the issues, but surprisingly, there are still several key principles the majority of Coloradans support.

After conducting extensive statewide polling, I outlined 10 practical ideas the GOP should embrace to address some of the big issues that Coloradans care about:

- Continue to protect our Taxpayer’s Bill of Rights (TABOR). Few things are more popular than people being allowed to vote on any tax (or large fee) increase.

- Lower taxes. Coloradans overwhelmingly support a property tax cut for both residential and commercial property. With housing costs on the rise, low-income families would especially benefit from this tax cut.

- Increase teacher pay. More of the existing money we spend on education should go to teachers instead of the bureaucracy.

- School choice. The impact of the pandemic on our education system has led to even more support for parental choice. Colorado should also pass a stipend for families to use for out-of-school learning opportunities – like tutoring.

- Public safety. With crime on the rise in many Colorado communities, voters are looking for leadership on this issue. They strongly oppose any destruction of property. And while they are open to reforms within the law enforcement system, they certainly don’t want to dismantle or defund it.

With 42% of Coloradans choosing to be unaffiliated with a political party, it’s more important than ever for candidates to be clear about their plans if voters entrust them with power. If Colorado Republicans unite around a few key issues, and drive their message home with voters, I believe the party will quickly begin to make a comeback.

Sincerely,

Michael Fields

Executive Director of Colorado Rising State Action

Here are the new gas and road-usage fees behind Colorado Democrats’ $4 billion transportation plan

The new fees would start in July 2022 to pay for infrastructure projects, efforts to improve air quality and public transportation initiatives

Colorado drivers would begin paying a new fee of 2 cents on every gallon of gas they purchase starting in July 2022 under legislation Democratic state lawmakers are expected to introduce in the coming weeks.

That fee, which would not require voter approval, would increase to 8 cents per gallon starting in July 2028 under the proposal, which is part of a $4 billion, 11-year effort to raise and spend money for badly needed transportation projects across the state.

Lawmakers, political groups and business interests have been trying for years, without much luck, to find a transportation funding solution. The proposal, which includes a number of other new road-usage fees, is backed by Gov. Jared Polis and also aims to reduce traffic congestion on Colorado’s roads, expand public transportation and improve air quality by making it easier for people to own electric vehicles and spending millions on environmental initiatives.

“We think this is the time that we absolutely have to get something done and something meaningful,” said Senate Majority Leader Steve Fenberg, a Boulder Democrat. “Not a baby step, but a real meaningful step toward solving the transportation problems that we have in our state.”

To continue reading this story, please click (HERE):

Proposition 117 Says Colorado Voters Have To Approve New Fees

Colorado’s Competitiveness: The Challenge of Economic Recovery Under More than $1.8 Billion in New Regulations, Taxes and Fees

Prior to 2020 and the global economic and cultural upheaval caused by the COVID-19 pandemic, Colorado stood out for having strong economic growth and offering a desirable lifestyle. Coloradans had created the #1 state economy and enjoyed competitive advantages in attracting business growth and an educated workforce. In fact, in late 2019, US News World Report ranked Colorado’s business climate as one of the best in the nation.

However, after two periods of negative economic shocks in 2020, in both late spring and through the holidays, the state of business in Colorado remains under duress.

- There were 150,000 fewer jobs in Colorado in December 2020 relative to the start of the years, representing a 5.4% cut.[i] While the statewide reduction is significant, it masks the disproportionate impacts across industries, as the leisure and hospitality industry was down 90,900 jobs by end of 2020, whereas professional and business services was up 7,100 jobs.[ii]

- State taxable sales were down $8.9B, or -1.35%, in 2020 relative to 2019.[iii] Small business suffered, especially. As of February 10th, small business revenue was down 29.5% from January 2020 levels.[iv]

- Colorado’s unemployment rate increased by the 2nd-most among all states, from 2.5% to 8.5%. The Colorado state unemployment ranking went from near first (4th) to almost last (48th).[v]

To continue reading this story, please click (HERE):